2024-9-18 14:14 |

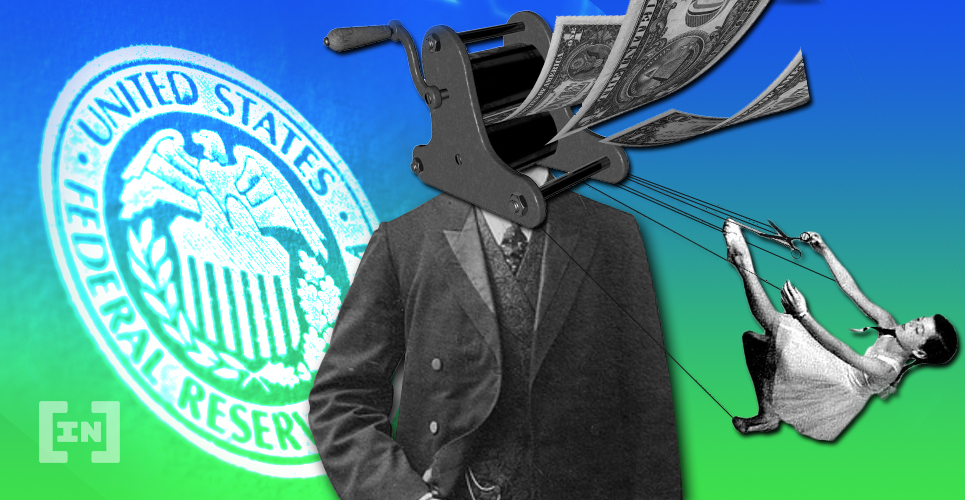

Worn down by months of lackluster price action, crypto investors are looking forward to the Federal Reserve cutting interest rates today as a key catalyst for a meteoric move.

After starting the week trading at sub-$58K following a second assassination attempt on the former U.S. President and Republican frontrunner Donald Trump on Sept 15, Bitcoin (BTC) has since bounced back as investors continue to weigh the potential impact of the Fed lowering interest rates with a gargantuan 50 bps rate cut.

Capriole Founder Expects Bitcoin To Regain $64K “Very Quickly” After Incoming Fed Rate CutsThe price of Bitcoin rose Wednesday, hitting as high as $61,242 on Tuesday, according to CoinGecko data as traders grew more confident that the U.S. Federal Reserve’s upcoming meeting would yield a jumbo-sized rate cut. At press time, the price of the alpha crypto had settled at $59,939, up by 1.8% over the last 24 hours.

Investors worldwide expect the Fed to announce an interest rate cut today, marking the first rate cut in roughly four years. As per the CME FedWatch tool, the odds are presently 39% for a 25-basis-point rate cut and a 61% likelihood for a massive 50-basis-point rate cut.

If the Fed decides to slash borrowing costs by 50 basis points, risk assets, including Bitcoin, could react positively, many industry observers have suggested. This would mirror past instances where aggressive rate cuts boosted the crypto’s price.

While mostly stagnant in the last month, Capriole Investments founder Charles Edwards believes BTC is now poised to resume full-blown bull rally after the Fed’s impending interest rate move.

“This marks the start of a new dovish Fed policy regime, the first significant change since late 2021, when the Fed notified of their hawkish regime shift and which saw rates rise from 0 to 5.5% in 18 short months,” Edwards wrote in a Sept. 17 report.

“A weekly close above $64K would end the 7 month sequence of lower highs and likely see us travel back to range high ($70K) with haste, and probably beyond. Nonetheless, the Technicals picture is mixed at best, and bearish at worst, until the range (and monthly resistance at $60K) is reclaimed,” the pundit added.

“Based on the current response to the Weekly $58K level, and given the major Fed event tomorrow, I would not be surprised to see that level taken very quickly to the upside, provided no bearish surprises from Chairman Powell tomorrow.”

Will today’s expected Fed announcement give Bitcoin’s price a nudge up the chart?

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|