2020-4-8 20:20 |

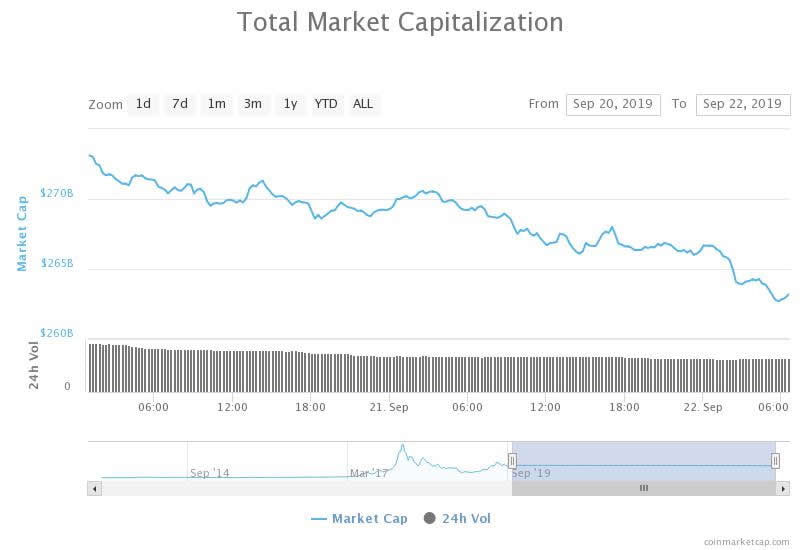

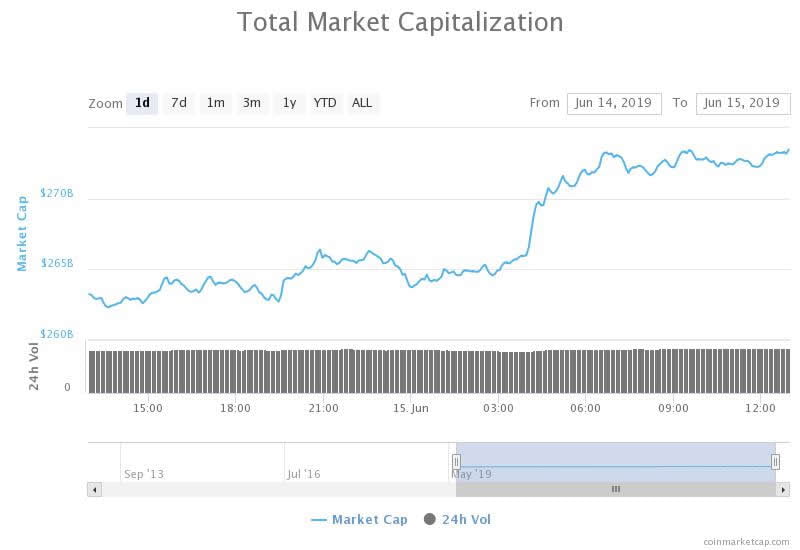

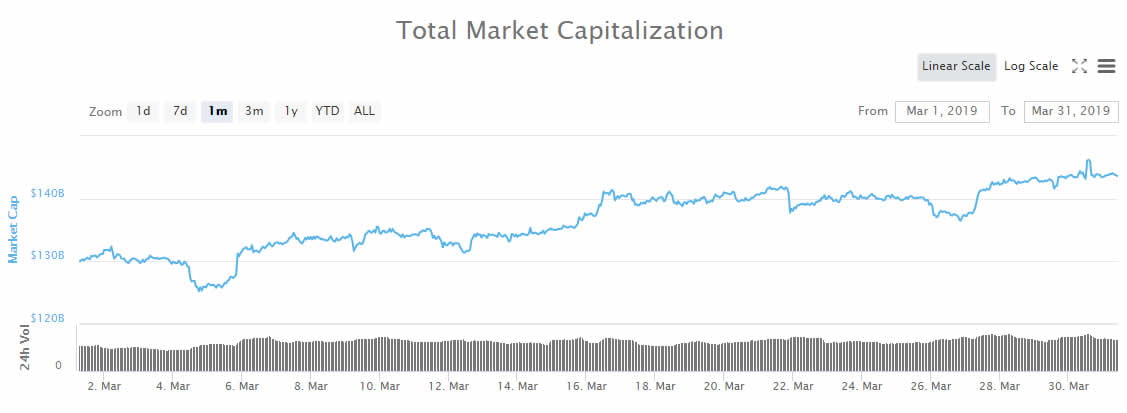

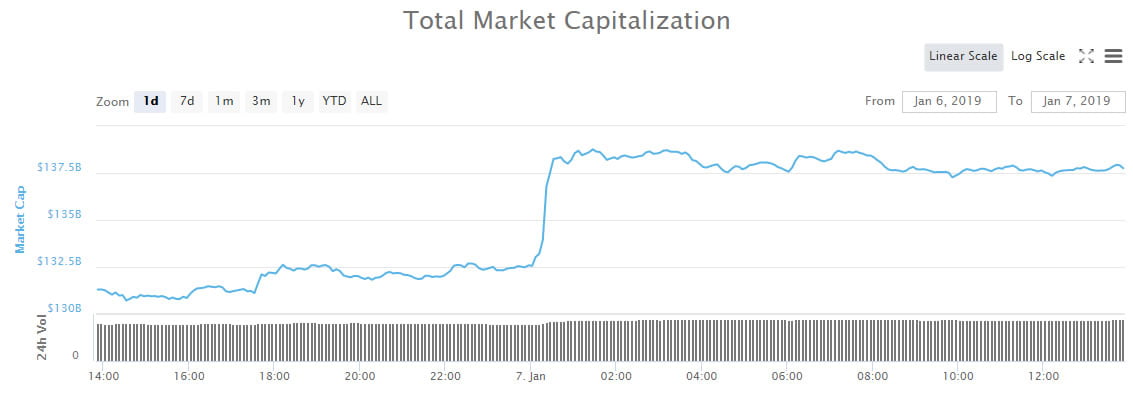

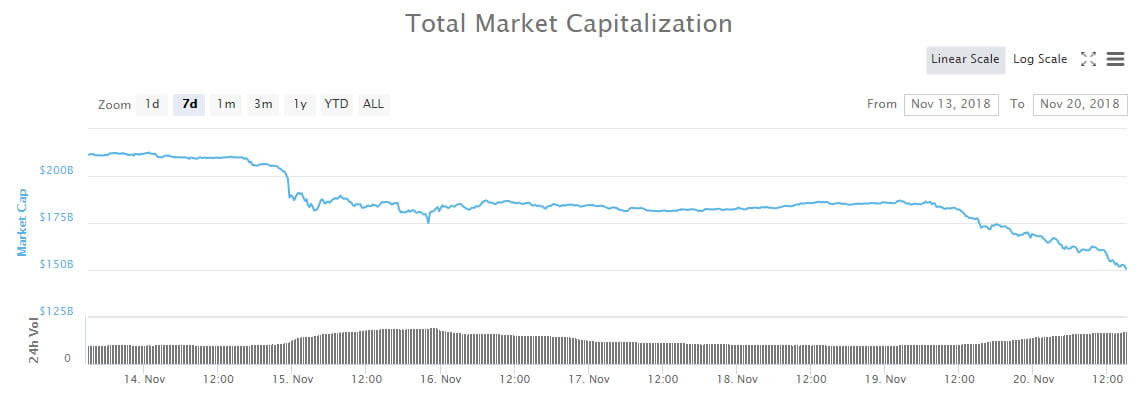

After the crypto carnage on March 12, the overall crypto market capitalization lost nearly $190 billion from the high of mid-February. Since hitting this low, which was last seen in early February 2019, the crypto market has added over $90 billion.

This has been on the back of Bitcoin climbing above $7,000. The asset which is still mirroring the stock market, surged yet again in line with the equity market after the coronavirus outbreaks started to stabilize in some of the worst-affected countries like Italy and Spain.

While Bitcoin recorded considerable losses alongside the S&P 500, the crypto asset has recovered the majority of its losses. It actually outperformed the largest banks and payment processors.

We compared the price performance of #Bitcoin vs the largest incumbent financial institutions. As shown, bitcoin has outperformed the large banks and payment processors throughout this volatile period. pic.twitter.com/QrQzHhuNM8

— TradeBlock (@TradeBlock) April 6, 2020

Now, the flagship cryptocurrency could climb to $7,500 level, according to Craig Erlam, a senior market analyst at Oanda.

“It’s struggling to gather the momentum required to break the barrier down but as we know with Bitcoin, that can change dramatically in a heartbeat,” Erlam said. “If it breaks through those levels, then we could be looking at a healthy surge and another run towards $10,000.”

But it’s not just bitcoin but altcoins are also recording gains, following the leading cryptocurrency.

Ripple (red), Bitcoin Cash (blue), Litecoin (green), Ethereum (black). Past two years rebased to 100 and relative to #bitcoin. All are 60% worse than bitcoin. Remarkable. pic.twitter.com/3G9FiLZ9oq

— Charlie Morris (@AtlasPulse) April 7, 2020

Among the top ten cryptocurrencies, Tezos (XTZ) has emerged as the winner as it makes its way to the 10th position after surging 11.36%. The past week, it jumped nearly 25% and is up over 51% YTD.

Ethereum is another asset that saw significant gains, up 27% in the past week and 30% YTD. However, Ether’s realized price is much higher at $202.

“Ethereum's MVRV Ratio, a metric used to assess if price is above or below “fair value”, currently sits at 0.8 – indicating that it is currently undervalued,” noted Glassnode.

Interestingly, since late 2019, ETH exchange balances have increased by over 21%, 16% of Ether’s circulating supply, to a level last seen in December 2016, as per IntoTheBlock.

Chainlink is another asset that remains the best performing crypto asset, spiking almost 13%. This crypto asset has risen 390% in the past year. On April 6th, the total number of LINK addresses surpassed 300,000.

With 13% gains, Kyber Network is also enjoying a green day along with VeChain (9%) and Litecoin (7%).

Meanwhile, on a year-to-date basis, BSV emerged as the winner with 100% gains. In anticipation of its halving this week, BSV investors accumulated the digital asset that has the number of addresses with a balance in BSV reaching an all-time high of 18 million.

Bitcoin (BTC) Live Price 1 BTC/USD =$7,119.1510 change ~ -1.58%Coin Market Cap

$130.36 Billion24 Hour Volume

$8.95 Billion24 Hour VWAP

$7.33 K24 Hour Change

$-112.3925 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|