2024-4-25 16:36 |

Quick Take

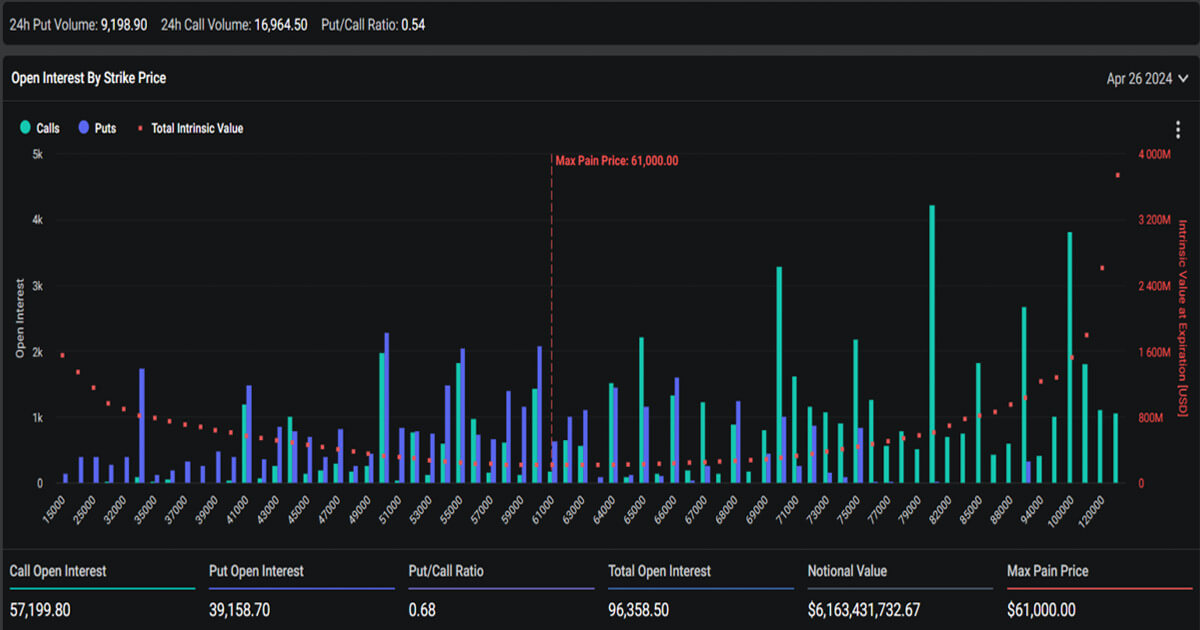

As Bitcoin’s price hovers around $63,000, slightly down over the past 24 hours, the options market is providing insights into shifting investor sentiment ahead of the expiration on April 26. A key development has been the reduction in positive gamma exposure as Bitcoin declined through the heavily traded $65,000 call strike.

According to Imran Lakha, a 20-year professional options trader notes:

Short gamma reduced on the way down as we went through the big long strike at 65k suggesting volume has been smashed lower, calls are getting dumped

Bitcoin Gamma Level: (Source: laevitas)The options open interest data provided by Deribit reveals a max pain price of $61,000, which could potentially serve as a short-term support level. While significant open interest remains in calls above the current spot price, the lack of put open interest below $60,000 indicates a lack of downside protection. CryptoSlate has pinpointed this price level as a crucial support threshold.

April 26 expiration, Open Interest by strike price: (Source: Deribit)The put/call ratio of 0.68 reflects a modest bias towards calls, but this has decreased notably due to likely profit-taking on downside hedges.

In conclusion, the options market data suggests a cooling of bullish sentiment as Bitcoin pulled back from recent highs. However, the remaining upside option holdings could still influence short-term price action, with the max pain level as a potential support zone to monitor.

The post Bitcoin options signal cooling bullish sentiment as key support level emerges at $61,000 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|