2025-3-16 10:30 |

Bitcoin (BTC) continues to experience massive selling pressure as global trade war fears and macroeconomic uncertainty fuel market-wide fear. The price is holding above the critical $80K level but remains stuck below $85K, failing to establish a clear short-term direction. With investors hesitant to take major positions, BTC is in a fragile state, where both bulls and bears are waiting for the next major move.

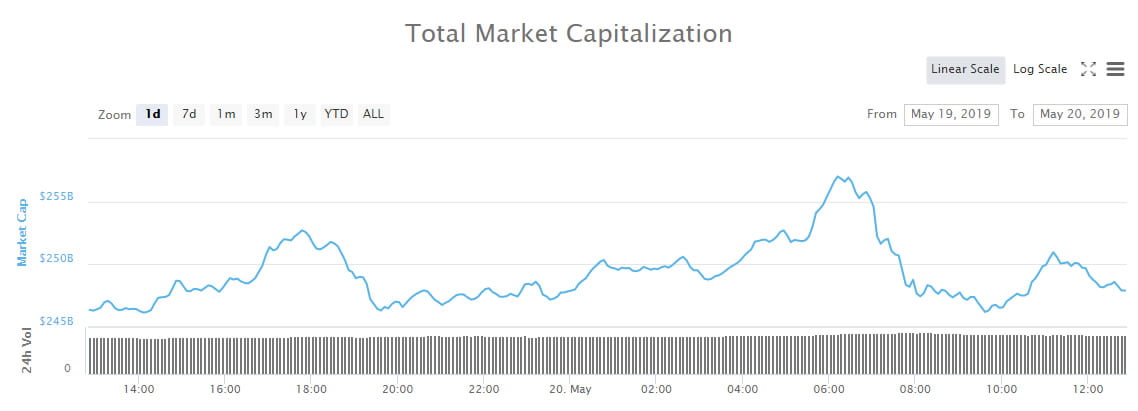

Despite the current uncertainty, key market metrics reveal a moderately bullish sentiment in the Bitcoin options market. According to recent data, there is a greater concentration of contracts and trading volumes in call options, indicating that some traders are positioning for potential upside.

The next few trading sessions will be crucial, as Bitcoin must either reclaim key resistance levels to confirm a recovery or risk further downside pressure if sellers continue to dominate. With the options market hinting at potential upside, BTC’s price action remains uncertain, but traders are closely monitoring key support and resistance zones.

Bitcoin Market Signals Suggest A Potential ReboundBitcoin has dropped nearly 20% since the start of the month, with bears maintaining control and pushing prices lower. The overall trend remains bearish, and unless bulls step in to reclaim key levels, the downtrend could continue. However, some analysts believe that BTC could be gearing up for a massive recovery once it stabilizes above $80K and reclaims the $90K mark.

Despite short-term weakness, Bitcoin’s long-term fundamentals remain strong. Institutional adoption continues to expand, and US President Donald Trump’s plan to establish a Strategic Bitcoin Reserve could serve as a major catalyst for future price movements. If demand increases and confidence returns, BTC may see a significant push toward new highs.

Top analyst Axel Adler shared insights on X in the derivatives market, revealing that the Bitcoin options market currently exhibits a moderately bullish sentiment. There is a greater concentration of contracts and trading volumes in call options, suggesting that some traders are betting on a potential rebound. However, large put option positions in the $75,000–$85,000 range indicate that investors are also hedging against further downside risks.

This hedging activity signals uncertainty and the potential for high volatility, making BTC’s next move highly unpredictable. The coming weeks will be crucial, as Bitcoin must either reclaim higher levels to confirm a recovery or risk further declines if selling pressure continues. Traders are closely monitoring price action, waiting for a decisive breakout in either direction.

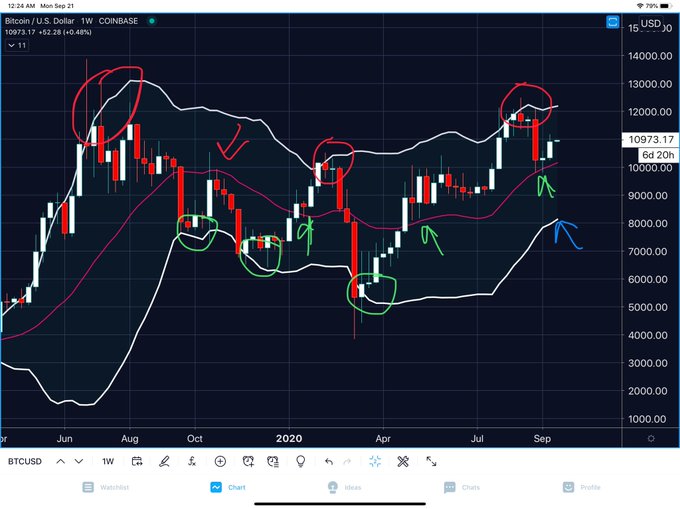

Bulls Fight To Reclaim Key LevelsBitcoin is currently trading at $84,000, attempting to hold above the 200-day moving average (MA) around this level. Bulls need to regain momentum quickly and push BTC above the 200-day exponential moving average (EMA) at $85,500 to establish a foundation for a potential recovery.

However, market sentiment remains uncertain, and bears are keeping pressure on BTC. If bulls fail to reclaim the $85K level, Bitcoin could face renewed selling pressure, leading to a potential drop below the critical $80K mark. This would further extend the current downtrend, increasing the risk of deeper corrections.

For BTC to confirm a recovery, it must break past the $90K mark, a key psychological and technical resistance. Reclaiming this level would signal renewed buyer confidence and could set the stage for a stronger rally. However, failure to hold current support could lead to increased volatility and further downside risks.

With Bitcoin hovering at crucial levels, the next few trading sessions will be critical in determining whether BTC can stabilize and regain lost ground or if the downtrend will continue toward lower support zones.

Featured image from DALL-E, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|