2023-9-20 13:32 |

Quick Take

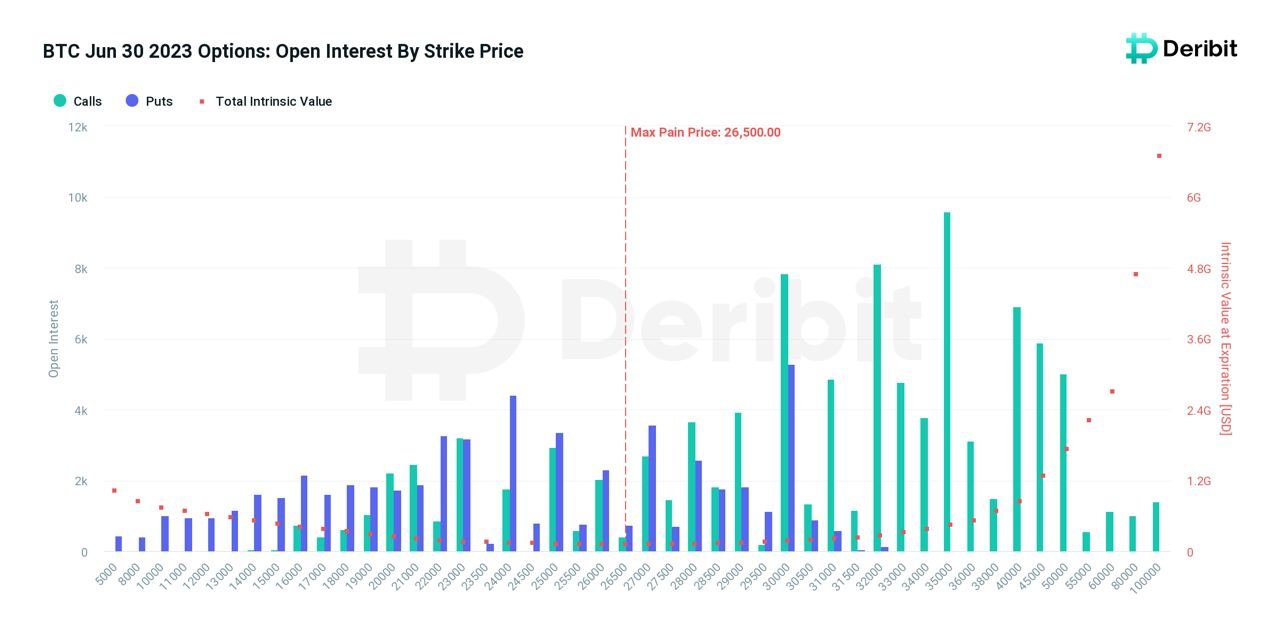

Recent data analysis reveals a noteworthy divergence within the Bitcoin options market. The volume of Put (red) and Call (green) options is displaying a material deviation, with a put/call ratio presently at 0.61.

This split signifies a shift in the market sentiment, where traders are seemingly leaning more towards call options with over $300 million in volume, compared to the puts volume, which is currently around $188 million.

This disparity indicates a potential bullish sentiment among market participants. However, the lower put/call ratio suggests that there is still a substantial number of traders hedging against potential price pullbacks, thereby illuminating the inherent volatility and risk that underpin the cryptocurrency market.

These diverging volumes in call and put options represent a complex narrative of optimism tempered with caution, reflective of the evolving dynamics in the Bitcoin options market.

Options put vs call : (Source: Glassnode)The post Bitcoin options market sees bullish shift amid rising call options volume appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Crypto Alliance (CALL) на Currencies.ru

|

|