2024-10-14 14:00 |

Bitcoin’s recent price swings seem to have sparked a wave of uncertainty among retail and institutional investors as its Open Interest (OI) has witnessed a significant decline in light of several negative factors hindering the market, such as macroeconomic turbulence.

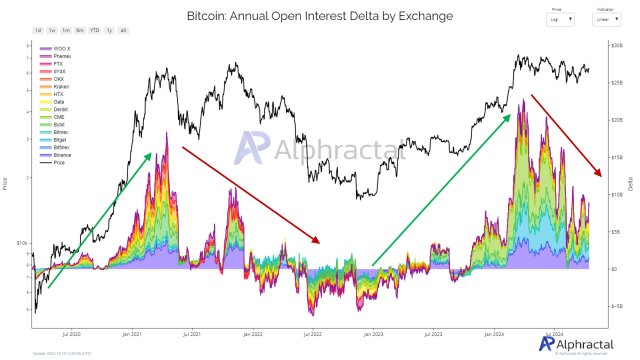

Is Bitcoin Poised For A 2021-Style Performance?In a pessimistic development, the open interest in Bitcoin has dropped sharply lately, mirroring a dip that was experienced in 2021. Alphractal, an advanced investment data analysis firm, reported the negative trend in the key on-chain metric on the X (formerly Twitter) platform, which reflects a period of caution or consolidation.

This decline in open interest, a metric that counts the total number of derivative contracts such as futures or options, might imply that trader are closing their positions due to the increasing uncertainty in the current market.

The platform spotted a reduction in the key indicator similar to what happened in 2021, after analyzing the 180-day or annual delta of Bitcoin’s open interest across all crypto exchanges. “The resistance at $38 billion in open interest represents a significant challenge in the short term,” the platform added.

It is worth noting that the decline comes after a remarkable growth in open interest in the Bitcoin futures market since 2020, exceeding the $42 billion threshold. This increase is indicative of investors’ increased interest in leverage, especially on larger crypto exchanges.

Alphractal highlighted that the Chicago Mercantile Exchange (CME) presently controls about 26.3% of all positions, while the world’s largest cryptocurrency exchange, Binance, controls 20.2% of the market.

According to the platform, understanding institutional interest will be essential for Bitcoin to continue its upward movement. This is due to the fact that open interest usually rises in tandem with an increase in the price of BTC. However, Alphractal noted that if the Annual Open Interest Delta moves into negative territory, a bearish process in the market might be on the horizon due to a lack of institutional interest.

BTC Begins The Week In ProfitPresently, Bitcoin is showing strong resilience, starting the week on a positive note, which has triggered optimism about its potential in the short term. The crypto asset has once again reclaimed the $64,000 mark after a drop from the level in the past week. Given the renewed positive sentiment and price movements, BTC could set to attract more gains as bulls continue to push for further price increases.

At the time of writing, BTC was trading at $64,429, demonstrating a nearly 3% price growth in the past day. Both its market cap and trading volume have also displayed healthy movement in the past day, rising by about 2.86% and 60.60%, respectively.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|