2022-12-29 12:30 |

In today’s on-chain analysis, BeInCrypto looks at Bitcoin supply indicators. The analysis aims to determine the bear market’s stage, whether the macro bottom has already been reached, and how long the subsequent accumulation will last.

Currently, the supply in profit and loss metrics are reaching levels that have historically correlated with the macro bottoms of the Bitcoin price. However, they also give clues to the subsequent multi-month accumulation phase, which we have yet to see signals of completion.

Moreover, the relation between the two types of supply suggests that the BTC price may be in for one more final capitulation in this bear cycle.

Bitcoin Supply in ProfitCirculating supply in profit is a metric that indicates coins whose price at the time of the last move was lower than the current price. Naturally, its historical lows correlated with macro lows in the BTC price. It’s worth adding that the amount of supply in profit is getting higher in successive market cycles as the supply of Bitcoin itself increases due to the process of mining new coins.

During bull markets, almost all the supply in circulation records a profit. In contrast, during bear markets, the supply in profit declines steadily to reach a bottom at the end of each downtrend. If we combine all the historical lows of this metric, we get a clearly visible rising support line (red).

Chart by GlassnodeBullish Divergence Before the Bounce

An interesting development seen in the previous two bear markets is the bullish divergence between the BTC price and supply in profit. This is because it turns out that the macro bottom of the Bitcoin price (green lines) did not correlate with the bottom of the supply in profit (blue lines).

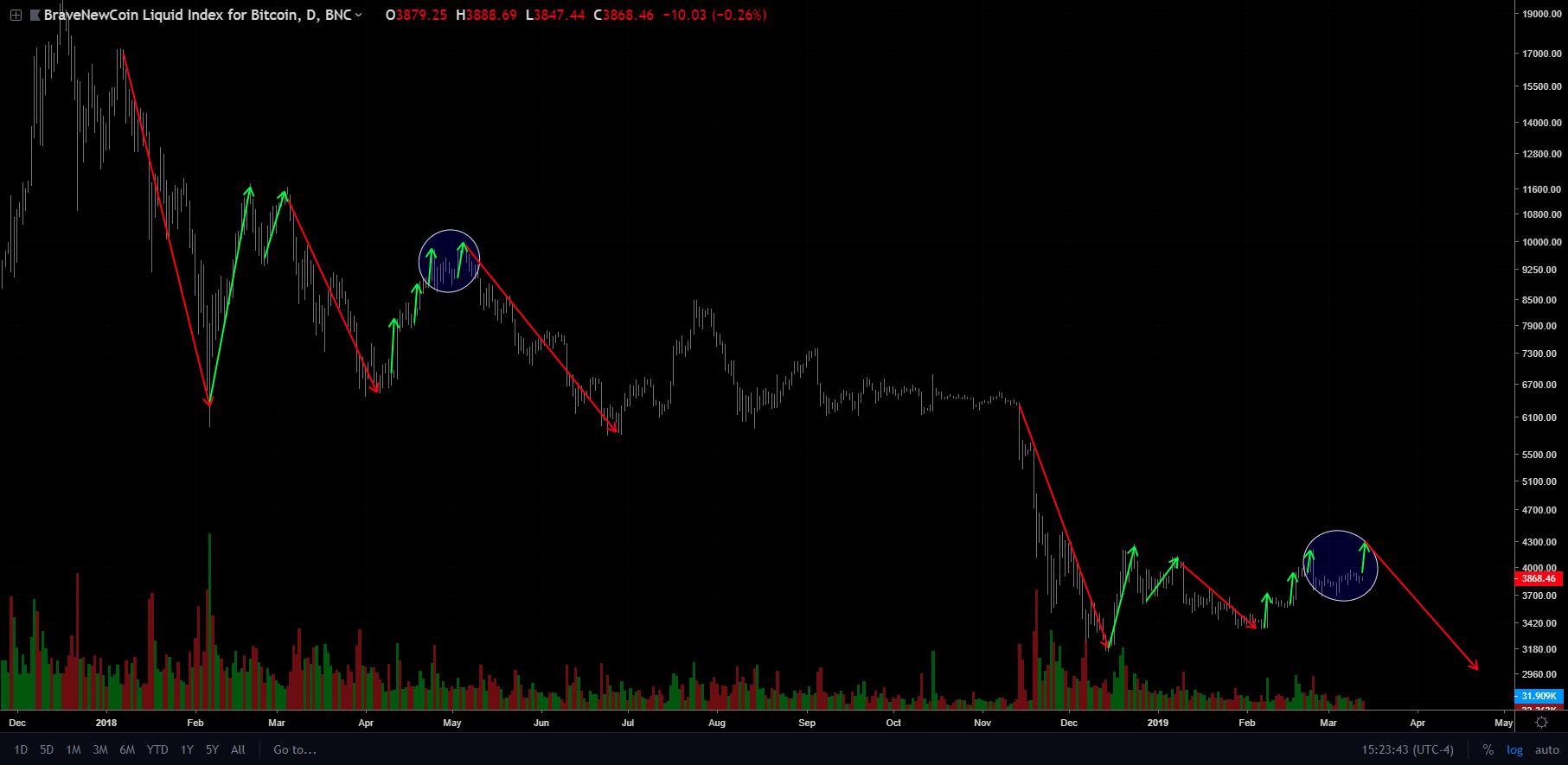

These events have historically been separated by a period of accumulation after BTC reached a bottom. In the two previous bear markets, bullish divergence appeared in 2015 and 2018-2019:

2015 Jan. 14, 2015 – higher bottom at 5.420 million BTC, lower bottom of BTC price at $172 (green) Aug. 24, 2015 – lower bottom at 5.254 million BTC, higher bottom of BTC price at $211 (blue) 2018-19 Dec. 14, 2018 – higher bottom at 6.960 million BTC, lower bottom of BTC price at $3,242 (green) Feb. 7, 2019 – lower bottom at 6.834 million BTC, higher bottom of BTC price at $3,400 (blue) 2022 Nov. 21, 2022 – bottom at 8.588 million BTC, and BTC price bottom at $15,797 (green)In the current bear market, neither the BTC price nor the supply in profit has reached further lows. We do not yet see another blue line on the chart. Thus, if a bullish divergence between the Bitcoin price and this metric is not generated, a continuation of the accumulation phase or even a drop to lower price levels is likely.

Bitcoin Supply in LossIf you reverse the supply in profit, you get the indicator of supply in loss. It determines the number of coins whose price at the time of the last move was higher than the current price. Of course, its historical peaks mark the lowest Bitcoin price levels. It can also be expected that the supply in loss will increase over time as the total supply of BTC grows.

In fact, on the long-term chart of the BTC price and supply in loss, we see that successive bear markets have led to new peaks in this metric. On Nov. 18, 2011, the peak was at 4.344 million BTC and correlated with the BTC price bottom at $2.05.

Four years later, on Aug. 24, 2015, the peak was already 9.280 million BTC, with the Bitcoin price at $211. It’s worth mentioning that the macro BTC bottom in this cycle was reached in January 2015 at $172.

The last peak appeared on Feb. 7, 2019, at the level of 10.691 million BTC, with the price of Bitcoin at $3,400. Previously, BTC reached $3,242 on Dec. 14, 2018. Noteworthy is the very high level of supply in loss during the COVID-19 crash of March 2020. At that time, the indicator briefly reached 10.399 million BTC, and the price of Bitcoin fell to $4,860.

Interestingly, today’s indicator readings are still lower than those of 2019 and are even below the March 2020 crash. The last peak of supply in loss was reached on Nov. 21, 2022, at 10.272 million BTC, with the price of Bitcoin at $15,797. Thus, if the long-term upward trend continued, BTC could face even lower levels.

Chart by GlassnodeWaiting for a Breakdown From Support

Another look at the chart of supply in loss comes from its long-term trends. In the previous section, we said that increases in this metric correlated with the decline in the BTC price, bearish cycles, and the subsequent accumulation.

If one wants to draw upward trend lines for supply in loss during bearish cycles, we see at least three such patterns (red lines). Two clearly correlate with the 2014-2015 and 2018-2019 bear markets, while the third appeared after the June 2019 local peak of the BTC price at $14,000.

In all cases, the breakdown from the uptrend line (blue lines) correlated not so much with the end of the bear markets but with the end of the long-term accumulation that followed. Moreover, in the last case, it was a multi-month re-accumulation after the COVID-19 crash bottom. The breakdown of these support lines was immediately followed by significant upward movements of BTC and the resumption of the bull market (blue arrows).

Chart by GlassnodeA similar rising support line can be drawn for 2022. However, we can see that, for the time being, there are no signs of any breakdown. So, even if the BTC macro bottom has already been reached, the trend likely won’t resume for some months.

Supply in Profit and Loss: Intersection Before CapitulationOne more trick that can be done with the metrics of supply in profit and loss is juxtaposing them against each other. On a long-term chart of their 14-day moving averages (14D MAs), we can see how, in the vast majority of periods, supply in profit (orange) outpaces supply in loss (blue).

However, there are rare occasions when the two lines intersect, and supply in loss briefly overtakes supply in profit. Obviously, such moments occur around the macro bottom of the BTC price and the subsequent accumulation (green areas).

So far, the curves have intersected four times. These instances corresponded to bear market lows in 2011, 2014-15, 2018-19, and 2022 (green areas). A brief touch of the curves was also recorded during the COVID-19 crash in March 2020 (blue circle).

It is worth noting that the final capitulation of the BTC price in all previous bear markets did not happen during their first intersection (red lines) but several days/weeks later. Currently, the supply in profit has fallen below the supply in loss for the first time.

Chart by GlassnodeFor BeInCrypto’s latest crypto market analysis, click here.

The post Bitcoin On-Chain Analysis: Supply in Profit and Loss Suggests Final Capitulation appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|