2023-6-28 15:00 |

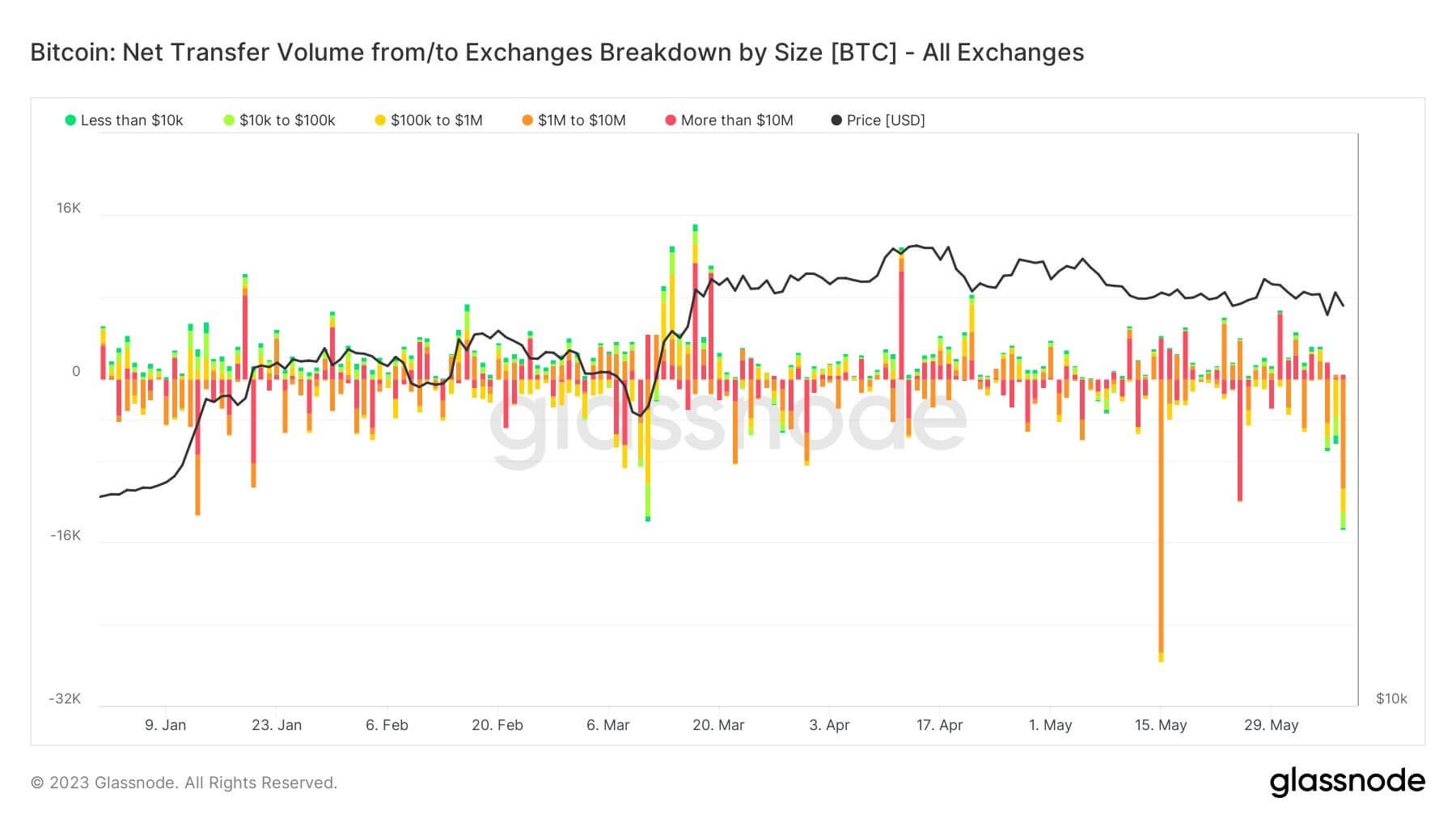

In the fast-paced world of Bitcoin mining, recent unusual activity has caught the attention of cryptocurrency watchers. Particularly, a surge in exchange interactions has been observed, with Bitcoin miners sending a record amount to exchanges.

Prominent on-chain analytics firm, Glassnode, has been at the forefront of tracking these transactions. In a recent tweet, the firm reported that Bitcoin miners have been engaging in a noteworthy level of interaction with exchanges, transferring an all-time high of $128 million worth of Bitcoin.

Exceptional Exchange Activity By MinersThe significant update found in this report is the amount of funds involved. According to Glassnode, the $128 million sent to exchanges by Bitcoin miners represents 315% of their daily revenue.

The on-chain analytics firm tweeted:

Bitcoin Miners are currently recording extremely high Exchange interaction, sending an ATH of $128 million to Exchanges, equivalent to 315% of their daily revenue.

Typically, the transfer of coins from miner or investor wallets to exchanges is perceived as an intention to sell or liquidate coins. However, in this context, it can also be seen as a reflection of optimism about Bitcoin’s future price potential.

Implications And Market PerceptionThe mining revenue in the Bitcoin network is intimately linked with the price of Bitcoin. Therefore, miners tend to increase their sales when they perceive the market to be robust enough to absorb the additional supply. This recent move could indicate strong confidence in the current market strength.

Glassnode, in additional tweets, points out a growing trend of strong accumulation and a shift towards self-custody, especially in the wake of the recent LUNA debacle and FTX fallout. This suggests an increasing trend among investors and miners towards maintaining control of their own assets as opposed to relying on third-party custodians.

Regardless, Bitcoin has seen a slight decline in the past 24 hours, down by 0.6% with a trading price still above the recently reclaimed $30,000. Prior to the retracement, Bitcoin has since been on an upward trajectory over the past two weeks up by more than 10%.

Bitcoin surged from trading below $25,000 amid the intensified regulatory scrutiny from the United States Securities and Exchange Commission (SEC) which eventually affected the world’s largest crypto exchanges Binance and Coinbase as the US regulator filed a lawsuit against both companies for the offering of unregistered securities.

However, weeks following the lawsuit, BTC was quick to recover with more than $100 billion added to its market cap in the last 14 days, up by 16.8%. Interestingly, BTC’s daily trading volume has recorded a plunge in the past week.

The assets’ daily trading volume has declined from a high of $31 billion last Wednesday to a low of $16 billion in the last 24 hours.

Featured image from iStock, Chart from TradingView

origin »Bitcoin (BTC) на Currencies.ru

|

|