2021-12-4 14:25 |

BeInCrypto takes a look at Bitcoin (BTC) on-chain indicators that relate to miners, more specifically the total miner revenue and Puell multiple.

Total BTC miner revenueTotal miner revenue decreases in half every four years, as indicated by the dotted vertical lines. This occurs due to the BTC halving event, the most recent of which occurred in May 2020.

Total Bitcoin Miner Revenue Chart By GlassnodeA look at the indicator since May 2020 shows that total revenues have been between 950 and 1050 BTC (black lines), with the exception of a sharp fall during the July market drop. However, that was corrected by the biggest difficulty adjustment in history.

Currently, total miner revenues are at 880 BTC, the same level as they were in November 2020, prior to the acceleration of the upward move towards the April all-time high BTC price.

Total Bitcoin Miner Revenue Chart By GlassnodeMarket commentator @BTC_Archive tweeted an image that shows that accounts that belong to miners are accumulating once again. Accumulation by miners usually occurs during the beginning of long-term bullish trends. Therefore, the fact that these accounts are accumulating shows that conviction in the market is still strong.

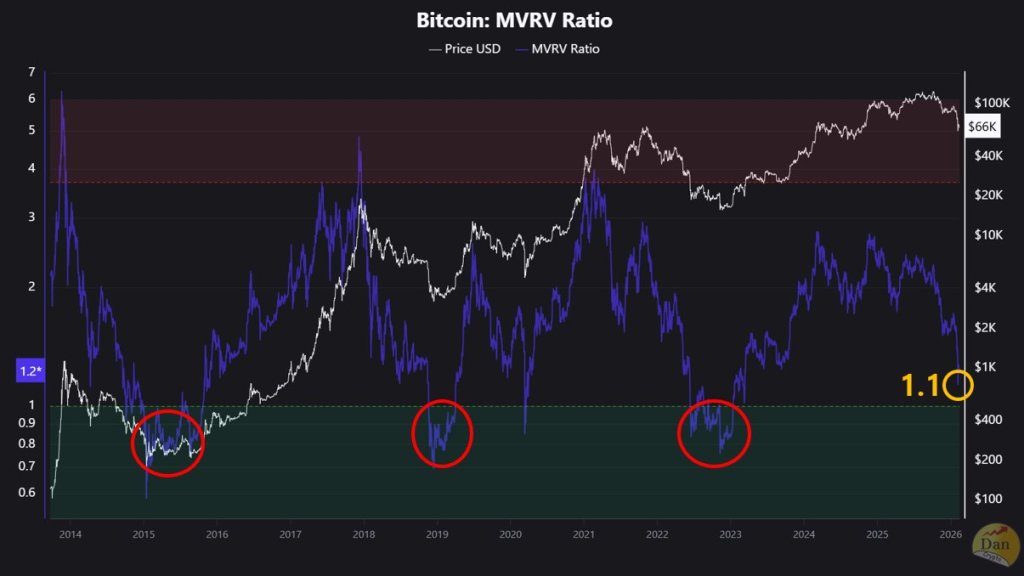

Bitcoin Miner Position Change Chart by Glassnode Puell MultipleThe Puell Multiple is an on-chain indicator that is created by dividing the value of all minted coins by a yearly moving average.

Values between 4 and 10 (red) are normally associated with market cycle tops. Conversely, those between 0 and 0.5 are associated with market bottoms.

So far, the 2021 market cycle has been the only one in which a value between 4 and 10 hasn’t been reached. The yearly high so far has been 3.43, reached in March.

The indicator currently shows a value of 1.26, which has historically been reached in the middle of bullish trends.

Therefore, according to this indicator, there is still more room to grow for BTC.

Bitcoin Puell Multiple Chart By GlassnodeFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post Bitcoin Miners Continue Accumulating — BTC On-Chain Analysis appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miners' Reward Token (MRT) на Currencies.ru

|

|