2022-12-13 13:36 |

Coinspeaker

Bitcoin Miner TeraWulf Sees 33% Drop in Stock Price after Agreement with Bitmain

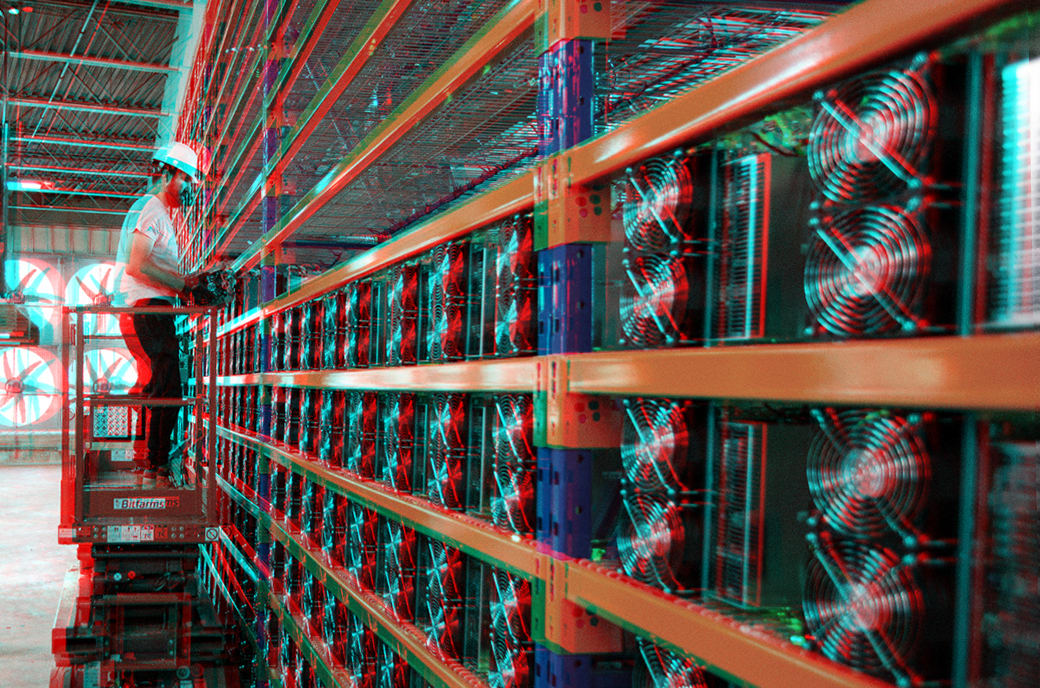

Bitcoin mining companies have been facing major operational challenges amid the crypto winter this year. As a result, the stock price of several public-listed Bitcoin mining companies has been heading south. On Monday, December 12, the stock price of Bitcoin miner TeraWulf (NASDAQ: WULF) dropped by a staggering 33% dropping all the way to 80 cents. This happened as the Bitcoin miner announced that it has successfully restructured its previous purchase agreement with Bitmain Technologies.

What Has Influenced TeraWulf Stock PriceBesides, TeraWulf also increased its hashrate guidance for early 2023 by 16% and has raised over $10 million to pay down a convertible promissory note. This year alone in 2022, the WULF stock price is down by nearly 95%.

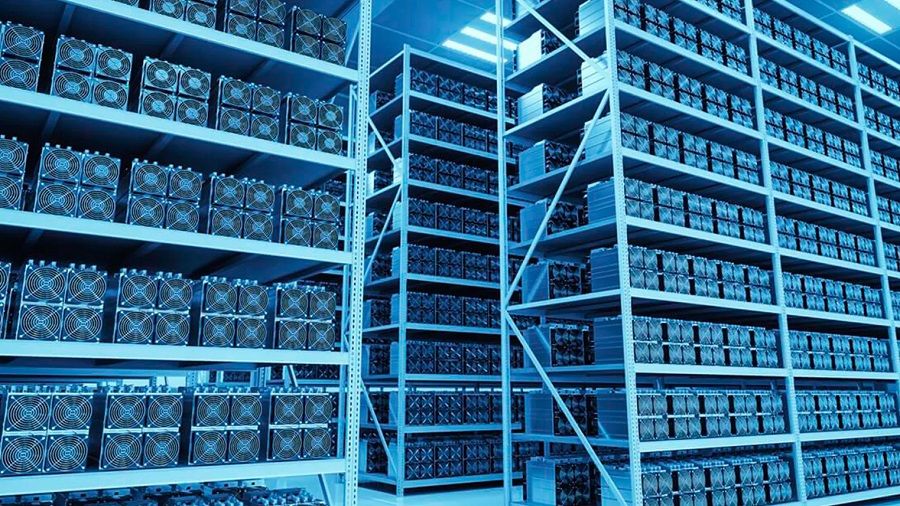

TeraWulf is confident that the restructuring of the purchase agreement with Bitmain Technologies will help them expand its self-mining capabilities while completely utilizing its 160 megawatts available mining capacity by the first quarter of 2023.

As part of the restructuring, the two companies agreed to cancel TeraWulf’s December batch of 3,000 S19 XP Pro bitcoin mining machines. This cancellation comes together with the application of remaining unused deposits with Bitmain.

Bitmain said that it will be replacing the previous batch with 14,000 S19j Pro miners for delivery by the first quarter of 2023 at no additional cost to TeraWulf.

As TeraWulf receives an incremental delivery of 8,200 miners, the Bitcoin miner has decided to increase its estimated first-quarter self-mining target to 44,450 owned miners. This will be higher than its previous estimate of 36,250 owned miners.

Additionally, TeraWulf has also raised fresh capital to repay the convertible promissory note with YA II PN Ltd.Commenting on this recent restructuring with Bitmain, Nazar Khan, Co-founder and Chief Operating Officer of TeraWulf said:

“With this recent agreement, the Company’s self-mining hash rate will increase by 23% and produce Bitcoin at an all-in cost to mine of approximately $6,300 per coin1”.

TeraWulf’s Restructuring PlansBitcoin miner TeraWulf has raised $10 million in fresh funding which comprises of $6.7 million registered direct offering of the common stock. This is in addition to the previous issuance of $3.4 million in convertible promissory notes to some of its largest shareholders.

TeraWulf said that they would use these proceedings to repay the advance with Yorkville. At the same time, they would terminate the accompanying SEPA entered into on June 2, 2022. As of September 30, TeraWulf has a $138.5 million in a term loan.

nextBitcoin Miner TeraWulf Sees 33% Drop in Stock Price after Agreement with Bitmain

origin »Bitcoin price in Telegram @btc_price_every_hour

Russian Miner Coin (RMC) на Currencies.ru

|

|