2019-2-4 21:52 |

Bitcoin May Reach First 7-Month Consecutive Decline In History

Alex Kruger, known for his work as a crypto trading analyst, has observed some bad news for Bitcoin. With the present trend of decline, a new milestone may be met, and it is not a good one. If February proves to be the same as the months before it, this will be the longest time that Bitcoin has been trending downward in its lifetime.

Posting to Twitter, Kruger said,

“Bitcoin has never before traded more than six months in the same direction. A down February would represent seven straight red months. Would be a first. “

From a selling standpoint, the previous bear market has already been beaten out by a total of four days. From December 16th, 2017 to now, there has been 415 days that have had a negative return. The former bear cycle that lasted this long was back between 2013 and 2015 for 411 days, when the digital current lost just over 86% in value. The price went from $1178 to $114. Now, the downward trend has not met the same severity (82.53%), but it is still a massive downward trend, and it is considered the lowest price drop.

Apart from the one that the market is presently in, every bear cycle resulted in a sharp reversal. After the crash in 2011, the bull run brought it up to $1178, and the bear cycle that lasted through 2015 brought Bitcoin to $19,751. If there is any indication that history will predict the future, this bear phase should end with a severe correction with a bull run.

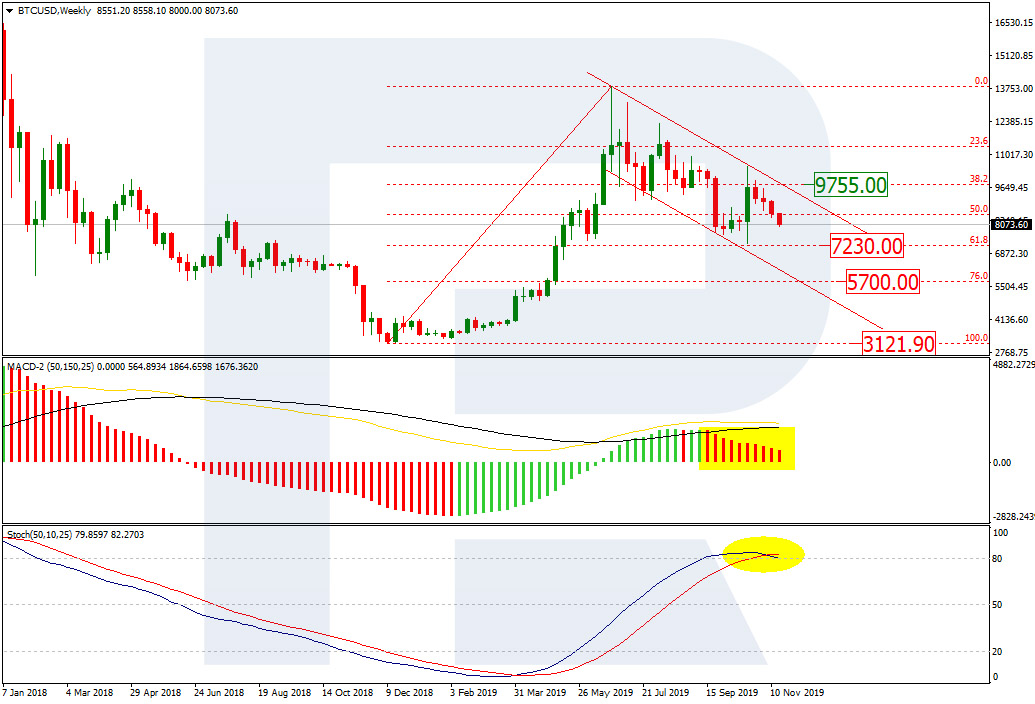

The crypto market was startled by the crash in 2018, which bulls remained positive through. They claimed that the institutional investors would ultimately help bring the market out of the slump and drive up Bitcoin prices. However, the bear market is not over yet, and several analysts believe that Bitcoin will need to bottom out at $1,500 first. There is no telling how long the bear market can last, but the mainstream market has dealt with this kind of issue as well.

The average bear market lasts for about five months, based on data taken on the traditional finance market after World War II. The longest bear market in this sector lasts for 61 months, concluding in March 1942. Since 1945, the most severe decline was the recession from 2007 to 2009. Analysts examining the market now believe that there are signs of a bearish breakdown, which means a correction may be on the horizon.

Realistically, analysts believe that the next bull target will be over $4,200 for Bitcoin. As of 9:30 am MST, CoinMarketCap reports that Bitcoin is at $3,463.46, having lost less than 1% in the last 24 hours.

origin »Bitcoin price in Telegram @btc_price_every_hour

Theresa May Coin (MAY) на Currencies.ru

|

|