2024-11-3 23:30 |

Bitcoin has entered a consolidation phase after falling short of breaking its all-time high this week, leaving bulls in anticipation of the next big move. Currently trading just below its previous peak, BTC’s inability to push past this level has led to a temporary reset in momentum.

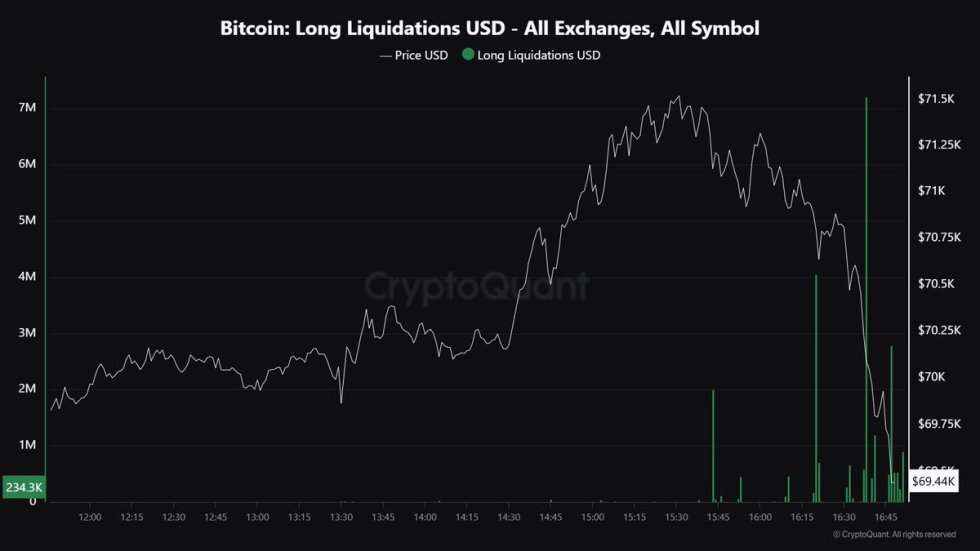

Key data from CryptoQuant shows a recent uptick in long BTC liquidations, signaling that bullish traders are facing a short-term shakeout. This wave of liquidations is forcing leveraged positions to unwind, which may clear excess leverage from the market.

While this has created near-term volatility, it could also set up the groundwork for a new surge. As liquidity resets, BTC may be establishing a healthier foundation for a stronger breakout attempt.

Analysts suggest that this period of consolidation could be a pivotal moment for BTC, preparing it to finally breach all-time highs and drive a fresh leg up in the market. With the stage set for potential volatility, investors are closely watching for signs of renewed momentum that could propel Bitcoin into uncharted territory in the days ahead.

Bitcoin Liquidity Resting Above ATHBitcoin is currently facing a pivotal moment as liquidity hovers just above its all-time highs, and bearish sentiment grows among traders. With key resistance firmly in place, many bears are confident that BTC will struggle to break through this critical level in the near term.

Insights shared by Maartunn on X highlight a concerning trend: the Bitcoin long liquidations across all exchanges are rising rapidly, suggesting that leveraged long positions are being squeezed out as the price remains stagnant.

This increase in long liquidations could signify a broader market shakeout, potentially setting the stage for a significant liquidity sweep. By forcing out bullish retail investors, Bitcoin may prepare for a resurgence that could drive prices beyond previous all-time highs. Traders are acutely aware that this could be a crucial turning point, as the dynamics of liquidations might create a catalyst for renewed bullish momentum.

However, there remains a considerable risk of further downside. Should the price continue to decline, it could lead to even more liquidations and a retrace to lower demand levels. This scenario would test current holders’ resolve and challenge the market’s overall bullish sentiment.

The upcoming week is particularly critical as the US election approaches, alongside the Federal Reserve’s decision on interest rates. These events are likely to impact Bitcoin’s price action significantly, making the next few days crucial for bulls and bears alike. Investors should remain vigilant and prepare for potential volatility as the market navigates these key developments.

BTC About To Enter Price DiscoveryBitcoin is currently trading at $69,700 after testing supply just below its all-time high of $73,794. As the market leader approaches this critical resistance, it is on the verge of entering a price discovery phase, a time typically characterized by significant bullish momentum that can propel both BTC and the broader market into a massive bull run. However, for this bullish trajectory to materialize, Bitcoin must confirm a decisive break above the all-time high.

Currently, BTC is holding strong above the key support level of $69,000, which is essential for maintaining upward momentum. If the price can sustain above this level, it will likely set the stage for a challenge against the previous all-time high. Conversely, if Bitcoin drops below $69,000, it could trigger a retreat toward the $66,500 demand level, where liquidity may be tested.

The next few days will be critical for Bitcoin, as traders monitor price action closely to gauge whether the momentum can sustain itself and lead to a breakout above the all-time high. The anticipation surrounding this pivotal moment is palpable, with market participants eager to see how Bitcoin navigates this crucial juncture.

Featured image from Dall-E, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|