2023-4-12 10:32 |

Bitcoin and Litecoin are some of the top popular cryptocurrencies in the world, and their prices are influenced by a variety of factors, including supply and demand. One significant event that can affect the price of these digital assets is the halving event, which occurs roughly every four years. In this article, we will discuss how the upcoming Bitcoin and Litecoin halving events will affect their prices and why it’s important to invest in them now.

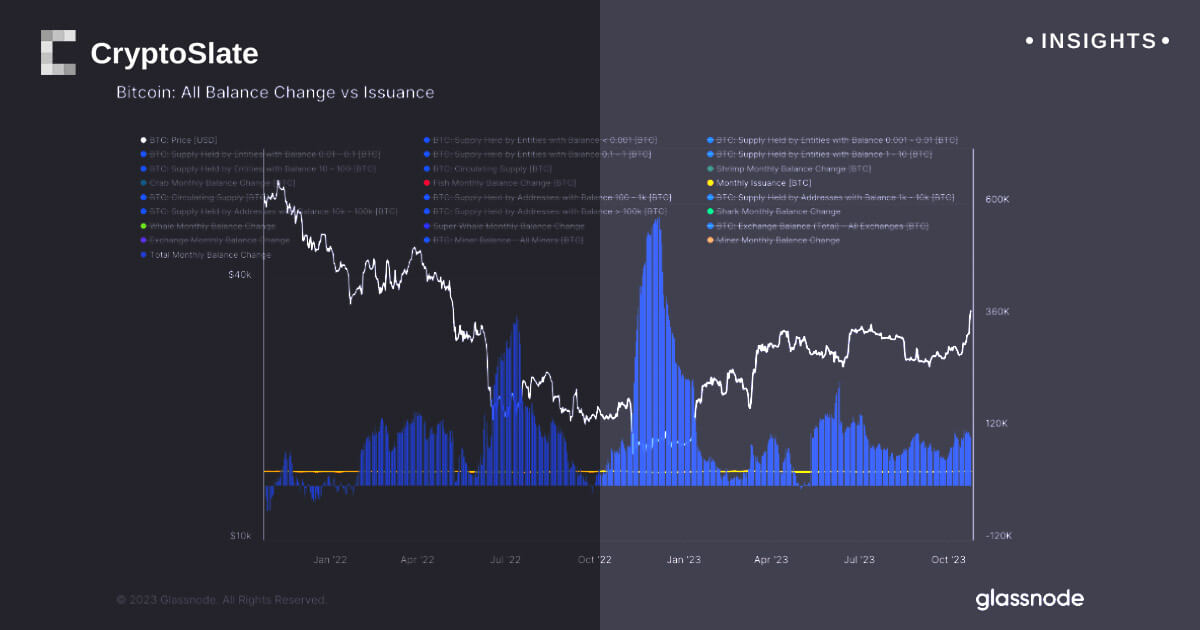

Bitcoin and Litecoin HalvingBitcoin’s next halving event is anticipated to happen in around May 2024. At that time, the reward that Bitcoin miners receive for processing transactions on the network will be cut in half, from 6.25 BTC to 3.125 BTC. This will reduce the rate at which new Bitcoins are created, ultimately limiting the distribution of the cryptocurrency.

Similarly, Litecoin’s next halving event is fixed to happen in August 2023. During this event, the reward that Litecoin miners receive for processing transactions on the network will be reduced from 12.5 LTC to 6.25 LTC. This will also reduce the rate at which new Litecoins are created, ultimately limiting the supply of the cryptocurrency.

Historical Effects Of HalvingHistorically, halving events have had a significant impact on the prices of both Bitcoin and Litecoin. For example, after the last Bitcoin halving event in May 2020, the price of Bitcoin increased from around $8,000 to over $60,000 within a year. Similarly, after the last Litecoin halving event in August 2019, the price of Litecoin increased from around $30 to over $140 within a year.

The upcoming Bitcoin and Litecoin halving events are expected to have a similar impact on their prices. One reason for this is the reduced supply of the cryptocurrencies that will result from the halving events. With fewer coins being produced, there will be less selling pressure from miners, which could lead to an increase in demand and, therefore, a price increase.

The Role Of Halving HypeAnother reason is the increased attention that halving events tend to bring to cryptocurrencies. The media coverage of these events can generate excitement and speculation among investors, leading to increased demand for the assets and potentially driving up the price. Therefore, it’s important to consider investing in Bitcoin and Litecoin now, before the halving events occur. By doing so, investors can potentially take advantage of the expected price increase that may occur in the months following the events.

However, it’s important to remember that investing in cryptocurrencies is still a highly speculative and risky space. The prices of these assets can still be volatile. There is no guarantee that the price will increase after the halving events as there are many other factors to be considered in the governmental approach and regulatory bodies’ position. As with any investment, it’s crucial to do your research and consider the potential risks before making any decisions.

Final ThoughtsTo summarize, the next Bitcoin and Litecoin halving events are expected to have a significant impact on their prices. The reduced supply of cryptocurrencies and increased attention from investors and the media could lead to a price increase in the months following the events. Therefore, it’s important to consider investing in these cryptocurrencies now, before the halving events occur. However, it’s essential to do your research and consider the potential risks before making any investment decisions.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Image Source: bikox99/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Event Token (EVENT) на Currencies.ru

|

|