2018-10-28 22:02 |

Bitcoin appeared for the first time ten years ago when its white paper was first released. At that moment, a financial crisis hit the world and the financial industry as never before. Backed by libertarians and other cypherpunks, the popularity of this virtual currency is currently undisputed.

MarketWatch was able to make a good summary of the most important moments in Bitcoin’s history. The first thing they mention is the first email that was sent by Satoshi Nakamoto on October 31, 2008.

The email reads as follows:

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.”

Although we do not know who Satoshi Nakamoto really is, he was in touch with several recognized developers and programmers from all over the world. Mr Nakamoto created Bitcoin and a system known as blockchain technology that allows for transactions to be processed in a decentralized way.

At the moment, there are more than 2,000 virtual currencies in the market, but not all of them are valuable. Indeed, just a few of them are able to offer something unique. Additionally, according to deadcoins.com, there are more than 1,000 cryptocurrencies that have already disappeared from the market.

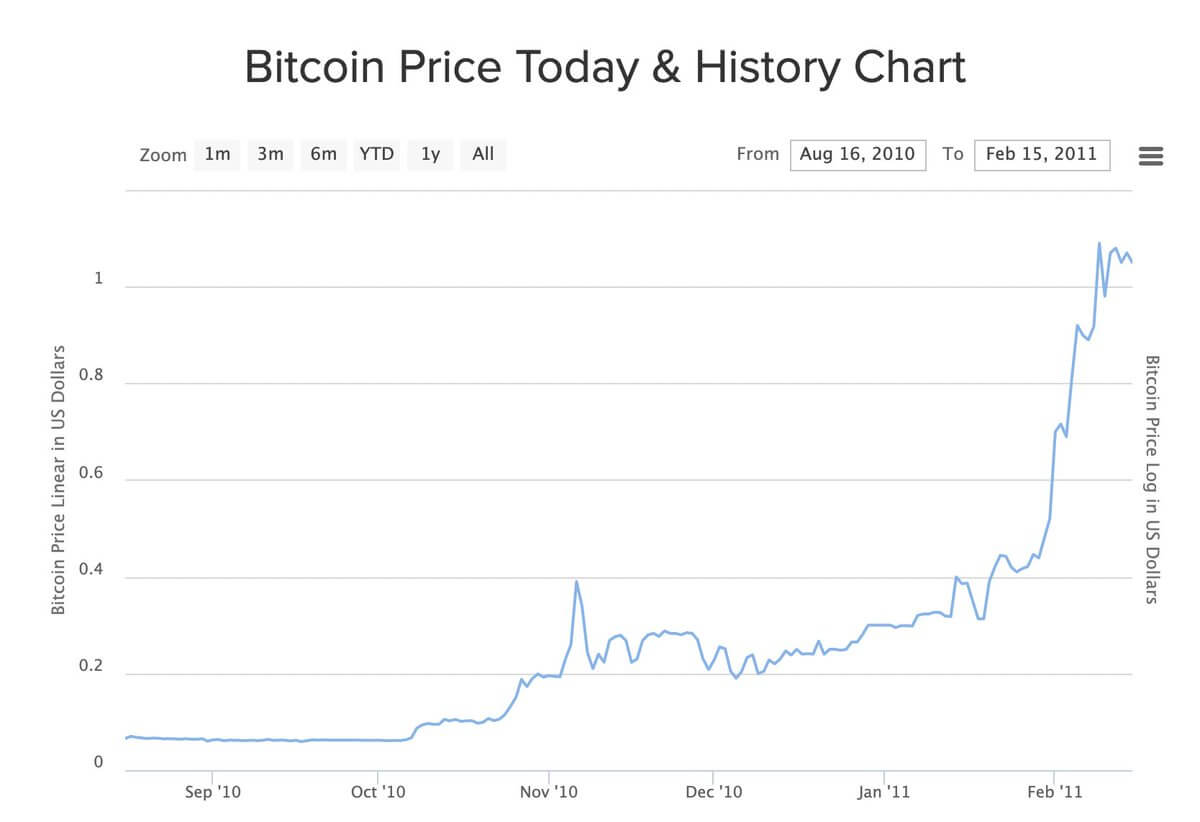

Since it entered the market, Bitcoin moved from $0.01 dollars to $20,000 dollars in December 2017. However, the market is currently in a bear trend and each Bitcoin is being traded around $6,500 dollars.

The article talks about the early days of Bitcoin when Satoshi Nakamoto sent several emails to a cryptography mailing list that was largely made up of cypherpunks. There were individuals that received Nakamoto’s proposal in a very positive way, while others showed scepticism on the matter.

Two months later, the first 50 Bitcoins were mined with the Genesis Block. This Genesis Block had a note that said “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

The first recorded transaction occurred in 2010. Satoshi Nakamoto sent Bitcoin to Hal Finney, a recognized programmer. On May 22, 2010, Laszlo Hanyecz performed the first purchase using Bitcoin. He spent 10,000 BTC to buy two pizzas. Now, this day is remembered as Bitcoin Pizza Day and is celebrated on May 22.

At that time, Bitcoin was traded in many different exchanges. But there was one that was the most important and dominant in terms of trading volume: Mt Gox. However, not everything was perfect for Bitcoin and cryptocurrencies. At that time, this exchange got hacked, four years after Bitcoin was created. This resulted in the loss of more than 800,000 bitcoins. This scandal around the attack affected the whole market and the industry.

The recognized investor, Tim Draper, said about this issue:

“I became enthralled in bitcoin when Mt Gox ‘disappeared’ my bitcoin. When that happened, I thought bitcoin would collapse, but it didn’t, so I knew it was more important than it seemed on the surface.”

Tim Draper became a very important figure in the cryptocurrency space. He has also purchased Bitcoins that the U.S. Justice Department seized in the Silk Road case. At that time, each Bitcoin was sold for just $300 dollars.

Although Mt Gox was one of the hardest situations that Bitcoin and the crypto space had to experience, there were other attacks and hacks. Bitfinex, also one of the largest exchanges in the market, has also experienced an attack that resulted in the theft of 120,000 Bitcoins.

Another important issue that Bitcoin is facing is related to its scalability. Credit card companies and other payment processing platforms are able to process an increased number of transactions per second, even thousands of them. But Bitcoin is just capable of processing around 5 transactions per second (TPS).

Nigel Green, CEO of deVere Group said that currently there is an important shift from fiat money to cryptocurrencies. For him, this tendency would increase in the next 10 years.

There are different experts in the space that say different things about what will happen in the next ten years in the cryptocurrency market. Some of them are very bullish while others think that Bitcoin would not succeed.

The industry is searching for better regulations in the most important countries around the world. Bitcoin needs to operate under a clear framework, and this is why regulators will play a very important role in the near future.

The cryptocurrency market is getting prepared to receive a new inflow of cryptocurrency investors, more specifically, institutional investors. There are some companies such as Fidelity Investments, Goldman Sachs or the Intercontinental Exchange (ICE) that are working in order to create platforms specifically designed for institutions.

Michael Novogratz, John Mc Afee, Tim Draper and Thomas Lee, are all bullish about the future of the space. However, Nouriel Roubini, Jamie Dimon or Warren Buffet are in the opposite side of the market.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|