2026-1-29 00:40 |

The SEC has now dropped its civil case against Gemini with prejudice, a significant win for the Winklevoss-led exchange after years of regulatory pressure. But not all news is celebratory, as US Marshals confirmed an investigation into claims that $40 million in government-seized crypto was stolen by a federal contractor’s son.

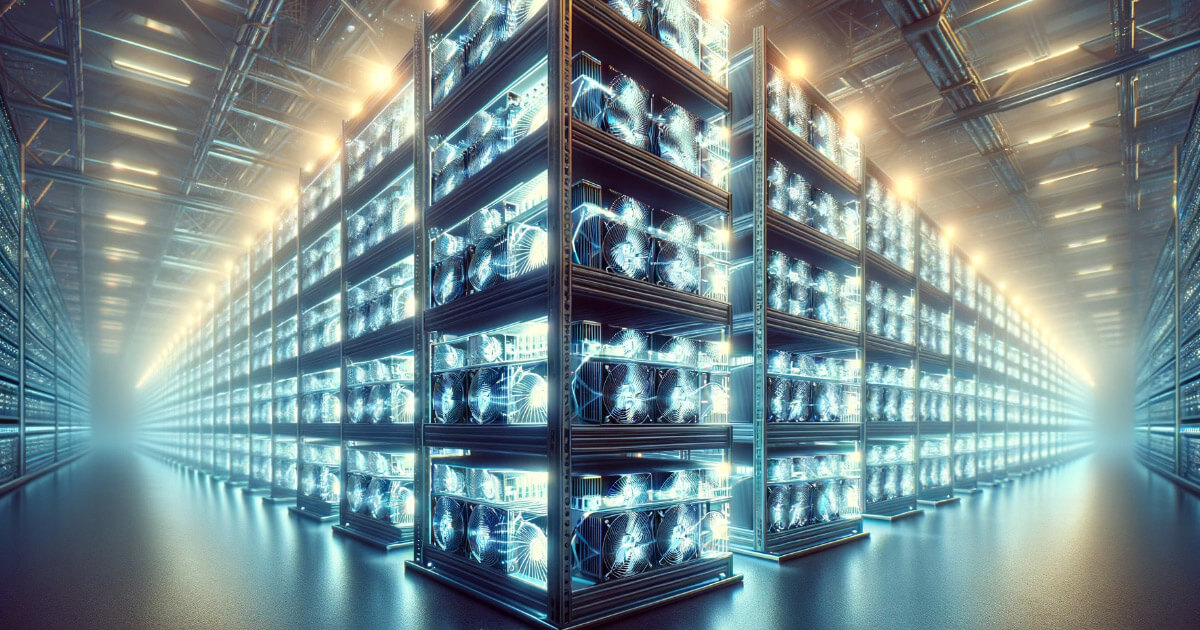

Meanwhile, AI data centers are facing the same local resistance that slowed Bitcoin mining expansion, namely, community pushback over power consumption and infrastructure strain.

If you’re keeping up with Bitcoin Hyper news and scanning for the next breakout, this mixed landscape rewards selectivity, so it may be worth looking in the direction of DeepSnitch AI instead.

This is a presale built around five AI agents that track whale movements, audit contracts, and catch scams before you commit capital. The presale crossed $1.35 million at $0.03681, up 143% from its starting price already, with full release coming up rapidly and clear moonshot potential in 2026.

SEC retreat, custody scandal, and AI infrastructure battles define the week’s crypto marketThe SEC has filed a joint stipulation to drop its case with prejudice after Gemini Earn investors received 100% in-kind return of their crypto through Genesis bankruptcy proceedings. Gemini contributed up to $40 million to fund that recovery. It’s a rare clean exit from a Biden-era enforcement action, and it signals that the regulatory climate, while still uncertain, is taking a turn.

But the custody story isn’t pretty, as US Marshals confirmed they’re investigating claims that John Daghita, son of a federal contractor managing seized digital assets, stole above $40 million in government-held crypto.

On-chain sleuth ZachXBT traced wallets allegedly controlled by Daghita holding $23 million, with additional Ether worth $36 million flagged to authorities. When the people guarding seized crypto allegedly become thieves, it raises uncomfortable questions about custodial security across the industry.

And AI data centers are hitting the same community resistance that Bitcoin miners faced, of local opposition over electricity demand, grid strain, and long-term environmental costs. About $64 billion in US data center projects have already been delayed or blocked.

For tokens at the intersection of AI and crypto utility, like DeepSnitch AI, that tension between demand and infrastructure capacity could drive adoption as projects compete for attention in a resource-constrained environment.

Bitcoin Hyper ecosystem updates, Chainlink’s slow build, and DeepSnitch AI’s 100x potential in 2026 DeepSnitch AICrypto tends to reward preparation more than conviction because, by the time something feels obvious, positioning is often crowded, and risk has elevated. DeepSnitch AI was built around that reality by expert on-chain analysts who know the pain intimately but also know how to avoid it brilliantly. The platform centers around five AI agents, or “snitches,” that work together to surface early signals and structural issues.

The credibility of this rare token comes from action and timing united, as DeepSnitch AI has already rolled out internal tools, allowing early holders to interact with the platform before it goes public. At launch, the five AI agents activate together, drawing on the experience of on-chain analysts who have spent years dissecting wallet behavior, contract risk, and market structure.

The presale remains at $0.03681 with more than $1.35 million raised. Staking is live with uncapped, dynamic APR, allowing rewards to scale with adoption, and holders already use the platform, even though the launch is expected soon enough.

For traders following Bitcoin Hyper news while deciding where to allocate next, DeepSnitch AI has proven its credentials with its working tools and prescient approach to the demands of the 2026 market.

Bitcoin Hyper news focuses on ecosystem growth, while DeepSnitch AI centers on tools that become more valuable the more they are used, which is precisely why the latter token has clear moonshot potential this year. But buying now, before launch, is going to make all the difference to the rewards it could bring in.

Bitcoin HyperThe Bitcoin Hyper news cycle has been wild this 2026, and HYPER trades around $0.00018 after an astonishing 479% surge over seven days (one of the most aggressive moves in the altcoin space this month). The presale raised above $31 million at $0.01364, demonstrating strong early demand, though current 24-hour volume remains thin at below $30.

As for Hyper development progress, this powerful potential is still brushing with volatility all the time. The token hit an all-time high of $0.1142 before correcting sharply, and it now trades 99% below that peak while sitting 4,473% above its all-time low. That kind of range defines high-risk, high-reward territory. So, it’s easy to see why where believers see a recovery play, skeptics see a cautionary tale.

For traders comfortable navigating those swings and keeping up with Bitcoin Hyper news as it happens, HYPER has speculative exposure to Bitcoin-adjacent narratives, but it doesn’t have the same plan to steer forward. For those preferring utility alongside their moonshot math, presales like DeepSnitch AI provide working infrastructure rather than price action alone.

ChainlinkInfrastructure plays don’t always get the spotlight, but Chainlink keeps on building, as ever. LINK trades around $12.07 and remains the dominant oracle solution connecting smart contracts to real-world data, a role that becomes more critical as DeFi complexity increases and institutional adoption accelerates.

From here, LINK could reach $32 by the end of the year, with long-term forecasts stretching past $93 by 2050. As on-chain activity grows, oracle demand grows with it, after all.

At $12.07, LINK offers measured exposure to crypto infrastructure growth without the volatility of newer tokens. But for those among you after token news with more asymmetric upside, presale entries like DeepSnitch AI are where modest capital can truly target larger multiples.

Final takeawayHYPER offers volatility-fueled speculation, LINK provides infrastructure stability, and DeepSnitch AI sits somewhere in between. The third has working AI tools, uncapped staking, and presale pricing where small capital can still chase triple-digit returns.

Launch is imminent, and major announcements have been causing stirs left, right, and center, as more and more traders are beginning to see the true 200x potential of this token.

And with bonuses out at the moment, you can think of them as front-loaded exposure. At today’s price, a $5k buy gets you about 136k DSNT. With the 50% bonus code DSNTVIP50, you are holding roughly 204k instead.

The presale and bonus codes are all handled through DeepSnitch AI’s official website.

For follow-up news, feature updates, and timing clues, the project’s X and Telegram channels are worth keeping open.

FAQs What’s the latest Bitcoin Hyper news for January 2026?According to Bitcoin Hyper news, the token surged 479% in seven days on renewed momentum, though thin liquidity adds risk. DeepSnitch AI offers a different profile, with live tools and imminent launch, alongside clearer catalysts.

How does Hyper development progress compare to AI utility tokens?HYPER relies on price momentum and community speculation, as Bitcoin Hyper news speaks to historically, but DeepSnitch AI delivers functional intelligence infrastructure that creates real value independent of short-term price action.

Which tokens benefit from Bitcoin Hyper ecosystem updates?Infrastructure-adjacent tokens like Chainlink gain from ecosystem growth, but DeepSnitch AI’s AI-powered tools position it to capture retail demand as more traders seek on-chain intelligence.

origin »Bitcoin price in Telegram @btc_price_every_hour

Hyper (HYPER) на Currencies.ru

|

|