2020-1-6 01:31 |

\n

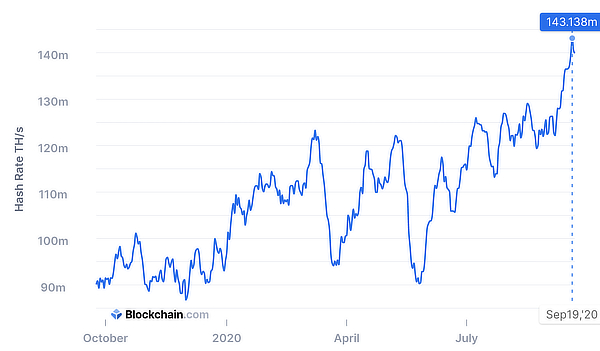

The Bitcoin hashrate recently hit new all-time highs (ATHs) over 119 Exa hashes per second (EH/s). This is equivalent to 1230 zettaFLOPS per second.

The #Bitcoin hashrate has hit a new all time high of 119,354,000 Th/s.

This is 8x what the hashrate was back in 2017 at the $20,000 top.

The Bitcoin fundamentals tell me that the #BTC price is about to explode SOON! pic.twitter.com/Mzk4XllKQS

— The Moon (@themooncarl) January 4, 2020

Each hash is an attempt at finding a solution to the mathematical equation required to mine a block on the Bitcoin blockchain. Hash rate reveals the number of miners on the network and is commonly used to indicate network activity.

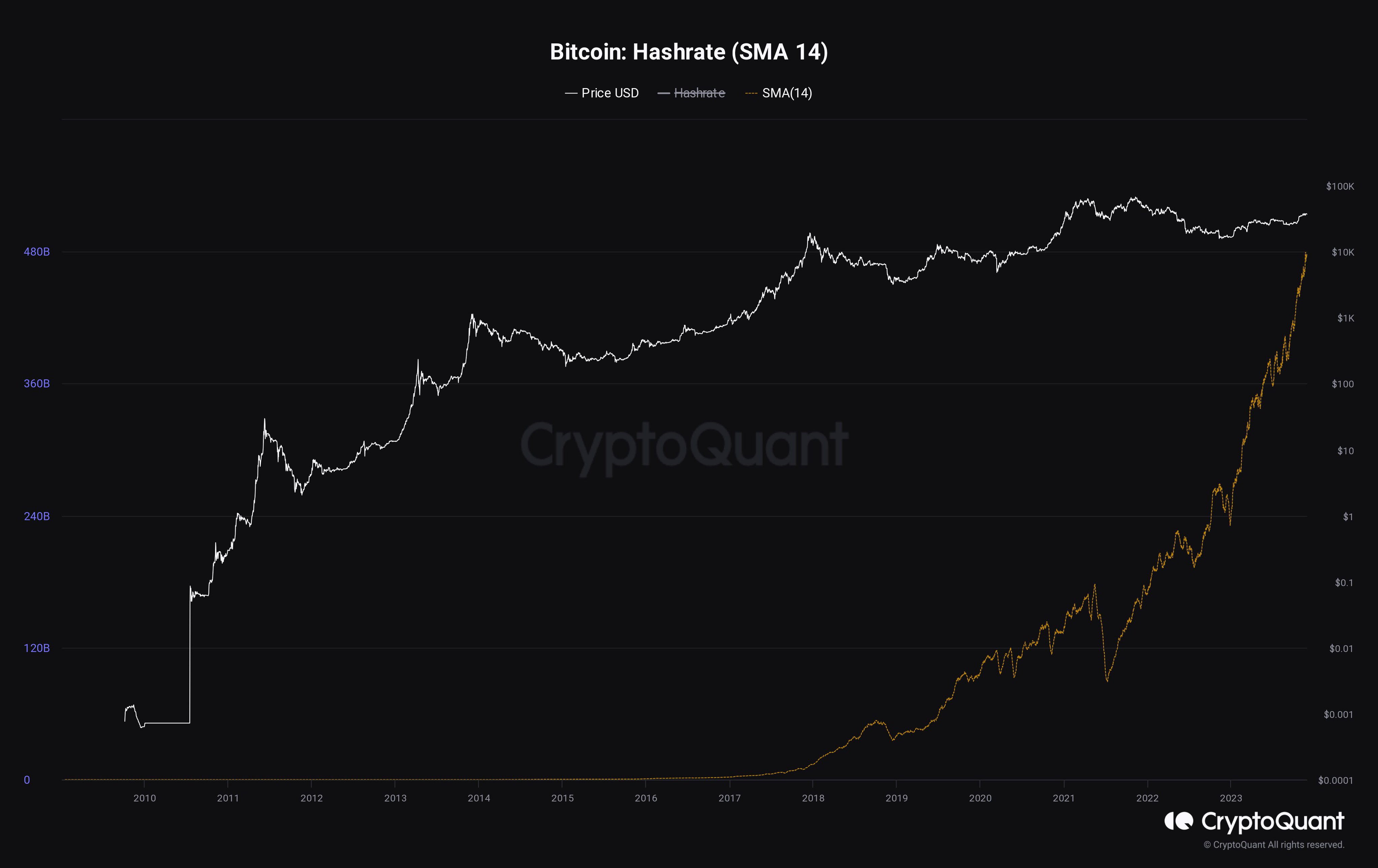

All-Time HighsThe numbers are really remarkable, considering past activity. The current hashrate is more than eight times greater than the rate in 2017 when Bitcoin famously reached $20K.

Additionally, the number is 120 times greater than the hash rate before the strong bull run of 2017. Bitcoin first hit one Exa hash per second in late December of 2016.

These numbers indicate that the activity on the Bitcoin network has exploded in recent years. Increased adoption, and the potential for profits from mining blocks, has likely driven miners onto the network.

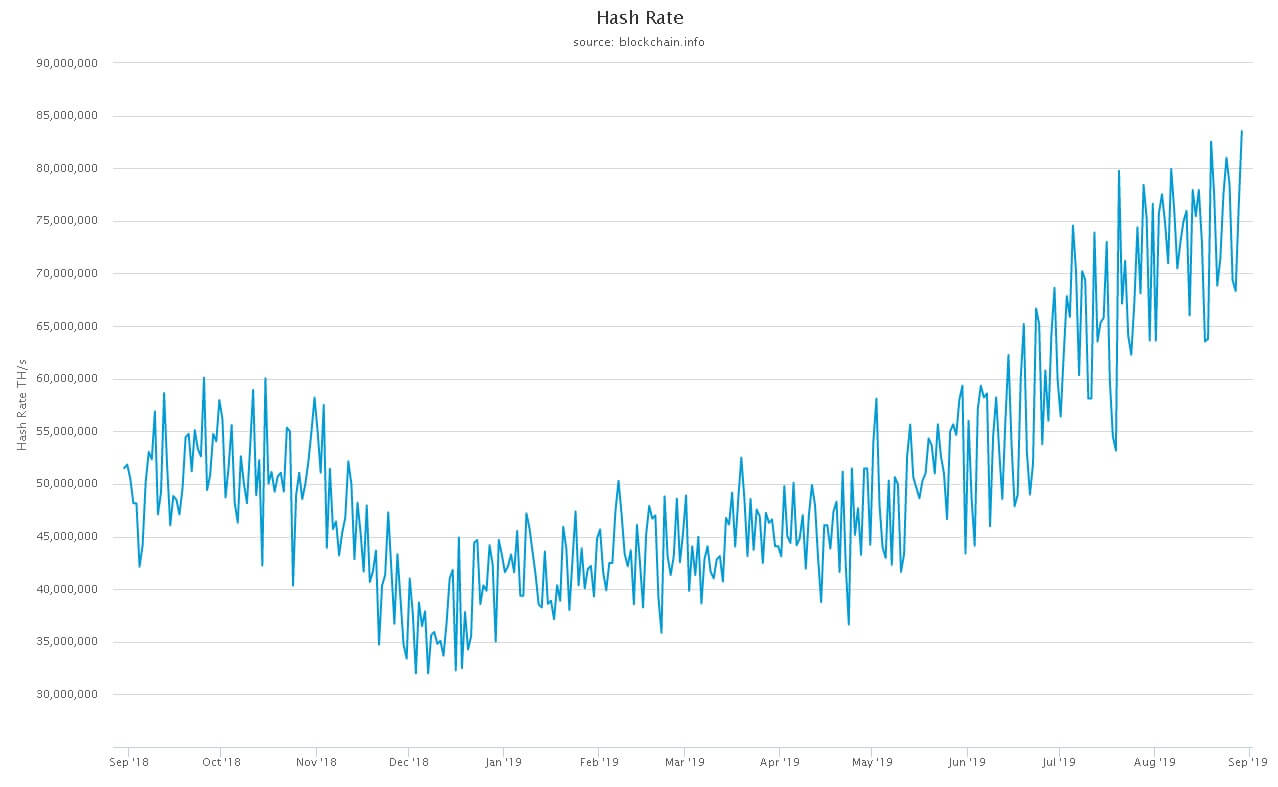

While this activity can, at times, be seen as a bullish price indicator, this isn’t always the case. Hashrate rose consistently during the now-infamous “crypto-winter” of 2018. Prices dropped drastically during this time.

The hashrate finally reversed during the fourth quarter of 2018, dropping nearly 20 EH/s during that interval. Nevertheless, while prices dropped as well, this drop in hashrate signaled a bull run for the first half of 2019.

In simple terms, while hashrate may be an indicator of activity on the network, it does not appear to have a price correlation. However, the increased activity could be a signal for market movement, as adoption increases and drives demand.

Capitulation and the Bitcoin HalvingThe other factor that is often not considered is the potential for miner capitulation. Miners capitulate when they sell their BTC to cover costs.

The coming halving, when the block reward drops to 6.25 BTC, could drive miners out of the game. As miners capitulate and leave the industry, the hashrate will likely see a substantial decrease. Whether the hashrate increases mean good things for the price, though, remains to be seen.

The post Bitcoin Hashrate at ATH, but Prices May Be Unaffected appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|