2024-6-3 21:19 |

Quick Take

A recent analysis by CryptoSlate indicates that Bitcoin miners continue to capitulate, as evidenced by the hash ribbon metric.

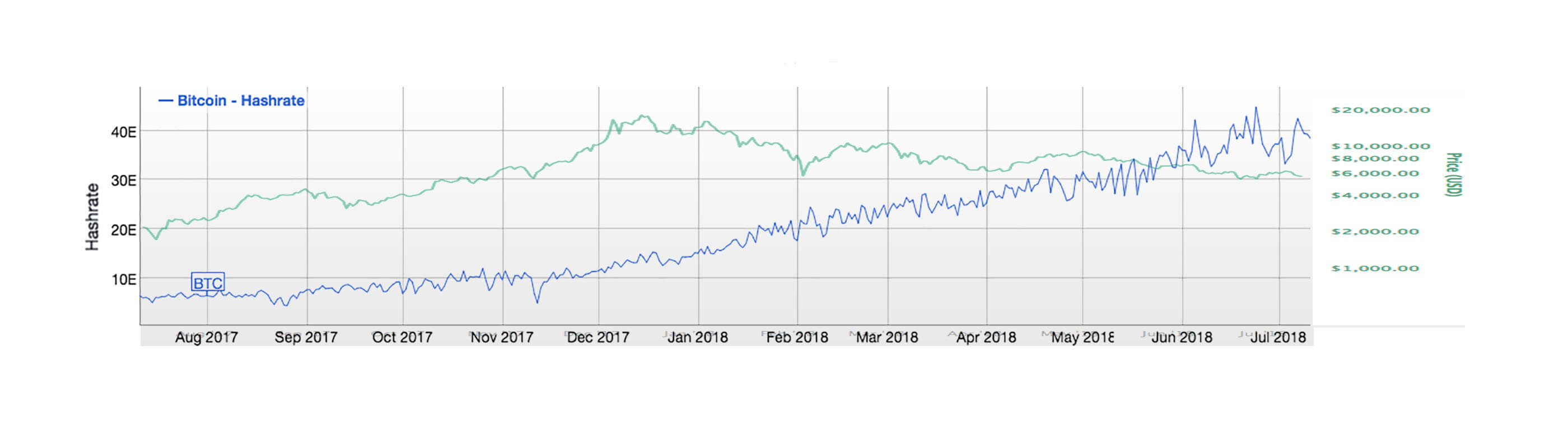

Glassnode data shows that the current hash rate, observed on a seven-day moving average, has dropped to 567 exahashes per second (EH/s), marking its lowest point since the post-halving period. This is a significant drop from the peak hash rate of 655 EH/s.

Over the past week, the hash rate has declined by 14%, representing the steepest 7-day moving average decrease in Bitcoin’s hash rate since July 2021, during the China mining ban — which experienced an over 22% drop.

Hash Rate: (Source: Glassnode)Despite the declining hash rate, the upcoming difficulty adjustment, set for May 6, is expected to increase by over 1%, according to Newhedge.

Interestingly, hash price data from Luxor shows a slight upward trend. It is currently valued at $56 per petahash per second (PH/s), up from a low of approximately $45 PH/s on May 1.

The rise in hash price suggests that despite the potential rise in mining difficulty, miners’ potential profitability is also improving, offering some respite amid the current challenges.

Bitcoin Hashprice Index: (Source: hashrateindex.com)The post Bitcoin hash rate plummets to 567 EH/s: steepest 7-day decline since July 2021 appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Giga Hash (GHS) на Currencies.ru

|

|