2023-8-28 11:49 |

Coinspeaker

Bitcoin Hash Price Plummets Despite Soaring Hash Rate

The mining revenue, otherwise called the hash price, of Bitcoin has dropped to levels not seen since FTX collapsed last November. This was when the BTC price fell to a market cycle low of around $16,500.

As it were, hash price measures the amount of dollars that miners earn per terahash. This implies that it is one of the indicators of profitability for those in the mining business.

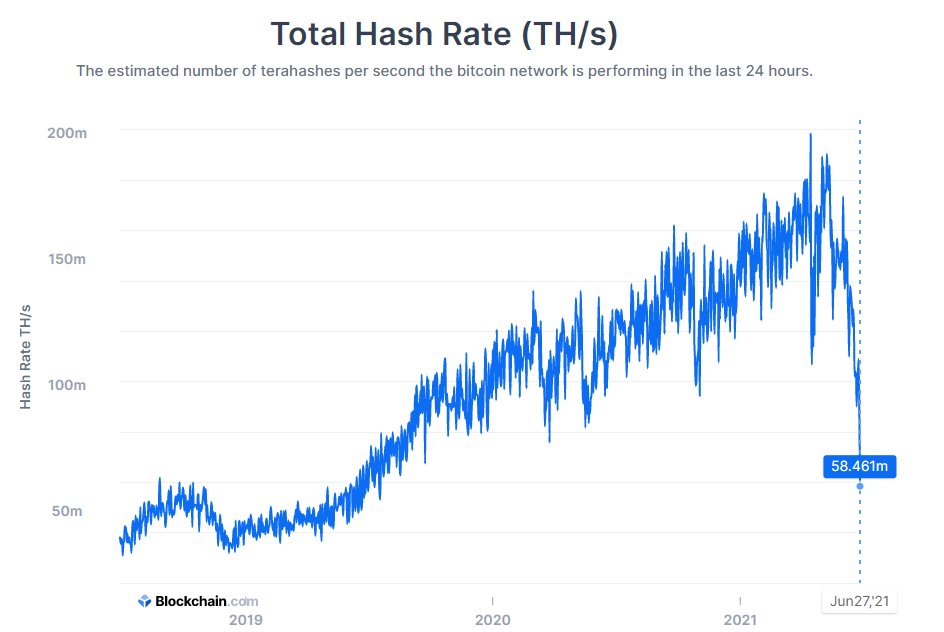

BTC Hash Price Plunges to 6 CentsAs earlier reported, the Bitcoin network hash rate recently surpassed 414 exahashes per second (EH/s), hitting a record high in the process. According to Blockchain.com, the network hash rate has surged by over 54% in the year running, and more than 80% in the past 12 months. But that only highlights the security of the Bitcoin network.

The mining revenues, on the other hand, have grown discouraging, albeit in the same period. As HashPriceIndex data suggests, Bitcoin mining revenue is now just $0.060 per terahash per second per day. That is about a 50% decline from the early May revenue. However, at the time, there was a high demand for block space due to the Bitcoin Ordinals inscription craze.

Analysts’ TakesMeanwhile, Bitcoin’s contrasting hash price and hash rates may not be cause for serious concern. According to market analyst Dylan LeClair, more efficient new rigs will keep being produced. But in the long run, prices must still adjust upward if mining is to remain profitable at such high hash rates, LeClair added.

For miners though, they appear to have devised means of staying afloat in the present situation. In the second quarter, for instance, many Bitcoin miners resorted to stock sales to generate funds.

To put the above statement into perspective, Bloomberg reported on August 24 that the 12 major publicly traded miners raised nearly $440 million through stock sales in Q2.next

Bitcoin Hash Price Plummets Despite Soaring Hash Rate

origin »Bitcoin price in Telegram @btc_price_every_hour

Giga Hash (GHS) на Currencies.ru

|

|