2024-4-18 14:41 |

A recent global survey conducted by Nickel Digital Asset Management, a leading regulated digital assets hedge fund manager based in London, reveals that a significant majority of institutional investors and wealth managers anticipate an increase in institutional investments in Bitcoin due to the upcoming halving event.

What does Nickel Digital survey show?According to the study, 69% of the surveyed professionals, who collectively manage about $816 billion in assets, believe the halving will positively impact institutional investment levels, with 18% expecting a dramatic surge.

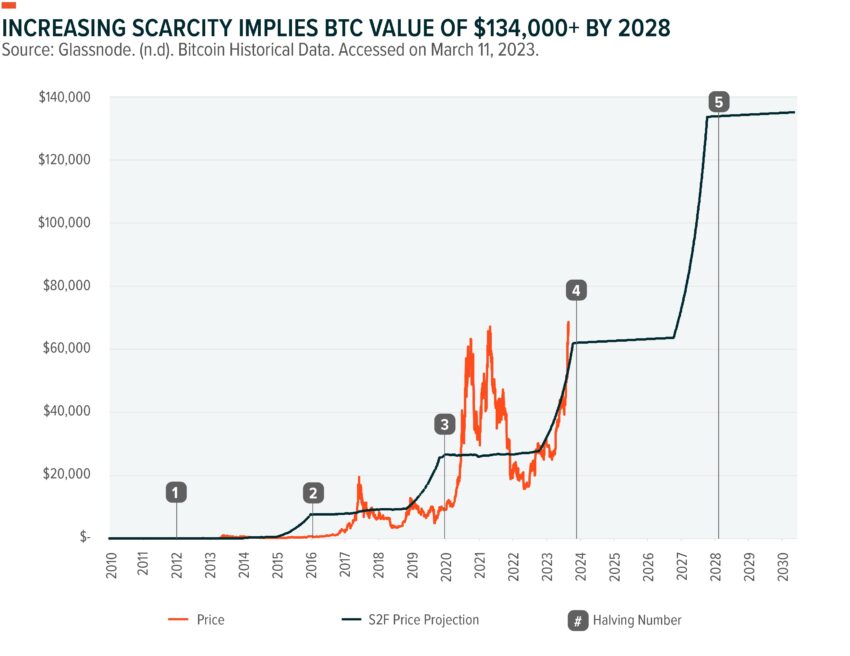

What does Bitcoin halving historical data say?Historical data underscores the transformative impact of past Bitcoin halvings.

Following the May 2020 halving, Bitcoin’s value soared by 36% after 100 days and an impressive 460% after 300 days.

Similar trends were observed in previous halvings in 2016 and 2012, although the immediate post-halving results varied.

In 2016, Bitcoin experienced a slight initial drop of 2.7% but climbed 133% after 300 days. The 2012 halving led to a 240% rise after 100 days and an astounding 896% increase after 300 days.

The survey included responses from institutional investors and wealth managers across several key financial markets, including the US, UK, Germany, Switzerland, Singapore, Brazil, and the United Arab Emirates.

The findings indicate a strong belief that this year’s halving could replicate or even exceed the post-halving rallies seen in previous years.

Interest in altcoins is growingNickel’s report also highlights a growing interest in altcoins, driven by the robust performance of Bitcoin and Ethereum.

Even before the halving, 83% of investors acknowledged that the strength of these leading cryptocurrencies is fostering interest in other digital assets. This trend is expected to intensify post-halving.

The post Bitcoin halving: survey predicts surge in institutional investment post event appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|