2020-7-8 00:00 |

Bitcoin futures have seen a rising premium over spot BTC in recent months, which seems to indicate that traders are bullish on the benchmark cryptocurrency.

This premium is particularly clear while looking towards the CME – which seems to indicate that professional traders and institutions are particularly bullish on BTC at the present moment.

This comes as Bitcoin and the entire cryptocurrency market faces an intense bout of abnormally low volatility, which has caused liquidity to dry up.

Periods of low volatility coupled with limited liquidity are typically followed by massive movements, and the current CME futures premium seems to indicate that institutions are expecting this move to favor bulls.

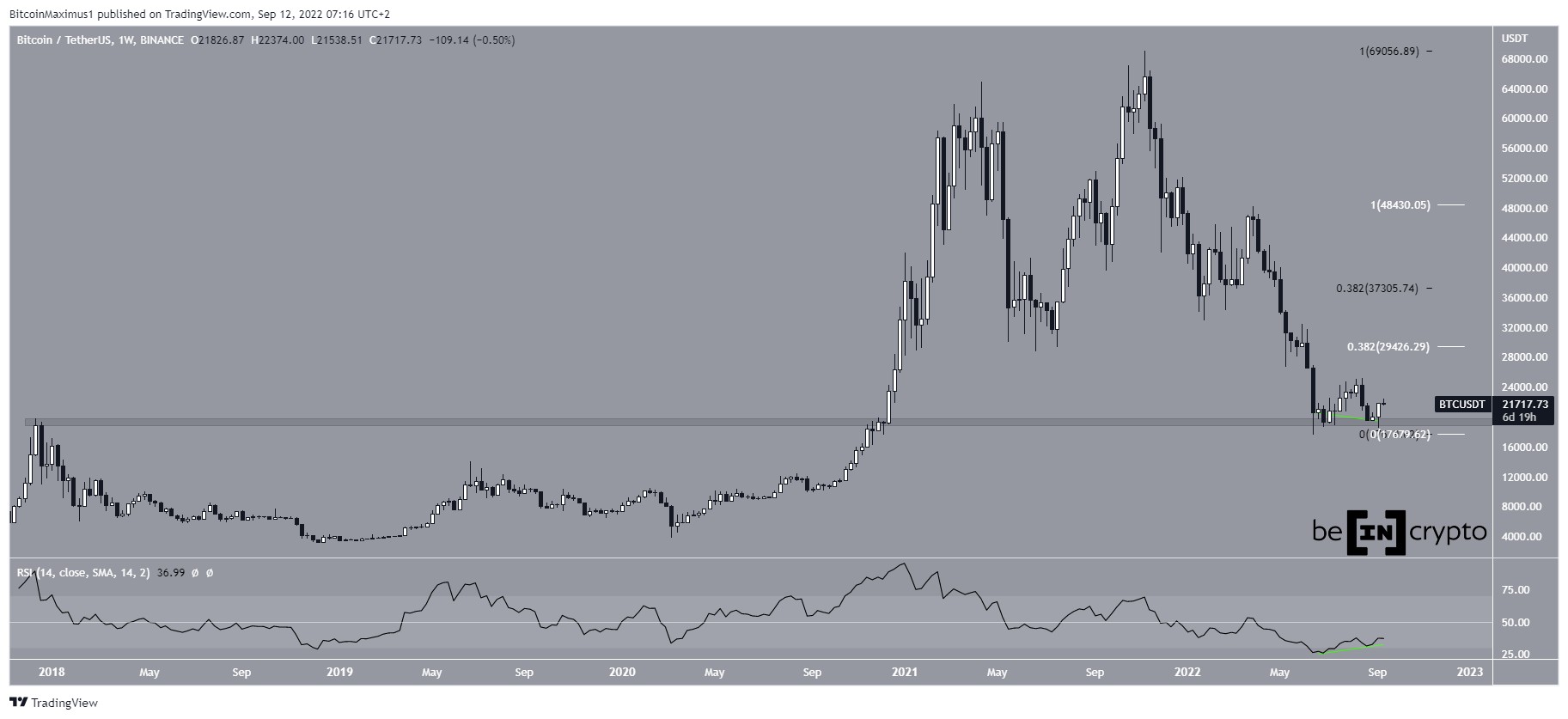

Bitcoin’s Consolidation Phase Suggests a Big Movement is ComingBitcoin has been trading between $9,000 and $10,000 for nearly seven weeks now, and the cryptocurrency has failed to garner any clear direction in the time since.

Its trading range has narrowed over the past week, as it is now trading between $9,000 and $9,300.

The series of lower highs that have been set during the past couple of months doesn’t seem to bode well for bulls.

As buyers and sellers remain at an impasse, where the crypto trends next could be largely dependent on its reaction to its $9,000 support and its $10,000 resistance.

Data via TradingViewWhich of these levels is decisively broken first should offer investors with significant insight into its next trend.

As NewsBTC reported yesterday, Bitcoin likely won’t trade sideways for too much longer.

Over the past month, the benchmark digital asset’s volatility has hit lows not seen in over a year. In turn, this has caused the market’s liquidity to begin drying up.

As cited in the report, the analytics platform Glassnode explained that exchange deposits and on-chain transactions have both seen a sharp decline over the past week.

“Liquidity dropped by 6 points over the past week, losing ground in terms of both trading and transaction liquidity as exchange deposits and on-chain transactions decreased.”

Limited liquidity makes the crypto more prone to seeing abnormal price movements, which could signal that a spike in volatility is inbound.

Institutions Remain Bullish on BTCAs to where this imminent volatility could lead Bitcoin, it appears that institutional investors are anticipating it to see upside.

This is indicated by the rising premiums seen while looking towards BTC futures on the CME.

Arcane Research spoke about this in a recent report, explaining that the premium has gone unchanged over the past week despite the crypto’s narrowing consolidation channel.

“June contracts are out of the way and didn’t even affect the bitcoin market. BTC is moving sideways and futures premiums are holding steady… The gap in premium between CME and retail-focused platforms is still present and fairly unchanged this week.”

Image Courtesy of Arcane Research.Where this premium trends next will likely depend on which direction Bitcoin begins moving once its consolidation close comes to an end.

Featured image from Shutterstock. Pricing Data via TradingView origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum Premium (ETHPR) íà Currencies.ru

|

|