2020-7-24 19:58 |

The Bitcoin market is back to seeing some action.

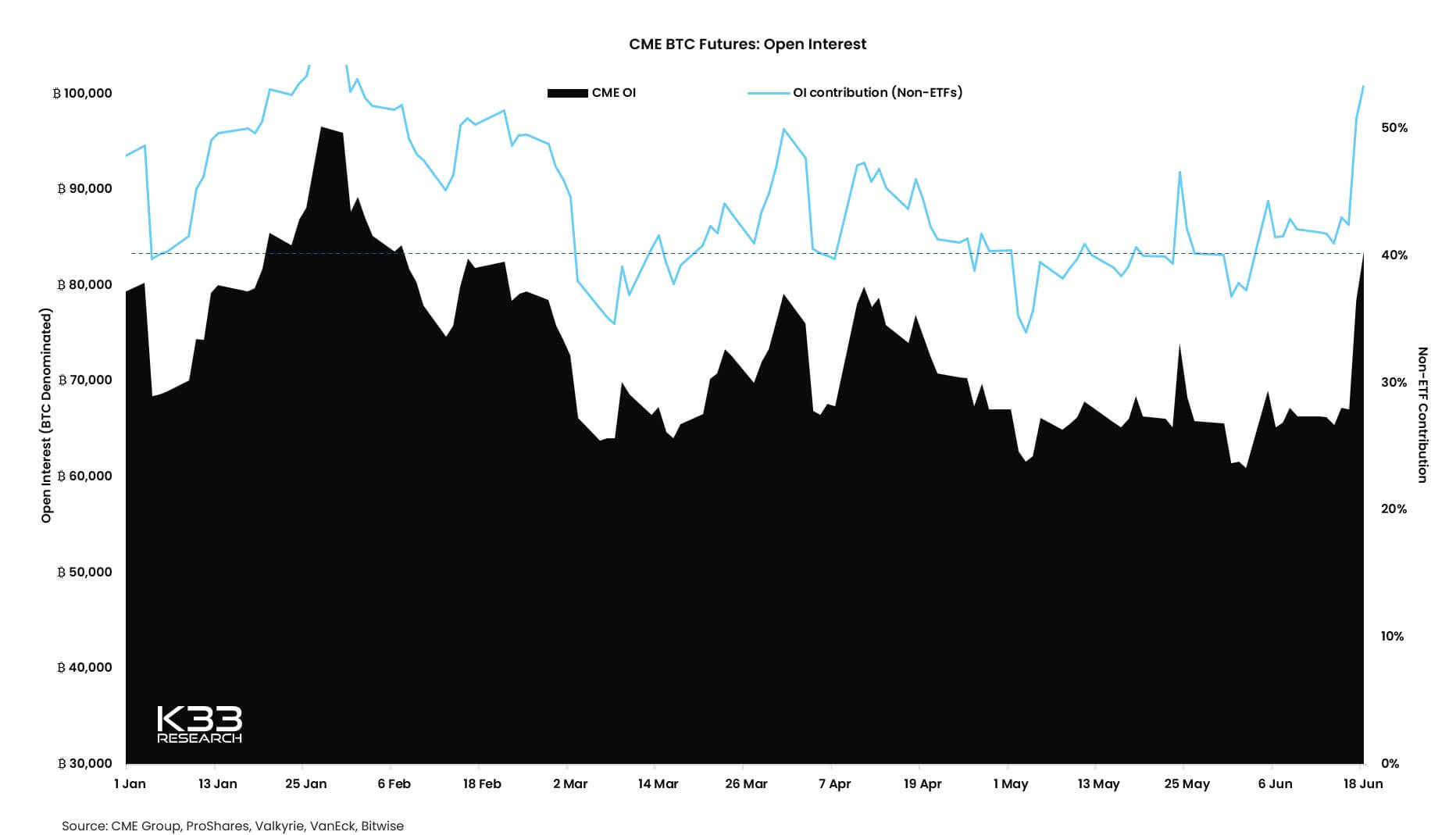

As the price of the BTC moves, so does the volume and open interest. Open interest for bitcoin futures on crypto derivatives exchange BitMEX has yet again exceeded $1 billion, back to the pre-March crash level.

The sell-off on March 12th hit BitMEX the hardest as it’s bitcoin balance dropped substantially. But now the total open interest on the exchange has returned to its levels of January.

Interestingly, before the March crash, BitMEX accounted for 36% of the total OI in the bitcoin futures market only to lose its market share to OKEx, which became the leading bitcoin futures platform in terms of OI.

But BitMEX took its top spot back recently and is now accounting for 23% of the total OI, as per Arcane Research.

Not just on BitMEX, but the total open interest in the bitcoin futures market has recovered to the pre-crash levels, currently at $4.362 billion, and is now on its way to February high.

This time, however, the OI is more evenly distributed among the participants that it was before the sell-off.

Huobi, Binance, and CME all hold more than 10% of total OI share while Bakkt has a mere 0.20%.

Source: Arcane ResearchBakkt is not only performing badly in terms of OI, but pretty much nothing is going on the ICE-baked platform, whose launch was once highly coveted by the market.

Bitcoin futures volume on the exchange remained below $30 million, which has grown to $48 million this week. The only exchange on par with Bakkt is Kraken. As for the open interest in Bitcoin futures, Bakkt holds the lowest place at just $7 million, followed by CoinFlex at $8 million.

When it comes to its bitcoin options product, Bakkt has nothing to showcase because absolutely $0 has been traded in volume and recorded in OI for over a month now. The Bitcoin options market remains under the dominance of Derbit, which controls 92% of volume recording $161 million in volume and $1.3 billion in OI on July 23rd, as per Skew.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|