2020-7-31 15:20 |

Average transaction fees and hash rates are surging, even as BTC/USD holds above $11k heading to the monthly close

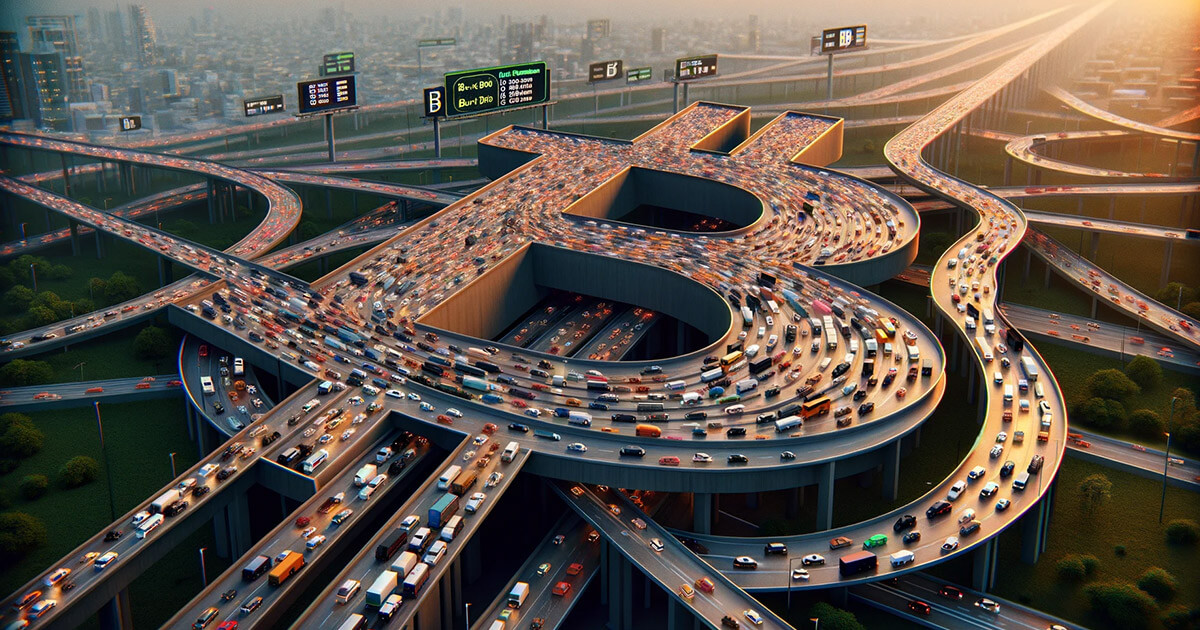

As Bitcoin’s price consolidates near $11,000, demand on the network has peaked. Data shows that average transaction fees have rocketed in the last few days in tandem with the recent spike in price.

After oscillating between $0.60 and $1.60 and averaging around $1.20, network fees have risen sharply to come within touching distance of previous highs.

Network data shows that the network fees have rocketed to $6, surging by almost 500% in a month.

Bitcoin transaction fees chart. Source: Blockchain.comOn July 30, the average transaction fees paid on the network was $6.06, which means the average transaction fee paid over the last seven days is close to hitting levels last seen in May; when network demand spiked in the wake of Bitcoin’s supply squeeze.

At the time, the price of the benchmark cryptocurrency rallied to the psychological $10,000 mark, which saw demand rocket. The climb consequently pushed the average fees paid to miners increase to yearly highs around $6.60.

Miner revenues are upA surge in transaction fees means that miners have seen increased revenues over the past several days. Data from Blockchain.com indicates that miner revenue from transaction fees has rocketed to over $2 million, up from an average of $300,000 on July 1.

Meanwhile, the total value broadcasted across the network is at highs last seen in the days leading up to Bitcoin’s May halving.

According to on-chain data from Byte Tree, over $3.9 billion worth of transactions have been recorded on the Bitcoin network in the past 24 hours. The total transaction value is up by 57% over the past seven days, and by more than 14% over the last five weeks.

Bitcoin’s hash rate at an all-time highWith BTC/USD price above $10k, the network has also seen an upsurge in hash rate. The total computing power on the network has recently hit and continues to sit near an all-time high of 126 exahashes per second (EH/s).

Growing profitability for miners and the projected increase in price are likely to see the hash rate spike to a new all-time high.

Bitcoin hash rate chart. Source: Blockchain.comIf Bitcoin can hold its head above $10,000 and post a monthly close above $11,000, the crypto market will head into August teeming with bullish sentiment. Analysts are forecasting a run to prices above $14,000 if bulls hold prevailing levels. Beyond that, Bitcoin will test its all-time highs at $20k.

BTC/USD is at the time of writing is trading just above $11,000 and is up 17% over the week.

The post Bitcoin fees increase as hash rate hits new high appeared first on Coin Journal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Giga Hash (GHS) на Currencies.ru

|

|