2019-11-7 03:20 |

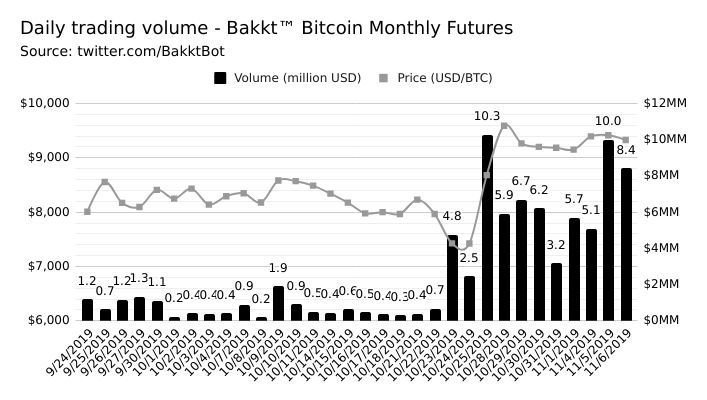

Since launching in September, Bakkt Bitcoin futures contracts were met with significant hype due to the possibility of institutional money flowing into Bitcoin. While the initial returns were disappointing, recent spikes above $10 million in daily trading volume could indicate that Bakkt is finally living up to its expectations.

The Bitcoin futures contract reached an all-time high volume of $10.3 million towards the end of October. In the Tuesday spike, 1061 contracts were traded, falling short of the record by 122. These rises suggest good news for both the Bakkt platform and the possibility of Bitcoin adoption by institutional investors.

The Bitcoin price has been consolidating inside a pennant since the rapid increase on October 25. However, recent price movement suggests that a breakout is likely.

Cryptocurrency trader @TheCryptoCactus stated that while he is undecided, he is leaning on turning bullish on the future prospect of BTC because the price movement looks like a continuation pennant.

$BTC leaning bullish over bearish, this is screaming bullish continuation pattern (pendant), increasing PA against decreasing volume, price holding above 24 EMA…

I think we will see a false breakdown wick, trapping shorters to around mid $9100's range before we pump.. bullish. pic.twitter.com/30zOOnKlAZ

— Cactus (@TheCryptoCactus) November 6, 2019

Additionally, he suggested an outline of future price movement, in which we have a false breakdown towards $9100 before a pump.

Bitcoin Continuation PennantSince reaching a high of $10,480 on October 26, the BTC price has been steadily decreasing.

BeInCrypto has previously reported that it is likely trading inside a horizontal channel.

However, the pennant outlined in the tweet is contained within the channel, so both patterns can coexist.

The support line is especially justifiable since it has been validated numerous times.

On the other hand, the presence of several wicks makes drawing the resistance line a conjecture.

Most technical indicators are neutral.

However, there is a bullish cross of the 100- and 200-hour moving averages (MA) which suggests that the price will break out.

The “false breakdown” outlined in the tweet would have the price breaking down from the pennant, before rallying towards the resistance line of the channel.

To be clear, we are not stating that this movement will happen, rather outlining how it would look if it will.

As it currently stands, a regular breakout seems likely.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Images courtesy of TradingView, Twitter.

Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!

The post Bitcoin: False Breakdown Followed by Pump? Analyst Outlines Possible Movement appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|