2023-6-10 13:49 |

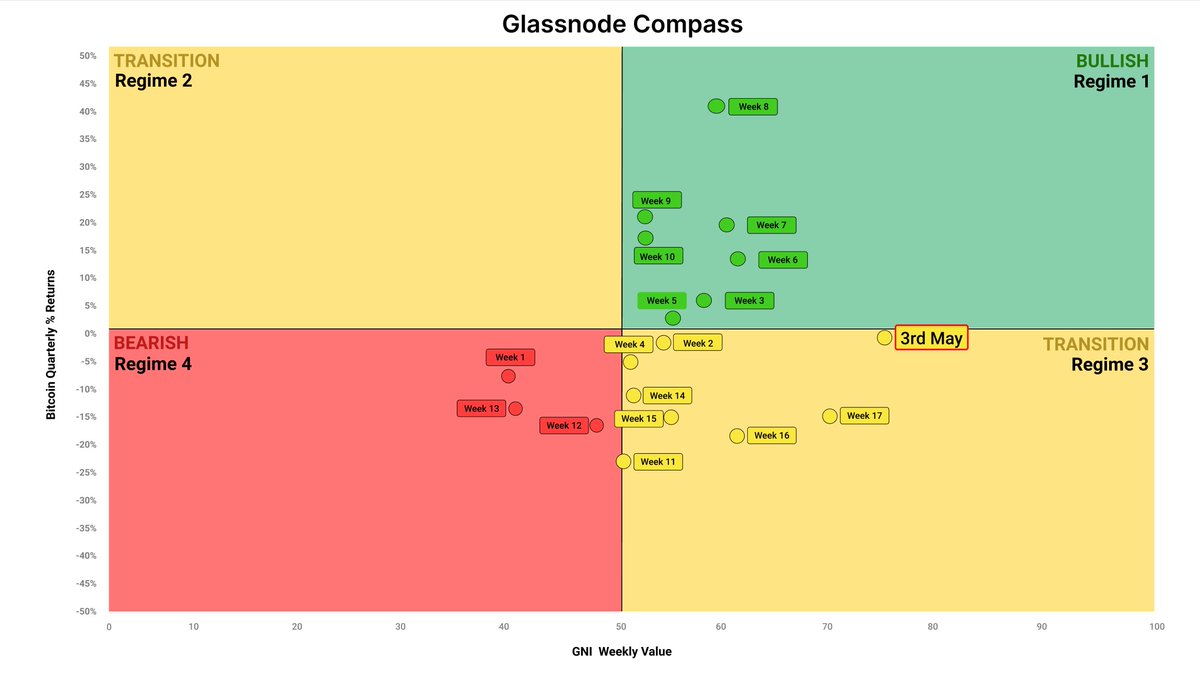

The digital assets market has recorded bullish signals this year but the recent outlook suggests it may be heading towards the first bad month of 2023.

Digital assets continue their week-long poor form with Bitcoin (BTC), Ethereum (, ETH), and other top 10 assets falling below prominent positions. Market leader BTC hit a 30-day low yesterday at $25,511, dropping 5% across 24 hours.

While several pundits described BTC as being on the cusp of pushing through the $28,000 resistance on its rebound, the asset rather declined to 10-week lows. ETH which traded above $2,100 post Shapella has hit a 7-day low at $1,740 making a short-term vote unlikely amid present market conditions.

Assets in the top 15 by market cap have all recorded weekly losses except Tron which gained 8.63%. The reason for these widespread losses ranges from fears about the United States debt ceiling, regulatory uncertainty and investors largely moving away from riskier assets. Some analysts have stated that these fears surrounding the market are overstated with some indicators showing positives.

Debt ceiling causing panicThis issue is two-way traffic. Several commentators believe that the US defaulting on its debt for the first time could result in massive inflows to Bitcoin. No matter the reason posed, there will be liquidity problems straining investors creating another debacle for the market.

BTC and the S&P 500 remain correlated with many banks predicting a sharp recession in the US this year. Investor sentiment remains low according to data compiled by the U.S. Bank.

“Our U.S. Health Check is at levels consistent with historical recessions as the Federal Reserve continues tightening monetary policy to combat elevated inflation,” the report stated.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|