2025-2-4 00:00 |

Bitcoin faced a massive selling event yesterday as U.S. trade war fears triggered a sharp market-wide decline. The uncertainty surrounding global economic conditions caused panic selling, driving BTC and many altcoins significantly lower. Investors are on edge as the market attempts to find stability after one of the most volatile sessions of the year.

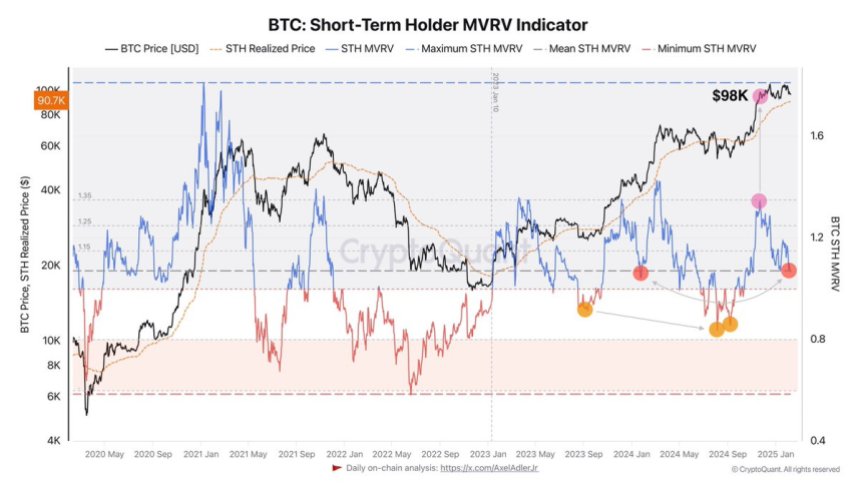

Top analyst Axel Adler shared an analysis on X, revealing that Bitcoin is reacting strongly to escalating trade war tensions. According to his data, BTC’s max drawdown last quarter was -17%, while the current drawdown sits at -16%, signaling that BTC is approaching a critical point. If selling pressure persists, BTC could face a deeper correction before finding solid support.

This sudden shift in market sentiment highlights how macroeconomic factors continue to play a crucial role in Bitcoin’s price action. While long-term fundamentals remain intact, short-term volatility remains a challenge for investors. Analysts are now watching key support levels closely to determine whether BTC can stabilize or if further downside is on the horizon. The coming days will be crucial in assessing whether BTC can reclaim momentum or if this selloff marks the beginning of a prolonged consolidation phase.

Bitcoin Faces Volatility During Bull MarketBitcoin is trading at key demand levels around the $95K mark after losing the crucial $100K level. Yesterday’s market-wide selloff triggered by U.S. trade war fears caused a sharp 10% drop in less than 24 hours, shaking investor confidence. The market remains highly uncertain, and this week could see further declines as selling pressure continues.

Key metrics shared by Axel Adler on X reveal that Bitcoin is reacting strongly to escalating global trade war tensions. According to his analysis, Bitcoin’s max drawdown last quarter was -17%, while the current drawdown sits at -16%, reflecting the extreme volatility dominating the market. These levels indicate that BTC is now approaching a crucial phase, where a further dip could test lower support zones.

Despite the short-term volatility, long-term fundamentals remain strong. Bitcoin continues to hold above critical structural levels, and accumulation trends suggest that large investors are taking advantage of these dips. Historically, such high-volatility periods have preceded major rallies, making this a key moment for traders and investors.

If BTC can reclaim the $100K mark soon, bullish momentum will likely return, setting the stage for a move toward new all-time highs. However, failing to hold above $95K could open the door for a deeper correction before BTC stabilizes.

BTC Price Action DetailsBitcoin is trading at $95,100 after a sharp decline to $91,530 during yesterday’s market-wide selloff. Bulls are struggling as they face ongoing selling pressure, but price action remains structurally bullish as long as BTC holds above the critical $90K level. This support zone is crucial in determining whether the market stabilizes or continues to slide further in the coming days.

This week, Bitcoin remains vulnerable to further declines as the U.S. market navigates increasing fears of a global trade war. Investor sentiment is mixed, with some expecting a deeper correction while others see this dip as a prime accumulation opportunity. If BTC stays above key demand around the $90K-$92K range, a strong recovery could follow.

For bulls to regain control, Bitcoin must push back above the $100K level as soon as possible. Reclaiming this psychological threshold would help restore market confidence and set the stage for another rally toward all-time highs. However, continued uncertainty and economic concerns could delay any meaningful upside movement. A decisive move in either direction will shape BTC’s short-term trend, making this a critical moment for traders and investors.

Featured image from Dall-E, chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|