2021-10-8 16:08 |

World’s largest digital asset manager Grayscale now holds $48 billion worth of digital assets under management according to the latest numbers released by the firm.

In a tweet meant to update its users yesterday, the firm shared details of its holdings per digital asset, revealing that its Grayscale Bitcoin Trust – the largest of the holdings – was increasingly gaining popularity amidst recent price gains.

That’s over $35 billion worth of BTC under management at the firm, and Michael Sonnenshein, the CEO of Grayscale, still believes there is room for more growth.

“The digital currency ecosystem is continuing to allow for new use cases and new protocols to come into the fold, and we are starting to see the confluence between digital assets and things like gaming or file storage. We are certainly going to see the emergence of new protocols before we see consolidation,” he said in an interview with Bloomberg.

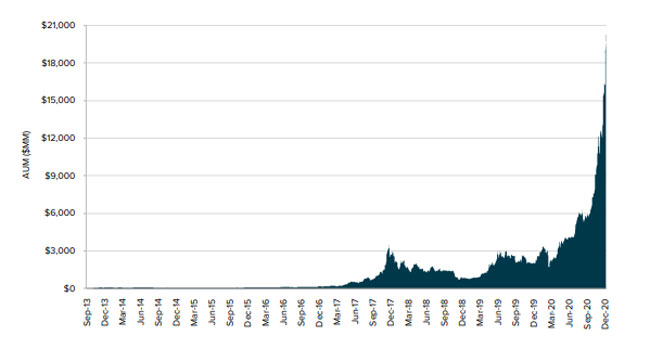

Research has shown that funds like Grayscale are among the leading in crypto adoption. With the recent addition of more tokens to its Large Cap Fund, Grayscale has more than doubled its digital assets under management from $20.2 billion last year. It attests to the conviction investment funds and institutions have for Bitcoin and crypto in general.

The recent trend has been favoring the massive accumulation of crypto by these institutional investors. The trend, according to some experts and traders, is important in propelling BTC prices way up the $100,000 mark by end of this year.

The CEO said that regulatory oversight on crypto would work well for investors and traders because it would “validate the asset class.” However, it should be done responsibly and from a point of information about the industry. According to him, regulators are faced with a tough job to regulate crypto given that the ecosystem has a “lot of momentum and it moves and evolves very quickly.”

The $48 billion worth of assets under management are distributed not equally among the funds 15 trusts or products, of which Bitcoin and Ethereum are the largest holdings. Ethereum holdings are now over $11 billion. The holdings per share for Bitcoin and Ethereum at the fund are $51 and $36 respectively.

The latest additions to the fund are Uniswap’s UNI and Solana’s SOL token, which were included in the Grayscale Digital Large Cap Fund (GDLC) portfolio five days ago. The two tokens reported massive gains last week even as Bitcoin slowed gains.

Meanwhile, Grayscale has been cutting down Litecoin and Bitcoin Cash holdings in the trusts.

origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|