2026-1-22 13:37 |

US spot Bitcoin and Ether exchange-traded funds recorded significantly wider outflows on Wednesday, underscoring continued institutional risk aversion as macroeconomic and geopolitical uncertainty weighed on digital asset markets.

According to data from Farside Investors, spot Bitcoin ETFs saw a combined daily net outflow of $708.7 million, marking the largest single-day redemption in roughly two months.

The selling was broad-based across products, with BlackRock’s iShares Bitcoin Trust (IBIT) accounting for the largest share of withdrawals at $356.6 million.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $287.7 million in net outflows, while four other Bitcoin-linked ETFs also posted negative flows.

DateIBITFBTCBITBARKBBTCOEZBCBRRRHODLBTCWGBTCBTCTotal21 Jan-356.6-287.7-25.9-29.80.00.0-3.86.40.0-11.30.0-708.720 Jan-56.9-152.1-40.4-46.40.0-10.40.0-12.70.0-160.80.0-479.716 Jan15.1-205.2-90.4-69.40.00.00.00.00.0-44.80.0-394.715 Jan315.8-188.90.00.00.00.03.00.00.0-36.46.7100.214 Jan648.4125.410.627.00.05.60.08.30.015.30.0840.6Data from Farside Investors.Spot Ether ETFs mirrored the weakness. The funds recorded a combined net outflow of $286.9 million on Wednesday.

BlackRock’s iShares Ethereum Trust (ETHA) represented the bulk of that figure, with $250.3 million exiting the fund in a single session.

Three other Ether ETFs also reported net outflows, while Grayscale’s Ethereum Mini Trust was an outlier, attracting $10 million in inflows.

Flows for the 21Shares Ether fund had not yet been reported, according to SoSoValue.

Macro shock drives ETF redemptionsThe heavy ETF outflows coincided with sharp intraday moves in the underlying cryptocurrencies.

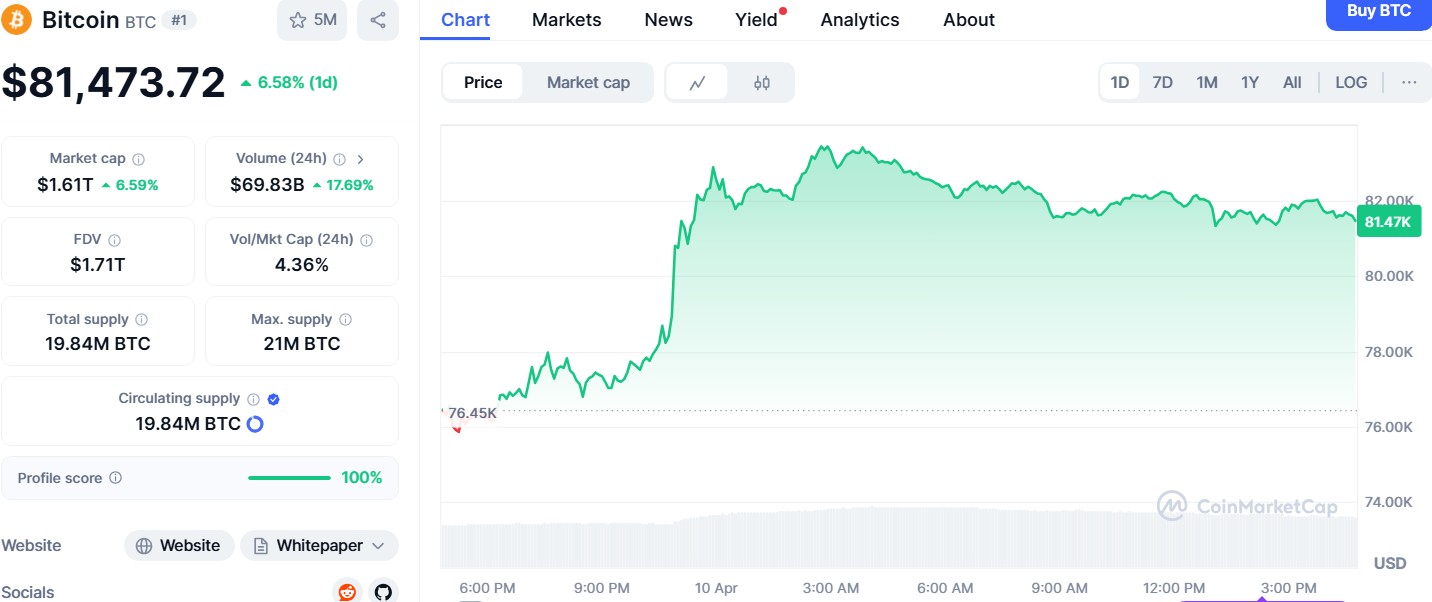

Bitcoin and Ether briefly fell as low as $87,000 and below $3,000, respectively, during Wednesday’s session.

The decline was widely attributed to renewed tensions between the United States and the European Union, as well as heightened volatility in Japan’s government bond market, which spilt over into global risk assets.

That risk-off move prompted institutional investors to further reduce exposure to crypto-linked products, extending a trend of defensive positioning that has persisted since late 2025.

Later in the session, markets found some relief. President Donald Trump said he had struck a framework agreement with NATO regarding Greenland and indicated that he would not impose tariffs on EU countries in February.

Those comments helped stabilise broader markets and triggered a partial rebound in crypto prices.

Bitcoin recovered to trade around $90,000, while Ether moved back toward the $3,000 level.

Crypto lags broader market reboundDespite the late-day recovery, digital assets struggled to keep pace with gains in other risk markets.

Bitcoin initially jumped after Trump said he would not impose tariffs against Europe over his demands related to Greenland, and that a framework deal had been reached.

However, the world’s largest cryptocurrency failed to hold those gains and drifted back below $90,000 shortly afterwards.

The price action contrasted with stronger rallies in global equity markets, particularly in technology stocks, which typically serve as a directional cue for cryptocurrencies.

At the same time, traditional safe-haven assets such as gold fell sharply, highlighting a divergence in investor behaviour.

Market participants said crypto remained out of favour relative to both equities and commodities, reflecting lingering caution after a flash-crash toward the end of 2025 that severely dented sentiment among both institutional and retail investors.

Bitcoin edged slightly higher on Thursday but struggled to convincingly reclaim the $90,000 level, suggesting that confidence remains fragile.

The post Bitcoin, Ether ETFs see around $1B in outflows as macro volatility spurs risk reduction appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

RiskCoin (RISK) на Currencies.ru

|

|