2020-2-28 22:18 |

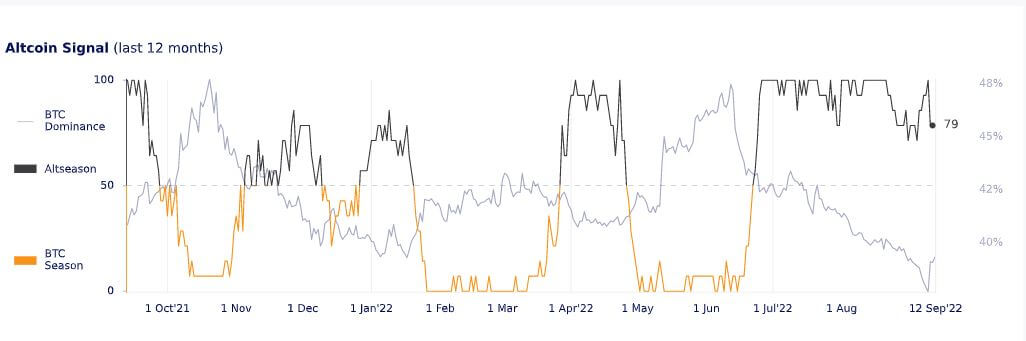

The Bitcoin dominance rate has been increasing since reaching a low of 61.98% on February 15. During this period, the Bitcoin price has decreased by roughly 15%.

Bitcoin Dominance Highlights The dominance rate broke down from a 756-day ascending support line. A death cross has transpired on January 23. There is resistance at 66.5%. There is support at 58.5% and 53%.February 26 was a sad day for Bitcoin bulls since the BTC price created a massive red candlestick and decreased from $9327 to $8823. The Bitcoin dominance rate, on the other hand, increased during this time. This is to be expected, since the Bitcoin price and its dominance rate have a negative relationship, as we have previously stated.

If the Bitcoin price continues to decrease, it would most likely mean that the dominance rate would increase. Therefore, the price of altcoins would decrease at an even faster rate than Bitcoin, putting an end to the “altseason hopes.” This was outlined by cryptocurrency predictor @IncomeSharks, who tweeted a Bitcoin dominance chart, and stated that the altseason believers would really want to see the dominance rate get rejected at the current level.

ALTS would want to see $BTC dominance get rejected here. Possible dead cat bounce if it does. A continuation and break above here could mean alts have more to drop. pic.twitter.com/M2rJWcfZBM

— Income Sharks (@IncomeSharks) February 25, 2020

Let’s analyze this chart closely and determine if the rate will indeed get rejected, or it will move upwards, spelling doom to altseason hopes.

Ascending Support LineOn February 6, the Bitcoin dominance rate broke down from an ascending support line that had previously been in place for 756 days.

The price is currently in the process of trying to reclaim it, but has been rejected slightly and created an upper wick.

The main resistance area is found at 72%

The daily chart gives quite a bearish outlook.

First, a bearish cross between the 50- and 200-day moving averages (MA) has transpired on January 23 and the dominance rate is trading below both MAs.

Second, the current movement looks like a retest of the 66.5% area as resistance. Combining this with the long-term ascending support line breakdown, we can presume that the dominance rate will get rejected near the current level and decrease afterward.

Future MovementIf the Bitcoin dominance rate decreases, as is expected, the closest support area is found at 58.5%. If that fails to hold the price, the next one is at 53%.

While the first support area is expected to be reached, it is too early to make a prediction on whether the rate will also reach the second one.

To conclude, the Bitcoin dominance rate has broken down below a long-term ascending support line and is currently in the process of validating it as resistance. Afterward, it is expected to decrease until it reaches at least one of the support areas outlined above.

The post Bitcoin Dump Could Lead to Altcoin Increase appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|