2021-10-4 17:50 |

Bitcoin Difficulty Ribbon is expected to soon flip positive as more miners come online, following a bearish capitulation.

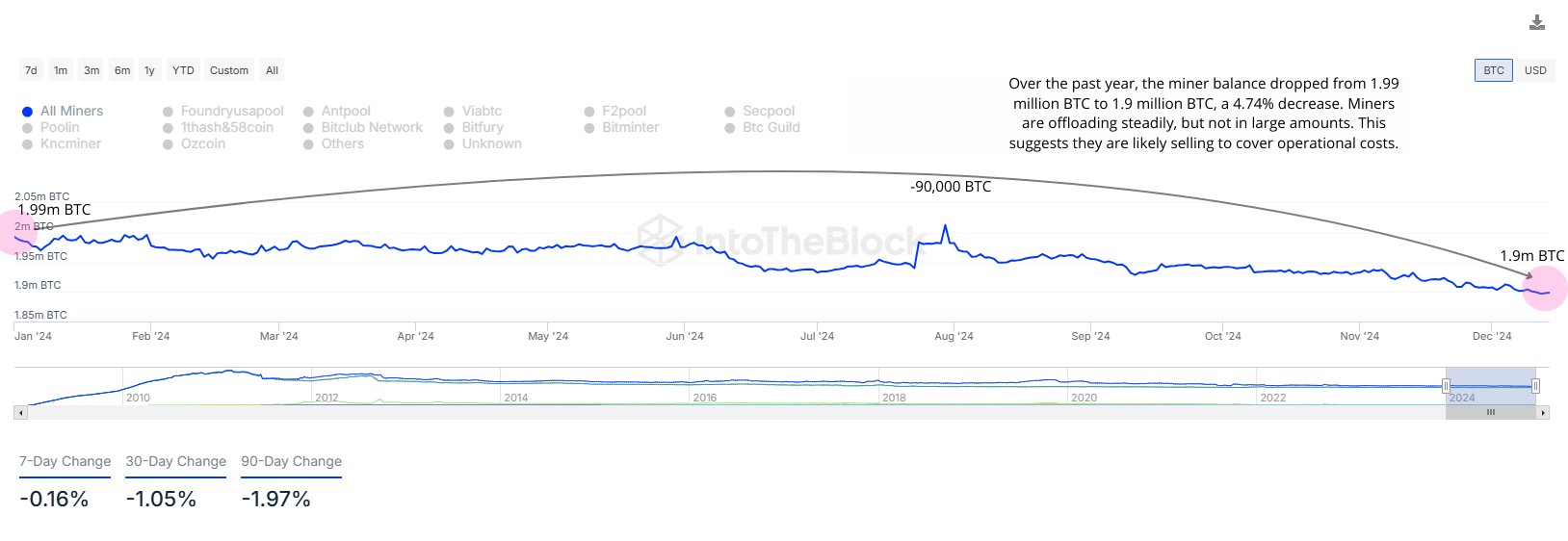

Bitcoin has seen several rallies in 2021, but generally, according to the Bitcoin Difficulty Ribbon, it has been bearish recently, evidenced by miners going offline. As with all trends, several rallies, corrections or pullbacks where the trends appear to reverse, only to resume the original trend over a period of time, are part and parcel of both bullish and bearish markets. Bitcoin is now 120 days into the recovery. This is similar to the bear market that occurred in 2018, where $250B was wiped off the market value of Bitcoin, sending it to $3000. The price took 164 days to recover.

How mining drives pricingThe Bitcoin Difficulty Ribbon is a graph of simple moving averages on mining difficulty. As an aside, moving averages remove sharp, short-term fluctuations. Two averages are popular on crypto charts, namely SMA (Simple Moving Average), and EMA (Exponential Moving Average).

The ribbon helps to visually understand the impact of mining difficulty on Bitcoin’s price. The mining difficulty estimates the number of hashes that are required to mine one block. The value is adjusted every 2016 blocks. A normalized standard deviation is used in order to quantify the values given by the difficulty ribbon. Low values have historically represented periods close to the bottom.

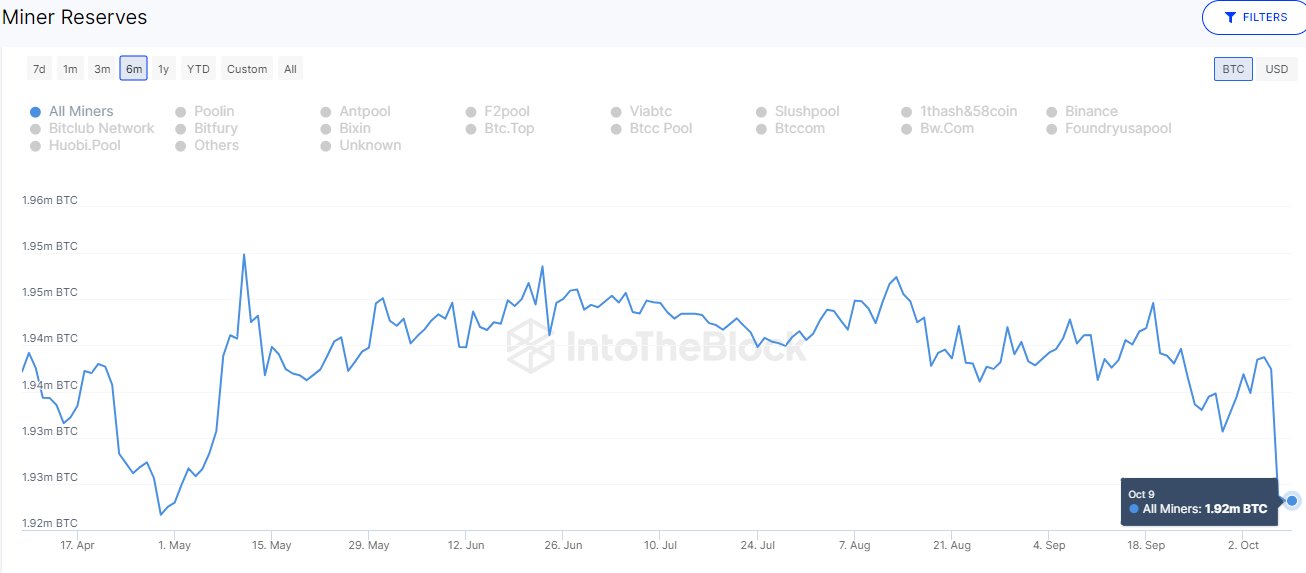

The more difficult the proof-of-work mathematical problem is, it becomes infeasible for smaller miners to validate transactions, as they run at a loss when trying to pay production costs. Thus, when mining is complete, the production cost payments produce bearish pressure on the coin price, as weaker miners need to sell more coins.

When this selloff reaches a point of not being feasible, i.e. when miners can’t validate blocks without earning more than they spend, they capitulate, compressing the ribbon. This then allows the strong miners to sell less, resulting in less selling pressure and bullish price behavior.

A recent example of reward halvingWhen rewards for mining are halved, and the market price has yet to catch up, miners also capitulate. This is the best time to buy Bitcoin. In 2019, many Litecoin miners capitulated when Litecoin’s hash rate dropped from 472.99 TH/s in mid-July 2019 to 296.54 TH/s in early September.

What do you think about this subject? Write to us and tell us!

The post Bitcoin Difficulty Ribbon Indicates Recovery as Miners Return appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miners' Reward Token (MRT) на Currencies.ru

|

|