2026-1-2 18:45 |

2025 delivered at least four distinct “crypto is dead” episodes: a January AI-induced flash crash, the October tariff liquidation that erased $19 billion in leveraged positions, months of altcoin carnage, and a fourth quarter slump that wiped out the year's price gains.

Mainstream outlets dusted off “crypto winter” language each time. Bitcoin logged more obituaries by mid-year than in all of 2024, bringing the all-time tally past 470 since 2010.

Yet, beneath the violent drawdowns and Twitter eulogies, the infrastructure kept building.

Stablecoin legislation passed. Spot ETFs pulled in tens of billions. Major jurisdictions published actual rulebooks rather than issuing enforcement threats.

The result is a year where crypto “died” repeatedly on price charts but quietly became more entrenched in global financial plumbing than ever before.

Related Reading The latest data from Bitcoin Is Dead dropped this week: Bitcoin has ‘died' no less than 431 times Aug 24, 2025 · Christina Comben DeepSeek and the January flash crashThe first “crypto is dead” chorus arrived in late January, courtesy of Chinese AI model DeepSeek. On Jan. 27, a cross-asset sell-off hit tech stocks and bled into digital assets.

A single session erased roughly $269 billion from the total crypto market cap and wiped out about $850 million in leveraged positions. Bitcoin dropped by more than 10%, from around $105,000 to below $98,000 in a matter of hours.

AI-linked tokens fell up to 70% in a day. Analysts suggested that DeepSeek had punctured not just the AI bubble but the entire “risk-on” trade, with Bitcoin singled out as the bellwether whose rally suddenly looked fragile.

The timing, barely a month into the year, gave the sell-off extra weight.

The crash took Bitcoin only back to late-December levels, not into a bear market regime. Prices later set new all-time highs above $124,000 by July, then another peak in October.

Market microstructure analyses framed it as the first major stress test of a more institutionally plugged-in crypto market rather than an existential failure, since the crash was driven by macro and AI repricing.

The January episode looked scary in real time, but in hindsight, it played out like a violent shakeout inside a still-bullish tape.

Bitcoin dropped from approximately $109,000 to below $98,000 during the January 27-28 DeepSeek flash crash before recovering above $105,000. The “10/10” tariff crash and record liquidationsThe biggest “crypto is dead” moment came on Oct. 10. President Donald Trump's surprise announcement of a 100% tariff on Chinese imports during the thin weekend liquidity triggered what CoinGlass calls the largest liquidation event in crypto history.

Estimates cluster around $20 billion of leveraged positions erased in under 24 hours, with more than 1.6 million accounts liquidated.

Bitcoin fell from $121,000 to near $107,000 within hours, Ethereum plunged below $4,000, and many altcoins printed near-zero wicks as market makers pulled orders.

The episode proved that crypto leverage and market structure were still dangerously fragile, despite the new ETF era. Policymakers explicitly used the event to argue that pending US market structure bills underestimated the systemic risk posed by crypto.

Related Reading How crypto-native leverage drove Bitcoin sell-off while ETFs barely flinched Oct 18, 2025 · Gino MatosThe scale of the liquidations was larger than anything seen in prior cycles, including Terra/Luna or FTX, which made it easy to frame as a reckoning.

Yet, prices didn't collapse to prior-cycle levels. Even after the rout and subsequent fourth-quarter slide, Bitcoin mostly traded in a $80,000-$100,000 band into year-end, well above the 2022-23 lows.

Structure changed, not vanished. Derivatives open interest dropped by roughly 25% in a single day, but spot ETFs, custodians, and on-chain markets continued to function.

Inflows into regulated products remained positive year to date, even after October. CoinShares tallies around $46.2 billion entering crypto ETFs in 2025, and BlackRock alone reports $74.8 billion in inflows to its digital asset ETFs as of Dec. 31.

The October liquidation was the largest in history, but the institutional rails passed a stress test. Custodians didn't blow up. Exchanges stayed online. ETFs continued to process creation and redemption baskets.

The plumbing worked, even as the speculative superstructure got demolished.

Crypto ETFs recorded $46.3 billion in year-to-date inflows through 2025, with Bitcoin ETFs leading at $26.8 billion despite late-year outflows. Altcoin, AI-token, and memecoin carnageAnother thread in the “crypto is dead” narrative is the destruction in higher-beta sectors.

AI tokens and memecoins took repeated beatings throughout 2025. During the January DeepSeek episode, many AI-linked coins fell 20% or more in 24 hours, with some recording intraday losses of up to 70%.

Later coverage turned to “2025 meme and AI altcoin crash” angles, describing how sectors that led the early-year euphoria had given back most of their gains and, in some cases, round-tripped to pre-cycle prices.

Trump-themed and election-related meme tokens saw heavy drawdowns as the year wore on.

The memecoin wreckage was real and brutal, with hundreds of tokens that had spiked 10-fold or more in early 2025 finishing the year down over 90% from their peaks.

This is the perennial story of speculative layers getting decimated while underlying rails consolidate.

Chainalysis noted that DeFi TVL recovered significantly from 2023 lows even as hack losses and protocol blow-ups stayed below prior peak levels.

The altcoin carnage was a feature, not a bug, consisting of a violent sorting mechanism that punished purely speculative bets while leaving infrastructure plays relatively intact.

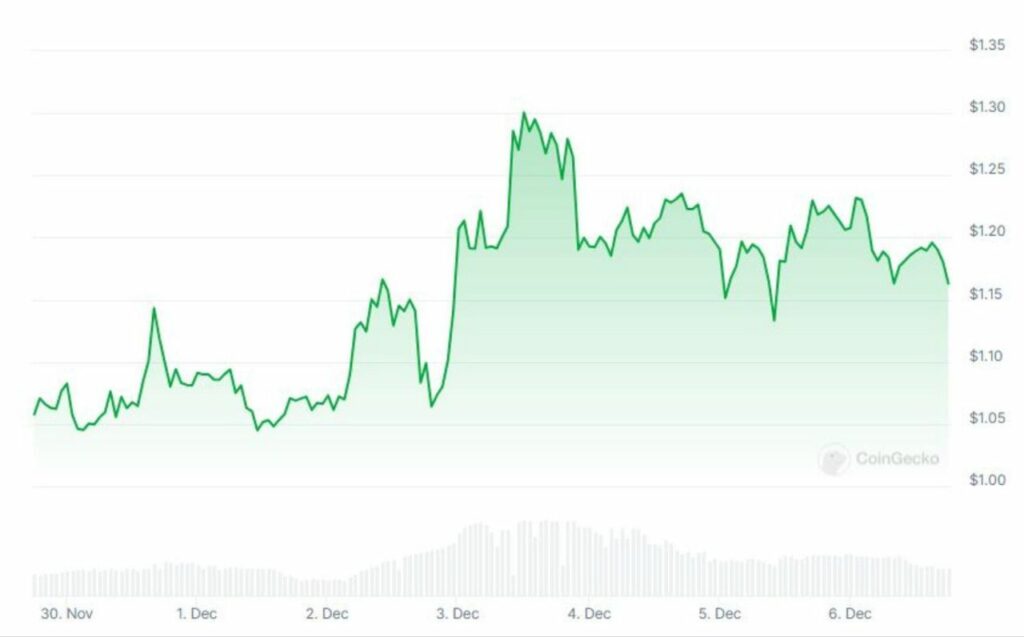

The Q4 slump and “Crypto Winter 2.0” headlinesFrom mid-November into December, mainstream outlets wrote Bitcoin's obituary again. By mid-November, Bitcoin had fallen about 30% from its October record and given back its year-to-date gains.

Mainstream finance publications framed it as erasing 2025 gains and asked whether Trump-driven optimism had run its course.

Additionally, the term “crypto winter” was back in usage, which is the richest vein of “crypto is dead” language.

99Bitcoins data show Bitcoin had already logged more “obituaries” in 2025 by mid-year than in all of 2024, with at least 11 separate death declarations tracked by summer.

The fourth-quarter slump gave critics ammunition. If the year started with euphoria over Trump's strategic Bitcoin reserve and ended with prices lower than where they began, what was the point?

Yet, the counterpoints are strong.

Bitcoin ETFs are still $22 billion in inflows this year, and the historically hostile Vanguard reversed course in December, allowing clients to trade third-party crypto ETFs, citing market maturation.

U.S.-listed crypto ETPs held $153 billion in total assets across 130 products by year-end, with Bitcoin ETFs commanding $125 billion. Image: James Seyffart/Bloomberg Intelligence Related Reading Vanguard caves on crypto to retain clients as rivals win flows — opens $9.3T platform to crypto ETFs Dec 2, 2025 · Oluwapelumi AdejumoBesides, Wall Street moved as generic SEC listing standards opened the door to multi-asset crypto ETFs, including products holding XRP, Solana, and even Dogecoin.

For price context, Bitcoin's sub-$90,000 prints in November-December 2025 still leave it multiples above its 2022-23 lows and above its previous cycle top of roughly $69,000. That makes the “dead” label look more like exhaustion after a huge run than genuine collapse.

Regulation, rails, and usage kept movingTo understand why crypto wasn't actually dead, it is necessary to zoom out from price.

Elliptic's Global Crypto Regulation Review 2025 says governments shifted “away from enforcement-led approaches” toward comprehensive frameworks that prioritize innovation, highlighting moves like the US GENIUS Act stablecoin law and broader global alignment.

Yellow's “Crypto Regulation Heatmap” tracks how MiCA in Europe, Hong Kong's licensing regime, the UK's reopening to exchange-traded crypto products, and a friendlier US stance collectively made 2025 the first year in which major markets had actual rulebooks rather than pure uncertainty.

The SEC's generic listing standards, issued in September, streamlined the launch of new crypto ETFs across Nasdaq, Cboe, and NYSE Arca, allowing multi-asset products like Grayscale's GLDC to clear more quickly.

Crypto ETFs registered billions in net inflows into crypto ETFs globally in 2025, even though late-year performance was poor.

Away from trading, payment, and settlement rails, work continued to move forward. Visa and other large processors expanded stablecoin pilots on USDC rails for cross-border settlement, while stablecoins captured a growing slice of cross-border flows, particularly in emerging markets.

The tension at the heart of 2025: the year produced more Bitcoin “deaths” on paper, record liquidations, and a sickly fourth quarter tape.

However, it also established the first genuinely global regulatory frameworks, turned crypto ETFs and stablecoins into mainstream plumbing, and kept usage metrics well above those of any prior cycle.

Crypto died four times in 2025, and each time it came back more embedded in the financial system than before.

The post Bitcoin “died” four times in 2025, but a hidden infrastructure boom proves the skeptics completely wrong appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

4THPILLAR TECHNOLOGIES (FOUR) на Currencies.ru

|

|