2019-10-7 10:18 |

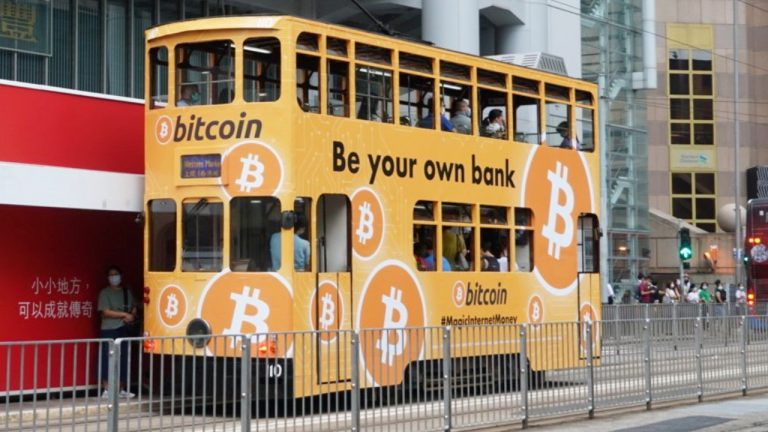

A few days ago, the crypto community went crazy after news surfaced that people in Hong Kong were trading massive amounts of Bitcoin at jaw-dropping prices.

This might be signaling a potential interest in cryptocurrencies as a hedging strategy amid a political and economic crisis that is affecting not only that region but all of China.

More than 12 million Hong Kong Dollars and 173 Bitcoin have been traded on Localbitcoins in seven days, as BeInCrypto has previously reported. Many analysts consider that politics and the lack of confidence in the country’s financial system may be the cause behind this episode. eToro’s senior analyst Mati Greenspan is one of them:

“I can’t help but feel that this could very well be a sign that some Hong Kong protesters are seeing bitcoin as a way to opt-out of the local economy, which is run by governments and financial institutions,” Greenspan said in an article. Other analysts and traders shared the same viewpoint, especially since there have been previous attempts to “break” the banking system.

Politics and Bitcoin? Think Again…However —like most theories— not everyone agrees with this, and Usefultulips.org creator Matt Ahlborg explained why this approach might not be 100% accurate.

In a Twitter thread, Ahlborg commented that unidentified sources confirmed to him that this spike was due to a single trader taking advantage of Bitcoin’s bearish trend to accumulate massive amounts of BTC:

I looked into the Hong Kong Dollar’s (HKD) record week on LocalBitcoins last week and was put into contact with a pro trader who claims they were the counterparty to most of this volume. The trader claimed that most of the volume was caused by a single customer who conducted “over 30 trades” during the week. When I asked if they knew the reason for the trades, their response was that the customer essentially “bought the dip” (paraphrased)”

Ahlborg said that his source saw no relation between the operations of this mysterious trader and the country’s political crisis, however, he clarifies that other experts questioned this idea by saying that whoever denies there is a connection between Bitcoin and Politics is “not telling the whole truth.”

Not Getting the Whole PictureOTC markets are challenging to analyze, because unlike with traditional crypto exchanges, trades are not monitored continuously, and in fact, some transactions are not even publicly revealed. Therefore, many say that OTC trading does not affect the prices traders see on traditional exchanges.

Although BTC trading has returned to normal levels over the past few days, it is advisable to follow this market. Previous attempts to escalate the conflict could be a sign that, at some point, Hong Kong could start a journey that ends with the region turning into a new Bitcoin paradise.

What do you think about this conclusion? Does Hong Kong affect Bitcoin’s price more than it seems? Let us know your thoughts in the comments below.

Images are courtesy of Shutterstock.

The post Bitcoin Didn’t Spike in Hong Kong Because of Politics, Analyst Concludes appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|