2025-3-1 04:00 |

In an interview with CNBC’s Street Signs on February 27, Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered, offered insights on Bitcoin’s recent price decline and laid out a bold forecast for the world’s largest cryptocurrency. Despite near-term volatility, Kendrick expects Bitcoin to reach $200,000 this year and as high as $500,000 before the end of President Trump’s term.

Bitcoin Crash? No Problem!Kendrick opened the discussion by noting the influence of political developments on investor sentiment: “So I think the Trump Administration will be positive medium term. So we came into January 20, hoping for quite a lot and you could argue there was already quite a lot of positivity priced in.”

He highlighted the immediate post-inauguration shift in regulatory stance—specifically, the removal of SAB 121, which he described as having “been hampering financial institutions.” Kendrick also addressed the lack of a widely anticipated strategic Bitcoin reserve, replaced instead by a “stockpile” approach. According to Kendrick: “The stockpile for me is okay because it legitimizes other sovereigns […] both within the US [and outside]. A number of US states are considering holding Bitcoin on their balance sheet.”

Still, markets have been rattled by fresh uncertainties. Kendrick pointed to ongoing trade war and geopolitical flashpoints: “Initiatives in the last couple of weeks have been very confusing for risk assets […] tariffs on and off. Canada, Mexico, EU […] obviously some potential positives coming around Ukraine and or the Middle East but nothing solid really on any of those and risk assets don’t like uncertainty.”

Within the crypto sphere specifically, he cited the Bybit hack, trouble with the Solana meme coin scams, and a generally “confusing” environment as contributors to the pullback. Kendrick underscored the cascading effect on Bitcoin.

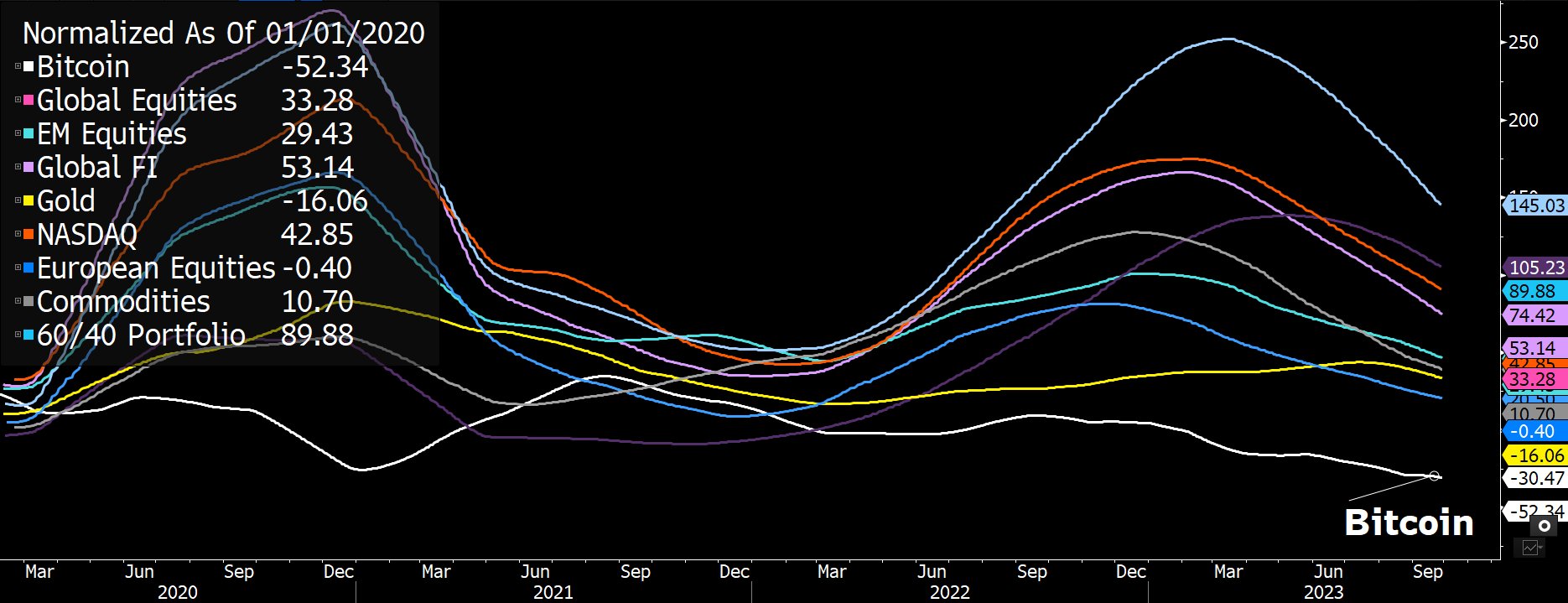

When asked whether Bitcoin remains a genuine diversifier amid its correlation with equities, Kendrick maintained a nuanced view: “Certainly when we see large moves like we’ve seen in the last few weeks […] on the negative direction risk assets all trade together […] Medium-term, I think the diversification story is reasonable […] The use case for Bitcoin in particular is to diversify against risks around traditional financial markets.”

Kendrick also addressed the large outflows from the spot ETFs since Trump’s inauguration: “Even in the last week, we’ve seen about $3 billion of outflows in terms of ETFs […] we got to a net position of about $40 billion of inflows over the first 12 months of those ETFs in the US […] but in the last week or so we’ve seen $3 billion of outflows.”

He estimates that those who bought Bitcoin post-election in November are now “heavily underwater” to the tune of $2 billion in paper losses. This newer cohort of holders, combined with the sector’s still-robust retail participation, has amplified volatility: “It’s much more difficult for investors then to hold through losses […] when you see moves like we saw this week, you tend to get some panic selling.”

$200,000 Target Still In PlayHe also reiterated the need for deeper institutional participation—citing banks like Standard Chartered and investment giants such as BlackRock—to improve custody solutions and reduce the frequency of such hacks like the Bybit one, leading to damaging headlines:

“As the industry becomes more institutionalized it should be safer […] hopefully we get some regulatory clarity in the US too […] that should add to that medium-term top side potential which for me is Bitcoin up to $200,000 this year and $500,000 before Trump leaves office.”

Looking ahead, Kendrick underscored that regulatory clarity—particularly around stablecoin rules and KYC—could trigger a wave of institutional and even sovereign capital inflows. He identified long-term public pension funds and sovereign wealth funds as pivotal market movers, referencing the Abu Dhabi Sovereign Wealth Fund’s purchase of 4,700 BTC-equivalent shares in the BlackRock ETF at the end of 2024:

“There’s that very long-term sector that is still to participate more […] and then also Sovereign so the only Sovereign that we know so far has bought the ETFs is Abu Sovereign wealth fund […] I’d expect more of that to come through this year as well.”

At press time, BTC traded at $81,428.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|