2023-1-30 17:30 |

Bitcoin closed the week strongly with a fourth consecutive green candle for the first time since August 2021. Four weeks of positive momentum during a bear market is extremely rare.

The last time printed four consecutive green candles during a bear market was during the COVID-19 crash recovery of May 2020. Prior to that, any time four weekly candles closed green during a bear market, the bottom of the cycle had already been made.

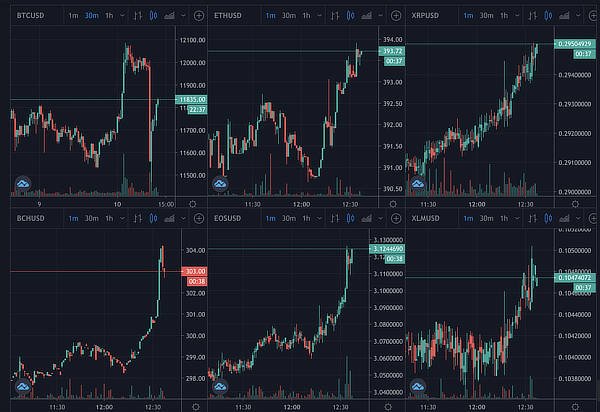

BTC-USDHowever, following the weekly close, Bitcoin did begin a retracement, with the price down 3.6% from the local high as of press time.

Bitcoin soared to $24,000 over the weekend as it made a second attempt to break the resistance level which has held since August 2022. However, as of press time, it has fallen to around $23,000, signaling a weekly red candle.

Further, the weekly candle also marked a higher high on the chart as Bitcoin continues its upward momentum. The year-to-date chart below illustrates Bitcoin’s strong start to 2023.

Year to date BTC-USDThroughout Bitcoin’s history, four green weekly candles have never been followed by a new cycle low during similar times in the having cycle. For example, Jan 30 is 994 days since the last halving in May 2020, and previous cycle lows came after 994 days in 2015 and 889 days in 2018. The current cycle’s low came 924 days after the last halving, which lies within the historical range.

Therefore, either Bitcoin’s low this cycle has been and gone at $15,530, or this is the longest bear market in Bitcoin’s history. Moreover, an uncertain global macroeconomic environment looms over the financial sector, with Bitcoin primed for its first test of a potentially deflationary world economy.

The post Bitcoin closes 4 consecutive weekly green candles for first time since August 2021 appeared first on CryptoSlate.

origin »Chronobank (TIME) на Currencies.ru

|

|