2022-7-11 15:10 |

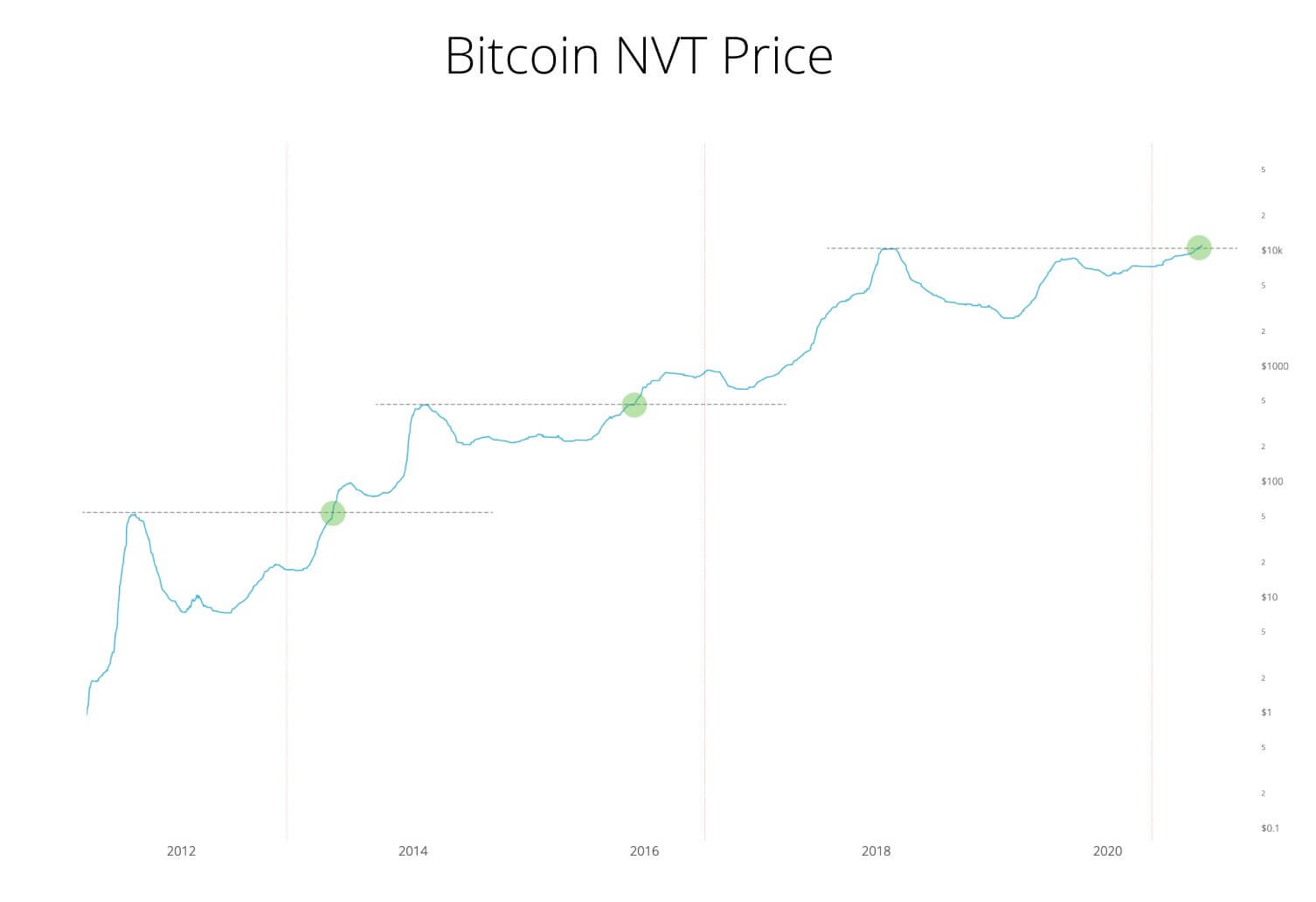

Fidelity Investments’ Jurrien Timmer stays upbeat on Bitcoin network strength, while another commentator flags a “compelling” risk/reward ratio at $20,000. origin »

Bitcoin price in Telegram @btc_price_every_hour

Ratio (RATIO) на Currencies.ru

|

|