2023-10-4 18:30 |

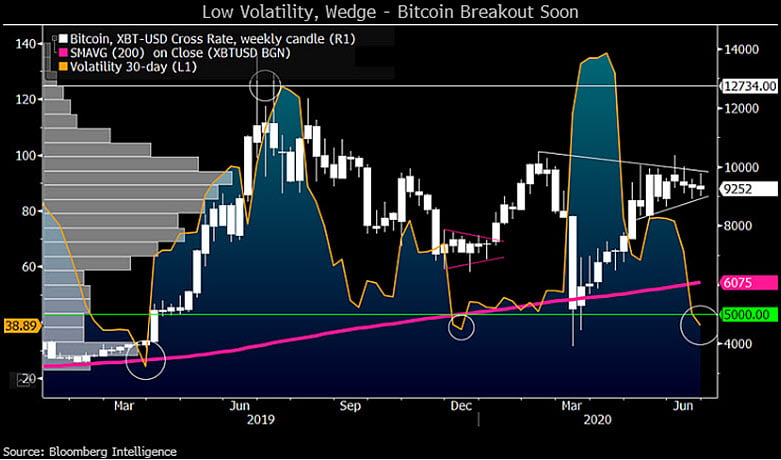

Chief commodity strategist Mike McGlone of Bloomberg Intelligence believes downside risks remain for Bitcoin as central banks continue aggressive interest rate hikes. In a tweet Monday, he suggested Bitcoin could yet decline to $10,000 this year absent a pivot toward policy easing.

McGlone cited a chart overlaying Bitcoin’s price action against the federal funds futures rate. With the Fed’s rate outlook still pointing higher, he argued tightening liquidity conditions portend lingering headwinds for the cryptocurrency.

“Coming of age in a zero-interest-rate world, the crypto hangover could be enduring as global rates continue to rise, despite recession signals,” McGlone tweeted. He contends that Bitcoin and risk assets broadly face enduring pressure as the low-rate era reverses course.

Last month, McGlone also highlighted the closely watched one-year forward Fed rate above 5% as a constraint on potential Fed easing or quantitative stimulus. As long as monetary tightening continues, he expects liquidity strains to undermine Bitcoin.

Though Bitcoin has rebounded alongside stocks in recent weeks, McGlone suggests the relief rally may prove short-lived. He pointed to $30,000 in resistance ahead but noted risks remain tilted toward a return to the $10,000 zone last seen in late 2020.

Other market analysts share caution around fading, tightening headwinds. While recession signals mount, central banks are signaling their intent to crush inflation at all costs. Further rate increases appear likely, even amid economic deterioration.

Until inflation shows definitive signs of abating globally, policymakers seem unlikely to pivot policies boosting Bitcoin and other risk-on assets. However, any hints of dovishness could spark a rally by reversing liquidity conditions.

For now, strategists like McGlone urge tempered optimism and prepare for additional volatility as central banks continue their hawkish push. But sustained Bitcoin accumulation during lean times may pay off once the Fed finally blinks.

We recommend eToro 74% of retail CFD accounts lose money. Visit eToro Now Active user community and social features like news feeds, chats for specific coins available for trading.Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

eToro offers staking for certain popular cryptocurrencies like ETH, ADA, XTZ etc.

The post Bitcoin Can Still Crash to $10,000 in Q4, Says Bloomberg Analyst appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|