2023-7-25 18:00 |

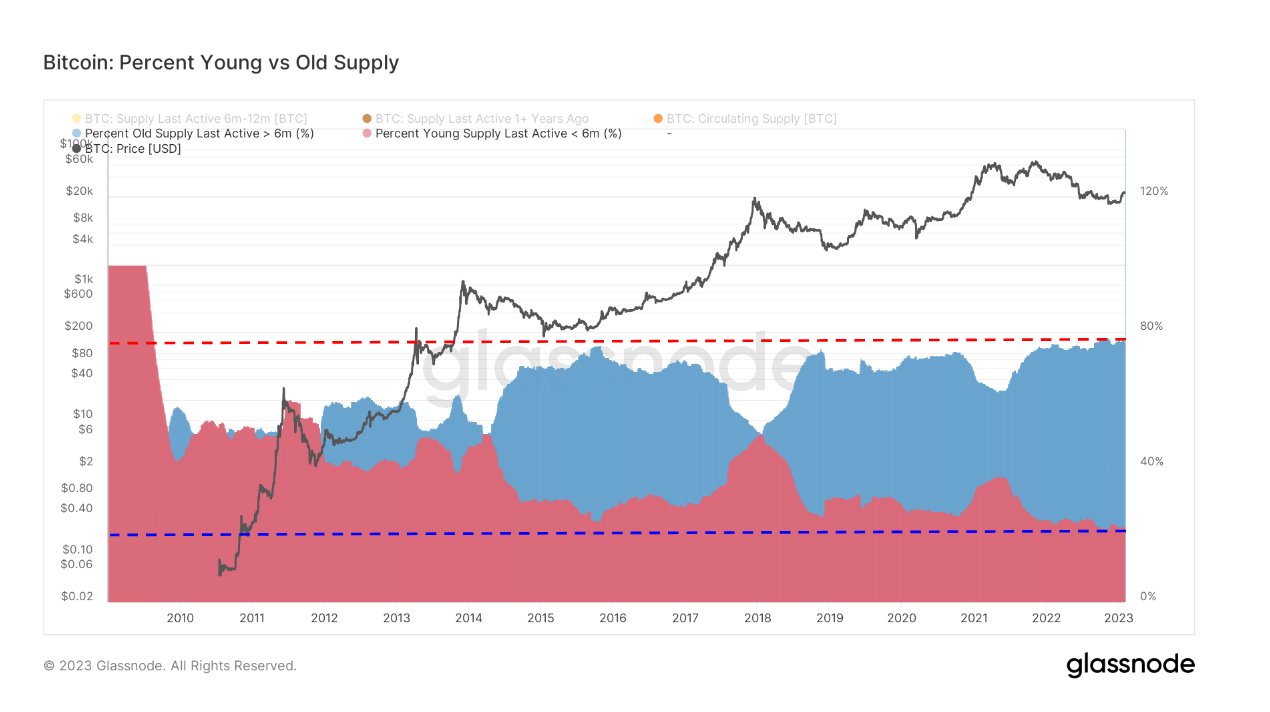

Bitcoin is becoming increasingly scarce. The current level of BTC supply in the hands of long-term holders is approaching its all-time high set in 2015. On-chain data shows a record pace at which investors withdraw their coins and move them to cold wallets.

Historically, such situations have occurred at the bottom of cryptocurrency macrocycles. Therefore, the high level of Bitcoin supply in the hands of LTH and the upcoming BTC halving could become catalysts for a new crypto bull market.

Bitcoin Supply vs. PriceBitcoin supply (orange line) is determined by a mathematical algorithm that drives the largest cryptocurrency to the amount of 21 million BTC that can ever be mined. New BTCs are awarded to miners for solving a mathematical task to validate the next block of the network chain.

However, the supply of Bitcoin is growing at a decreasing rate, which is regulated by the so-called halving (dashed line). Roughly every four years, the reward given to BTC miners is reduced by half. In turn, this makes fewer and fewer newly mined coins available on the market.

The result of this and the simple economics of supply and demand is that the price of the largest cryptocurrency increases over time (black curve). In short, the limited supply and decreasing issuance of new coins increase Bitcoin’s scarcity.

This scarcity, combined with cryptographic security, durability, and transparency – to name just the most important attributes of the Bitcoin network – increases the price investors are willing to pay for this digital asset.

Bitcoin supply / Source: GlassnodeIt is worth adding that the above Bitcoin supply chart is often modified by coins that are considered lost. By definition, lost coins have not moved for at least 7 years.

Then we get a metric of adjusted circulating supply, which takes into account lost coins. As seen below, the amount of BTC in circulation has remained relatively constant at around 15 million BTC since the beginning of 2016. This is despite the fact that almost 19.5 million BTC has been mined so far. Therefore, as many as 4.5 million coins are considered lost.

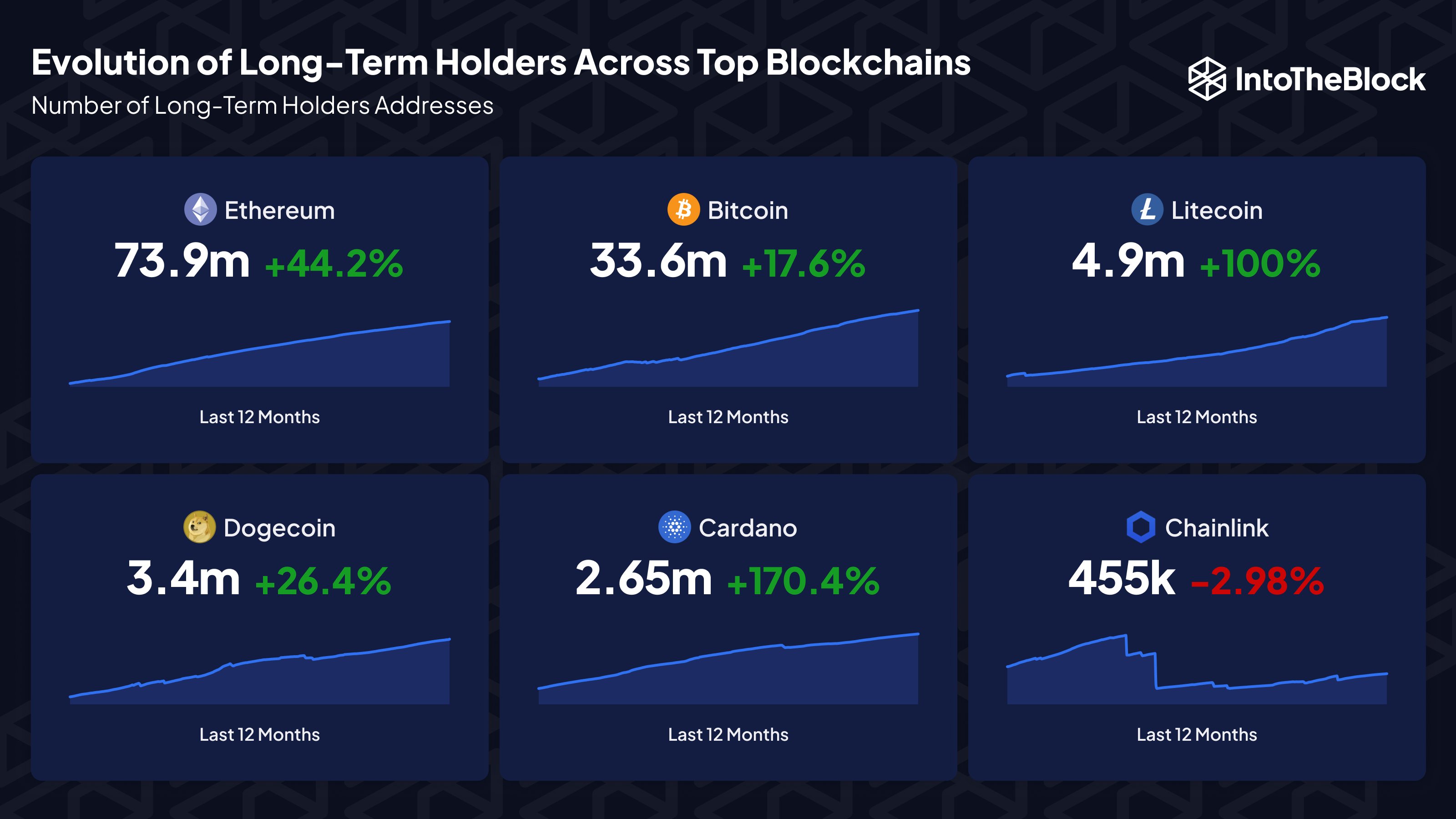

Bitcoin supply in circulation adjusted for lost coins / Source: Glassnode Bitcoin Supply in the Hands of HodlersLong-term holders (LTH) of Bitcoin are entities holding their coins for at least 155 days. They are also sometimes referred to as hodlers, as they follow a simple investment strategy called HODL.

Short-term holders (STH), on the other hand, keep their coins for less than 155 days, after which they transfer them to another address or sell them. The detailed definition still includes a 10-day transition period between the two types of holders.

Long-term vs short-term BTC holders / Source: GlassnodeWith on-chain data, it is possible to see how much Bitcoin supply is in the hands of LTHs at any given time. The metric of Long-Term Holder Supply provides such a chart.

First of all, we can see that the supply in the hands of LTHs has been steadily increasing and, at least since August 2022, has been consistently recording new all-time highs (ATH). The current metric suggests that 14.532 million BTC is held long-term. Naturally, it also partly takes into account lost coins.

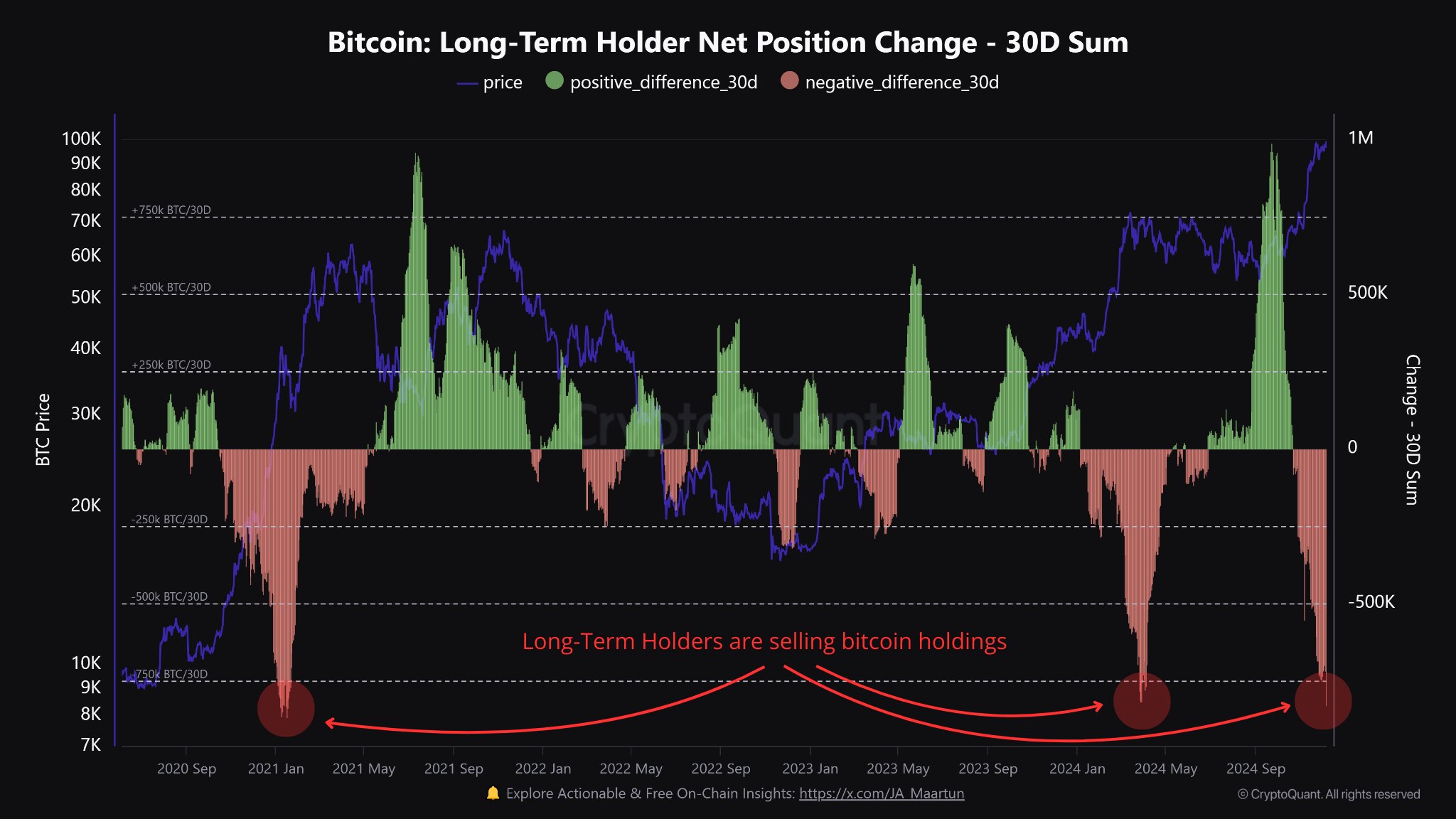

However, the most interesting feature of this metric is its inverse correlation with the price of BTC. Well, on a large scale, we observe that periods of dramatically declining Bitcoin supply in LTH hands (green) corresponded with macro peaks in the BTC price (blue).

Supply in the hands of LTH. Source: GlassnodeIn contrast, the reverse dependence is no longer so clear. The macro bottom in the BTC price has not always been the same as the peak in Long-Term Holder Supply.

However, it has always been the case that bear markets have led to increased assets held long-term. Moreover, this trend often continued throughout the accumulation phase and even in the first months of a new bull market.

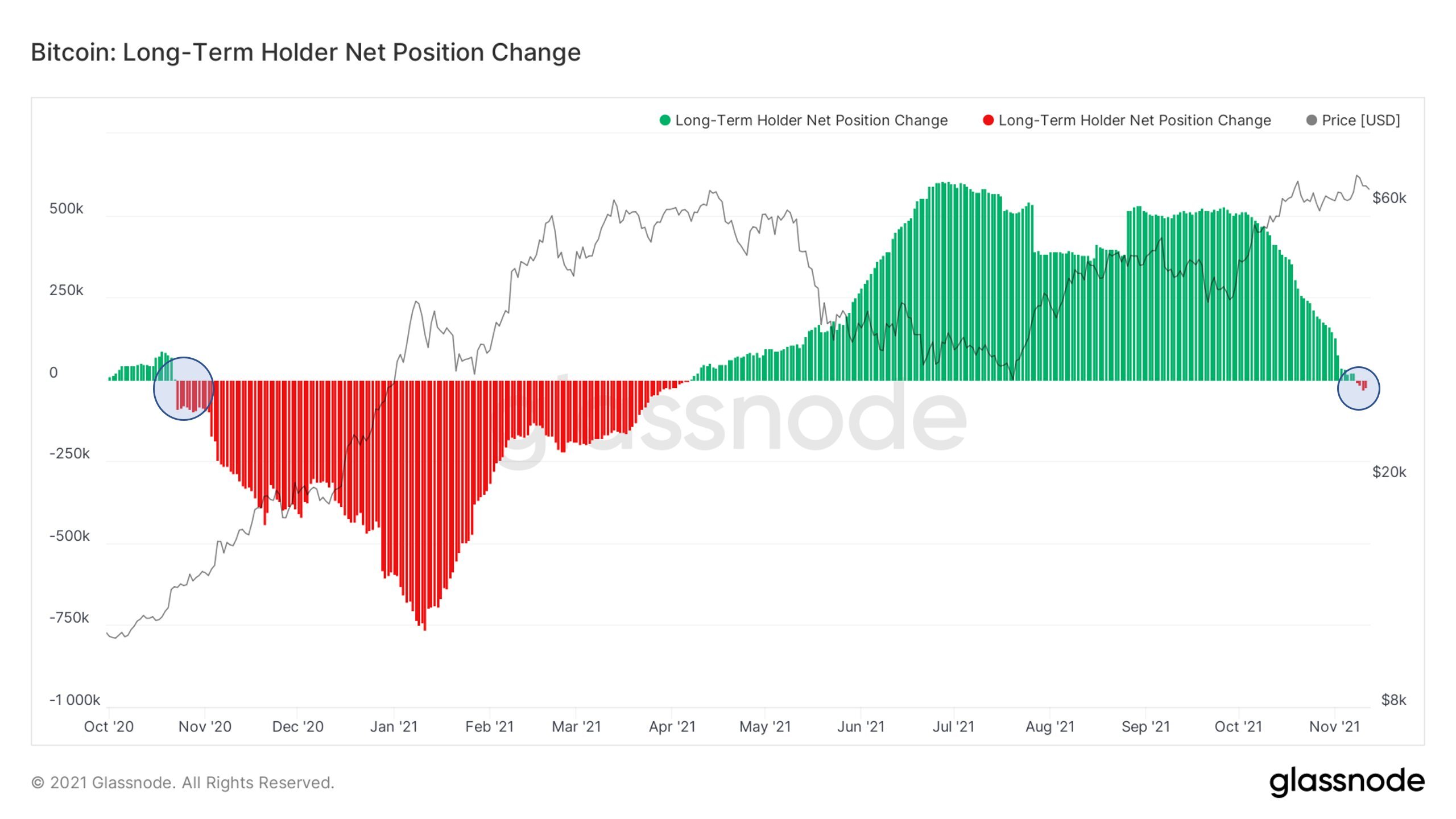

Returning to 2015 PeaksThe last sharp decline in Bitcoin supply in LTH hands occurred between October 2020 and April 2021. That’s when the BTC price rocketed out of the $11,000 area and recorded a historic ATH of $64,500.

Interestingly, when the price of BTC set the current ATH of $69,000 six months later, supply in the hands of LTH was already at new highs. In hindsight, this could have been read as an early signal of an impending bear market. Since then, Bitcon’s long-term supply has been rising.

Well-known cryptocurrency market analyst @therationalroot tweeted a chart of Bitcoin supply in the hands of LTH relative to the total available supply. He noted that the current percentage of long-term supply stands at 73.5% and is approaching the historic high of 2015.

Percentage of Bitcoin supply in the hands of LTH / Source: TwitterInterestingly, neither the bear market of 2018, the COVID-19 crash of 2020, nor even the bottom of the 2022 downtrend led to such a high supply of LTH as we are seeing now. According to the analyst, this is indicative of Bitcoin’s increasing scarcity.

What’s more, it indicates the high confidence investors have in the largest digital asset. On the other hand, when a new wave of short-term holders wants to acquire Bitcoin, hodlers will reduce their holdings. Then the price of BTC will be in the intense expansion phase of the future bull market.

For BeInCrypto’s latest crypto market analysis, click here.

The post Bitcoin (BTC) Supply: 73.5% in Hands of Long-Term Holders appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Supply Shock (M1) на Currencies.ru

|

|