2020-7-15 17:56 |

Coinspeaker

Bitcoin (BTC) Mining Difficulty Reaches New Level of Over 17 Trillion

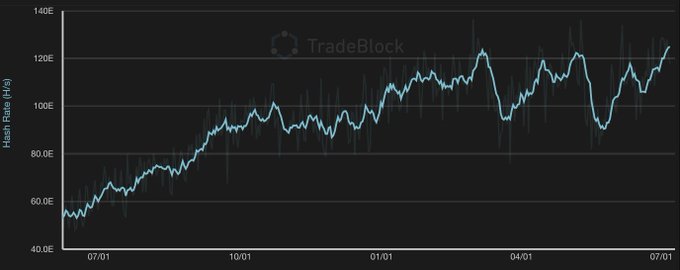

Bitcoin (BTC) mining difficulty has reached a new record high. It comes after last week’s record high of the hash rate. Bitcoin (BTC) hash rate saw a record increase of +9.89% to slightly over 17 trillion. It comes after a recent malaise at Bitcoin price. BTC prices haven’t moved much in the past few days.

This situation is bound to change soon. Price is testing the $10,000 mark as Bitcoin (BTC) prices are set to break through the resistance level.

On a positive note, Bitcoin (BTC) network is working just fine. It comes as investors have been worried about a sharp reduction in both hash rate and mining difficulty.

Many had thought that the May halving event would have led to miners leaving the network. Especially as mining operations for some miners would have become unprofitable.

Bitcoin Mining Difficulty Dropped After HalvingAfter the halving event, there was a drop in the hash rate. Mining difficulty reduced twice as well. Things changed last month when an increase in difficulty by 14.95% reversed the prior changes. This change has brought all prior concerns to a close.

Mining difficulty changes periodically (every 2016 blocks or 2- weeks). It is to maintain the ten-minute timing for the formation of new blocks. Trend-wise, increasing hash rates can increase block formation speed. Miners are generally not as profitable as mining difficulty increases. This trend has made many of the smaller miners go out of business. The bigger miners have been able to stay despite the fluctuations in mining difficulty.

Bitcoin mining difficulty is one of the indicators of how BTC prices play out. The effect of mining difficulty in the prices has been reducing over time.

China Holds an Increasing Influence on Bitcoin (BTC) NetworkThere is one other factor that has raised concern among investors. The fact that China holds over 60% of Bitcoin’s (BTC) mining power has increased growing concerns on Chinese influence on the cryptocurrency.

Many members of the crypto space assume that the rainy season in Sichuan corresponds to an increase in network difficulty.

Observations over the past few years point to the recurring correlation. While it may be seen as a fluke, where there is smoke there tends to be fire underneath. Sichuan China offers tremendous advantages to Bitcoin (BTC) miners. There have been reports of cheap energy costs. Many have even reported costs of 1 cent per kilowatt-hour. As the rainy season sets in, the hydroelectric costs drop. And mining activity increases.

On the other hand, China has recovered from the COVID-19 pandemic. The country has shaken off the effects of the coronavirus situation. It has led to an increase in miners been produced and shipped.

It brings the main concerns of many again back to the fore. As to the effects of Chinese activity on the Bitcoin (BTC) network, it is too early to tell if the Chinese are having an overbearing influence.

One thing is sure. Bitcoin (BTC) isn’t influenced by any particular set of factors.

Bitcoin (BTC) Mining Difficulty Reaches New Level of Over 17 Trillion

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|