2023-1-15 17:10 |

Bitcoin (BTC/USD) rallied to highs of $21,321 on Coinbase early Saturday as bulls pushed on from the breakout above the $20,000 mark. It was the first time since the brutal dump in November following the collapse of FTX that Bitcoin price had posted such gains.

The flagship cryptocurrency has registered seven consecutive green candles on the daily chart, starting with the break above $17,000 on Sunday, 8 January 2023.

BTC/USD price movement on Coinbase. Source: TradingView Bitcoin price hits pre-FTX dump levelsPseudonymous crypto trader Mags says Bitcoin has recovered all the losses recorded during the FTX dump, and a best case scenario for the benchmark crypto would be for BTC to continue to $25,000 without revisiting $18,700. The analyst tweeted:

“$BTC is back inside the previous range & is very close to the mid-range range ($21.5k), price has also engulfed the entire FTX dump. Best case scenario would be a continuation till $25k without re-testing $18.7k.”

Scott Melker aka The Wolf of All Streets, also points to Bitcoin’s breakout above $20,000 as likely to see the BTC price test resistance zones around $22,800 and then $25,000. The crypto trader and analyst shared the chart below on Twitter.

$BTC

Insane move.

Retraced nearly the entire FTX dump and went up almost as fast it went down. pic.twitter.com/J2m8NvdwqL

Bitcoin is currently trading around $20,700, still more than 9% up in the past 24 hours.

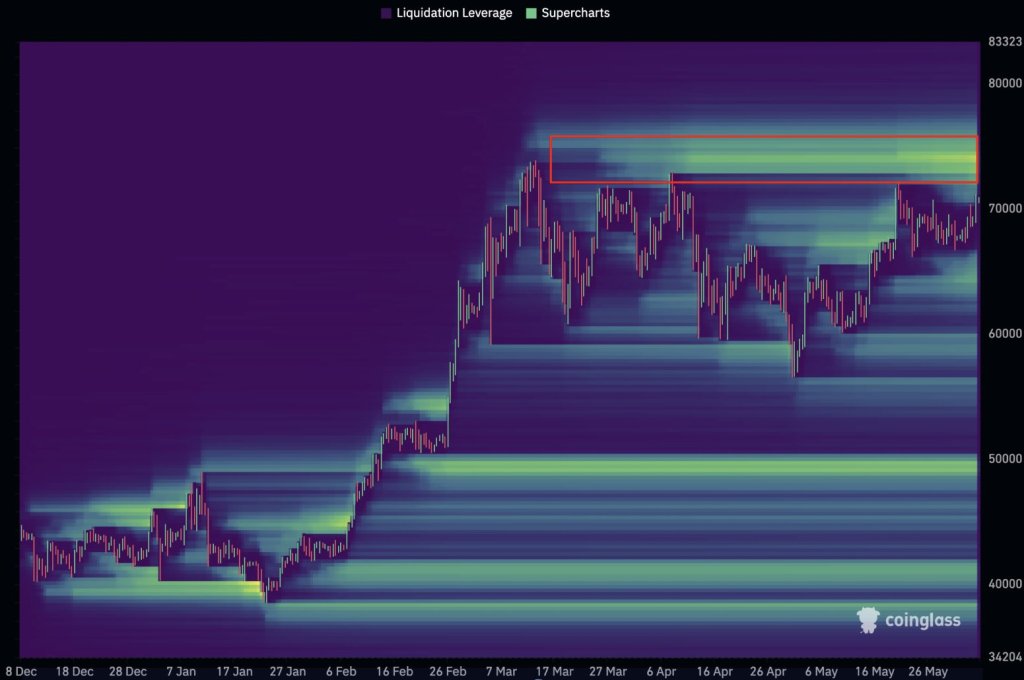

Over $725 million shorts liquidated in 24 hoursAccording to crypto data tracker CoinGlass, the double-digit rally in BTC and major altcoins over the past 24 hours has seen over 133,665 traders liquidated.

For instance, Ethereum price rose to highs of $1,565 on major digital trading platforms, with coins such as Binance Coin, Solana, Dogecoin, Polygon and Polkadot rallying to multi-month highs.

As of 07:20 am ET on 14 January, total liquidations stood at $725.39 million, with the largest single 24-hour liquidation of $6.8 million happening on crypto exchange Huobi.

Across the different digital assets, Ethereum had the most liquidations in the past 24 hours at nearly $260 million, while Bitcoin’s rally had about $239 million shorts liquidated.

CoinGlass data also showed Solana, Dogecoin, Aptos and Litecoin had all seen a significant number of traders rekt.

The post Bitcoin breaks above $21K as short liquidations hit $725 million appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|