2018-11-26 15:53 |

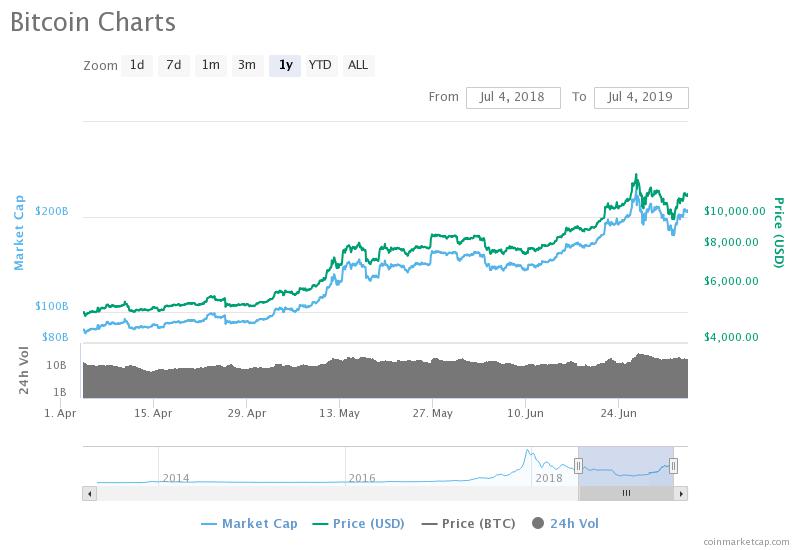

While we can easily associate 2018 with seeing one of the biggest bearish downturns for cryptocurrency, the latest drop has been both drastic and unprecedented. So far, it has seen a large percentage of altcoins trading at or below 90% of their value compared to their previous highs.

The likes of Bitcoin are not exempt from this either, with Bitcoin falling to levels that haven't been seen since early 2017's trading. With this downturn comes to the theorizing from industry analysts that Bitcoin will have to fall even lower in order to secure a stable bottom.

So why has Bitcoin made its plunge to its current price of $4,270? Well, it first began in late-October and into the early days of November as it failed to secure stable footing at the $6,500 and above range. As a result, a gradual decline was sparked. The decline then began to turn into a sharp reversal as of November 13th, seeing it take a fall from $6,350 to $5,700. This downward trend continued until it hit its current price, where it stands on shaky ground.

Following this initial drop, many analysts have since re-adjusted the pricing targets for the crypto, and have since reached a consensus that Bitcoin will need to fall a little further in order for it to establish a stronger bottom.

During a discussion on the CNBC show ‘Squawk on the Street', the trading chief at Genesis Trading and Genesis Capital, Michael Moro argued that bitcoin's bottom may not be finally seen until it reaches at or below the $3,000 level.

“You really won’t find [the floor] until you kind of hit the 3K-flat level. It’s really difficult. There are small levels of resistance. We’ve seen the 4,000 level get tested twice now in the last couple of days, but I really don’t think there’s too much in the mid-3s,”

he explained.

Moro went on to add that investors shouldn't buy at the dip unless they are the more dedicated sort, and have a stronger commitment to the long term success of Bitcoin. This because he identifies a significant volume of turbulence between now and when it finally begins its bounce-back.

There Is Still More Room To Fall For Bitcoin, Agree AnalystsWithin the cryptocurrency industry, there are a number of other analysts that more or less agree with the assessment made by Moro regarding the further losses that bitcoin will need to sustain, among other cryptos before a bottom is secured. Naeem Aslam, the chief market analyst at Think Markets U.K., goes on to elaborate on why he believes that the bottom for bitcoin may be at $3,500.

“Bitcoin is likely to move even lower after a failed attempt to break above the $4,700 level. The regulatory environment is suffocating the bulls and the bears are going wild. It is likely that the price may touch the level of $3,800 or even $3,500 if the current momentum continues,”

Aslam explained.

In a number of statements made to news sites more recently, Jani Ziedens, one of the analysts at CrackedMarkets, he stated that a good buy position for people in the near future would be in the $3,500 region, and that a short term bounce may happen if this level is reached.

“Look for the selling to continue over the next few days, but a bounce off of $3.5k-ish that returns to $5k is likely. While that doesn’t sound like a lot given the latest tumble, a bounce from $3.5k to $5k is a nearly 50% payout for just a few days of work. This is not for the faint of heart, but there will be nice rewards for those willing to jump aboard the inevitable bounce,”

he said.

With The Ongoing Downturn For Bitcoin And Crypto – Will Institutional Interest Help The Markets?While the persistent existence of a bearish market has brought a yearly low to the sentiment of investors to buy in, the increasing volume, not only of institutional use, but of its interest brings with it the prospect that this could serve as a strong reversal to any longer downward trend, propelling it instead to all-time highs.

One of the companies that are hoped to have a positive influence is Bakkt, which is the ICE-backed cryptocurrency platform. Bakkt serves to cater for both institutional and corporate investors and will be launching its Bitcoin product on January 24th, 2019. It's believed that this could have a distinctly positive effect on the markets at large.

Another example of this is Fidelity Investments, which is one of the world's largest traditional brokerage firms. It currently has its eyes set on launching an institutional-aimed cryptocurrency investment platform, which could help bring a broader influx of institutional interest, and, as a result, increased levels of funding into the cryptocurrency markets.

While he was speaking to CNBC, Moro had also noted to a certain degree of importance that daily pricing action is made up of a great deal of noise, and that many institutional investors don't really care about how bitcoin lands in 2018.

“This is about the fifth or sixth 75 percent-plus drawdown that we’ve seen in the 10-year history of bitcoin. And so if you have that [long-term] lens, I don’t believe institutional investors really ultimately care where the price of bitcoin ends in 2018 simply because they’re looking at things three to five years out,”

he said.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) íà Currencies.ru

|

|