2024-9-2 15:30 |

As September, often seen as a negative month for Bitcoin, kicks off, a crypto expert has pointed out that the digital asset is at risk of experiencing extended selling pressure amid recent market volatility and uncertainty. Recent data suggests that negative sentiment is growing, as more investors may want to sell their BTC in response to the turbulent market conditions.

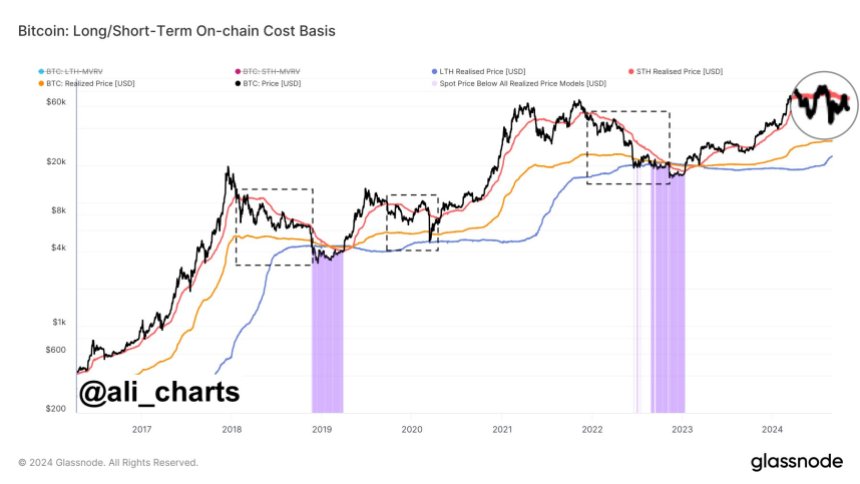

Will Bitcoin Undergo An Extended Selling Pressure?In a pessimistic research, Ali Martinez, a popular market analyst and trader, underscored a trend of continued selling pressure for Bitcoin, the largest cryptocurrency asset.

Martinez bases his projections on the Bitcoin Short-Term Holder Realized Price, noting a prolonged bearish movement around the metric, particularly in the past two months. The development has caused speculation within the crypto community about the coin’s prospects in the short term.

It is worth noting that the behavior of recent Bitcoin purchases can be estimated using the Short-Term Holder Realized Price. Given their increased propensity to sell should the price drop below their entry point, the metric serves as resistance during downtrends.

According to the expert, Bitcoin has struggled to rise over this level since 2022, currently at the $63,250 price mark. Therefore, until the crypto asset takes back this region as a support range, Martinez is confident that there is a chance that selling pressure will persist, suggesting a negative behavior for BTC in the short term.

Particularly, if key support levels are broken, there may be more price drops for BTC due to this selling pressure. Thus, the market expert has urged investors to be extra vigilant during times like this, which could lead to further losses in the market.

If this September produces a bearish outlook for BTC, the development could catalyze this selling pressure due to the negative movement of digital assets in the month in the last 10 years.

BTC’s Warm Supply Realized Price Level At $60,000While the short-term holder realized price is demonstrating a pessimistic trend, Martinez, considering the Warm Supply Realized Price for BTC, highlighted a potential start of an extended bear market in another post on the X (formerly Twitter) platform.

When Bitcoin rises above the warm supply realized price, it indicates a positive sign for growth. Meanwhile, when it falls below the level, it suggests a prolonged bear market shortly.

This level, according to Martinez, is at $66,000 at the moment, and should BTC remain below the level, Martinez stresses a strategic approach for bulls, implying a potential broader bearish sentiment.

The market’s capacity to take in selling activity without witnessing large price decreases will be a crucial determinant of BTC’s near-term direction as traders and investors exercise caution.

origin »Bitcoin price in Telegram @btc_price_every_hour

RiskCoin (RISK) на Currencies.ru

|

|