2022-3-16 00:00 |

While the executive order didn’t directly challenge Bitcoin, the language of the order hints at future threats that may come.

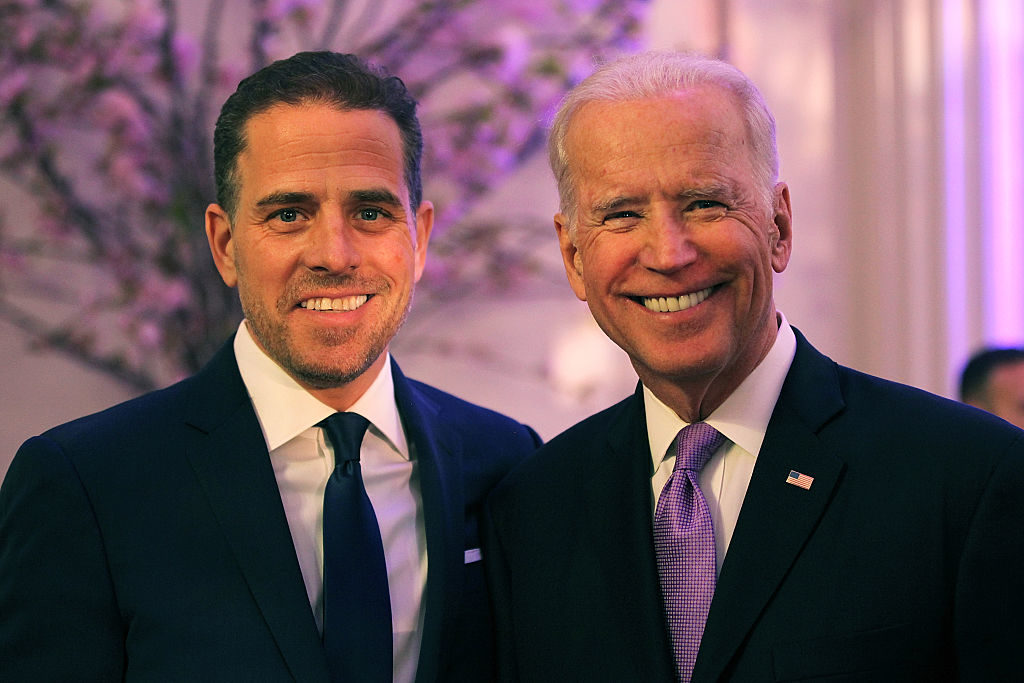

Let me give it to you straight. No one I spoke with from Washington or in the political space was expecting the Biden executive order (EO) to ban Bitcoin or proof-of-work mining. There was nearly zero expectation that President Joe Biden would take any specific action against the cryptocurrency space. From my perspective, it was pre-programmed for the EO to "order studies" and avoid any directives. I had been expecting this for weeks leading up to its release, along with many others I know.

Regarding the response by those in the industry, I appreciate others taking the time to point out the positives that we saw in the Biden EO and the general posture of the current administration. The greater focus to bring regulatory clarity is welcomed and we should celebrate the fact that Biden is not banning Bitcoin or taking decisive action against any part of the industry. As I understand, many were worried about this as a possible outcome. That being said, there are two critical components to this EO that leave me with a significant amount of concern moving forward.

Before we dive into them, let me preface that I will not take the time to lay out the positives in the EO as there have been many articles and tweet threads written on why the Biden EO was a positive for the industry. By leaving the positives out, it is not to persuade you that this EO is a "wholly" negative, more so to avoid redundancy. However, I want to focus on the negatives of the EO because I feel they went completely uncovered or under-discussed.

I’d like to take this moment to remind Bitcoiners (who want to see the United States become more pro-Bitcoin) that this is not the time to take our foot off the gas. We have had small successes, but let these triumphs be the "wind in our sails" that propel us towards more remarkable victories. We have the realistic opportunity to push the United States towards Bitcoin right at the perfect moment when we, as a nation, are in severe decline. The potential to shift towards Bitcoin could prevent a dystopian-like future by providing a peaceful transition to a Bitcoin future. I am incredibly hopeful about the future due to Bitcoin, but we all must strive towards that Bitcoin world together. We must stay engaged with the political process more so now than ever if we want to see the vision of the United States adopting Bitcoin become a reality.

Dangerous Praise Of CBDCsYou do not need to read very far into the Biden executive order before seeing CBDCs mentioned. In fact, CBDCs are mentioned in the very first paragraph, and the word CBDC appears no less than 34 times throughout the EO. The mention of CBDCs is in stark contrast to the lack of recognition of "Bitcoin," which is not mentioned a single time throughout the executive order despite being the entire reason the "crypto" market exists. Multiple times throughout the EO, CBDCs are consistently praised by Biden's Administration as a way to "reduce cross-border payments" and for "showcasing United States leadership." Before I jump into my views on CBDCs and why they are so dangerous to you as an individual, I took the time to get a comment from a leading congressional staffer who is highly focused on Bitcoin and cryptocurrency policy in DC.

"The executive order brings a level of legitimacy that we have not seen in the cryptocurrency space before. In that sense, it's a positive because clarity is desperately needed on a variety of issues. However, it was a little bit odd that the executive order had included reports on CBDCs while there are ongoing studies being conducted by the Fed on the same issue.

“The Fed reports on CBDCs that came out earlier this year had a much more cautious tone than many expected, and they were clearly cognizant of the potential risks to privacy should a CBDC be adopted. The executive order, in contrast, has a much more positive tone on CBDCs and seems to downplay the risks. It almost gives the impression that the Administration is trying to adjust the narrative already set forth by the Fed.

“For anyone who disagrees, I would ask them to read Section 4 of the executive order where it lays out issues that are to be included in the CBDC report. Where does it say to evaluate the potential risks to civil liberties? It doesn't. That's not a very objective report in my opinion."

When speaking to those on the Hill, the comments on CBDCs were the primary area for concern. The Biden administration seemed to be taking a very positive tone towards CBDCs, even going beyond the current position of the Federal Reserve Board. When “reading the tea leaves," this seems to show that the White House publicly favors CBDCs and is hoping to speed up their adoption.

The Biden EO states, "My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC." Each of us should be highly concerned with this desire to sprint towards CBDCs being used in the United States. Being patient and taking time to study CBDCs is essential as they are a potential risk to the very fabric of our society.

I have firmly stood against CBDCs as a medium of exchange and believe CBDCs should be avoided in the United States. One of the first nations to adopt CBDCs was China. The Chinese Communist Party is attracted to this technology because strong control is inherently built into CBDC architecture. CBDCs allow for the unfettered ability to spy on the users. They also invite the use of corrupt incentives to force users to behave however those in power desire. CBDCs go beyond the pervasive power to "control the money printer." CBDCs allow governments to control when and where you can spend. The obvious problem with this type of technology is that CBDCs can exclude individuals or businesses that are not "in line" with the current political leanings of the party in power. CBDCs can and will be used to control everything from which grocery stores you shop at to which political candidates you can support. CBDCs will be used to control which businesses can accept payment, and they'll be used to cut off support to store owners who don't follow government mandates. The ability to shut someone out of the financial system in a cashless society (which is where we are headed) would be a death sentence. No central authority anywhere should have this power. Unfortunately, we as human beings won't be able to resist the temptation to use the power inherent in the design of CBDCs against our enemies.

CBDCs will result in a world where governments can economically incentivize us against our own free will. Yet the Biden EO has no mention of the impact on civil liberties. Governments can and will use CBDCs to economically incentivize us to do whatever the state wants us to do or face being cut off from the digital economy in which we all live. I don't have to explain why Bitcoin is so important to counter this looming threat to our freedoms and liberties, but we should also be pushing back against Biden's attraction to CBDCs regardless of the power of Bitcoin.

While Biden has been sprinting towards CBDC adoption, I have been encouraged by the efforts of Congressman Tom Emmer. Not only has the congressman come out strongly against CBDCs, but he also drafted a bill that would outright ban the Fed from deploying CBDCs to the broader public in the United States. He released the bill with a long tweet thread that had some critical points:

"Not only does this CBDC model raise ‘single point of failure’ issues, leaving Americans' financial information vulnerable to attack, but it could be used as a surveillance tool that Americans should never be forced to tolerate from their own government.""Requiring users to open an account at the Fed to access a United States CBDC would put the Fed on an insidious path akin to China's digital authoritarianism.""...we must prioritize blockchain technology with American characteristics, rather than mimic China's digital authoritarianism out of fear."The whole tweet thread can be found here, along with the bill.

CBDCs should never be allowed to flourish among the people of the USA; however, if central banks want to use CBDCs as a tool to replace SWIFT, I see less of an issue with that approach. We can hope good people in the Biden Administration will see the many societal risks and problems with CBDCs and direct our government away from public deployment of CBDCs. Always remember, when giving the government power ask yourself if you would be okay with your opponent having that same power. When one administration leaves and the next comes in, they will now be the ones holding these newly-formed capabilities.

Bitcoin Energy FUD Inbound?Biden EO: "The United States has an interest in ensuring that digital asset technologies and the digital payments ecosystem are developed, designed, and implemented in a responsible manner that … reduces negative climate impacts and environmental pollution, as may result from some cryptocurrency mining."

This statement should cause all Bitcoiners to pause. Biden shows where his administration stands on Bitcoin mining in a single sentence. There is no need to read between the tea leaves here: "... environmental pollution, as may result from some cryptocurrency mining."

Unfortunately, Bitcoin mining is still seen as a threat to the goals of those who want to see our carbon emissions drop. Regardless of your position on greenhouse gas emissions and climate change, we should be doing whatever we can to educate our government that Bitcoin can help reduce GHGs so as to prevent a crackdown on Bitcoin mining in the United States.

Bitcoin mining may be the very thing that achieves the desired impact that many environmentalists have been pushing for decades. Unfortunately, we are in a dangerous period when proof-of-work mining is under attack worldwide. The United States has the next 50 years of energy innovation under its grasp after the China exodus, where nearly 50% of the hash rate was kicked out of China by the CCP. We are also seeing the same move being made by the European Union. They are moving to vote on an amendment to ban PoW mining in the EU as we speak. The United States is currently number one in Bitcoin mining and we should do whatever we can to keep this industry here in America. Bitcoin mining will rebuild America and will lead to a national security edge over our global opponents.

The United States needs to take the opposite approach as the CCP and the European Union, but this executive order doesn't give me hope that the Biden administration is headed in the right direction. Later in the EO, Biden mentions the need to research "the effect of cryptocurrencies' consensus mechanisms on energy usage." The term "consensus mechanism" refers to the mechanism by which consensus is achieved on the Bitcoin (or any cryptocurrency) protocol. Currently, that mechanism is proof-of-work which (in very basic terms) requires math problems to be solved by computers to achieve network synchronicity. Whoever solves the math problem the fastest gets the prize of earning the bitcoin in the next block (aka: block reward). The entire Bitcoin mining industry is built around this simple yet powerful way of protecting the network and processing transactions. Bitcoiners favor PoW because it is extremely efficient at providing security in a decentralized and permissionless fashion. However, there are other consensus mechanisms such as proof-of-stake. At first glance, PoS may seem like the evolution of proof-of-work but is a step backward in every conceivable way. To keep it light, after doing a significant amount of research on PoW versus PoS, I am firmly on the side of PoW. I do not believe PoS will be sufficiently decentralized or secure for the world's reserve assets. I also foresee a world that benefits from the energy used by Bitcoin so if “less energy” is the only benefit of PoS it is an extremely flimsy one.

Due to proof-of-work (PoW), Bitcoin mining is a business in search of the cheapest form of energy and the most efficient means for using that energy. Because of this, we will likely see billions of dollars dumped into energy innovation and chip fabrication in the United States. We will also see a massive build-out of renewable energy sources because they are the cheapest form of energy. Bitcoin mining also provides a baseload to renewable energy assets that often curtail their energy production when they can't find a buyer. This is where the term "buyer of last resort" was derived. Curtailing renewables results in wasted energy and disincentives investment into these energy assets.

Any discussion of a forced move from PoW to PoS is dangerous because Bitcoin will never move to PoS as it would be an untenable change to the protocol and would result in PoW miners leaving the United States. Miners leaving the United States would be a devastating outcome for our country. I want billions of dollars of investment into new energy assets in America. I want the tens of thousands of new jobs to be created here. I want the chip fabrication innovations to occur here. I also want to ensure that we achieve an energy-abundant future through the build-out of renewable energy assets all across this country. None of that will occur if the Biden Administration decides that PoW is "in the way" of them achieving their Environmental, social and corporate governance (ESG) goals. We should not think even for a moment that the Biden Administration won't take decisive action against Bitcoin miners. The last comment I will leave you with from the Biden EO: "We must take strong steps to reduce the risks that digital assets could pose to … climate change and pollution."

This Administration is clearly teeing itself up to take one or all of these actions:

Ban proof-of-work miningRegulate PoW mining to deathPush for or incentive inferior PoS projectsAll of these would lead to an outcome where the United States loses its lead in Bitcoin mining and gives up the potential to outmaneuver China and Russia on this key piece of Bitcoin infrastructure.

What You Can DoIf you live in the United States and you want to make sure your elected officials are pushing back against CBDCs or any attempt to ban proof-of-work mining, I would encourage you to take the time to send a message to your elected officials. I created a simple and easy tool to use with a pre-loaded message for your convenience:

Here is the one for opposing CBDCs

Here is the one to show support for PoW miners

Many organizations are also popping up that are doing an incredible job of shaping the narrative around CBDCs and PoW mining. Several organizations, including advocacy projects and PACs, will be exclusively focused on defending and protecting Bitcoin users and Bitcoin miners in the United States. If you are interested in contributing to their work, please reach out to me via Twitter direct message or email. [email protected].

In ClosingI again want to affirm my appreciation of those who rightfully pointed out the need for regulatory clarity surrounding Bitcoin and the digital asset space. More transparency and trust will lead to more investors and stable markets. It will also help to finally begin removing the worst parts of the industry where we all know a large amount of unfettered scamming is occurring.

We have a long way to go to ensure the United States becomes orange-pilled. The fight is not nearly over. So keep pushing and keep fighting for Bitcoin in the United States. The future is promising for the whole world if America can be the "shining city on a hill" for Bitcoin.

This is a guest post by Dennis Porter. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|