2024-8-28 02:30 |

Bitcoin is trending lower when writing, cooling off after the encouraging leg up on August 23. Although the uptrend remains, and the coin is not far away from $63,000, there is no discounting the possibility of sellers pressing on. The alignment with the dip of early August could trigger another wave of liquidation, causing panic.

Bitcoin Shaky, The First Two Levels To WatchTechnically, Bitcoin is within a bullish breakout formation from the bull flag established after the expansion on August 8.

Additionally, from a volume analysis perspective, bulls stand a chance since prices are still inside the bull bar of August 23. As long as trading volume remains light as prices trickle lower, buyers may jump back and drive prices higher above $66,000.

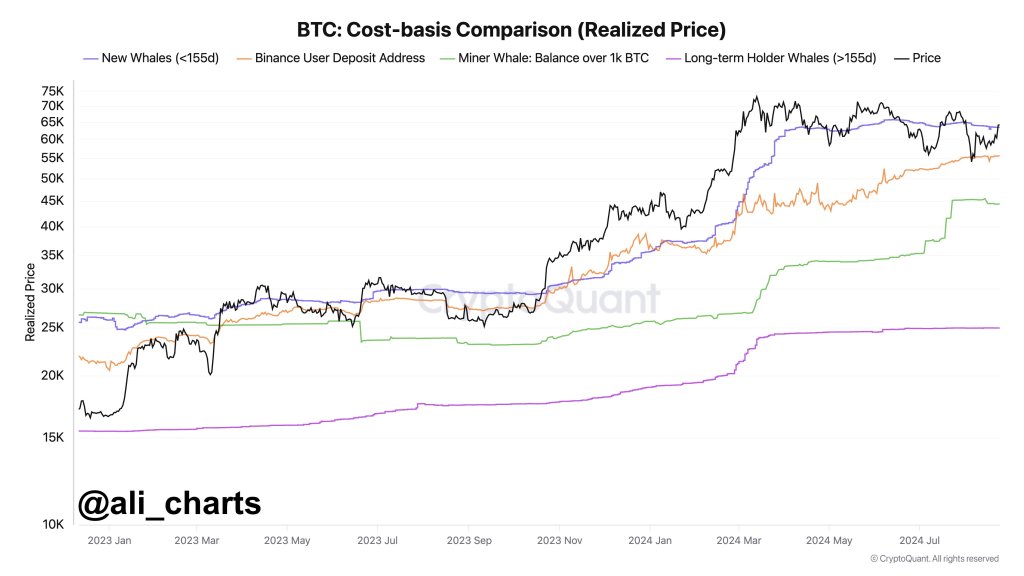

Even so, assuming Bitcoin bears have the upper hand, one analyst on X thinks it will be important for traders to closely monitor how prices will react at the following four reaction lines. From the Bitcoin cost-basis comparison via CryptoQuant, the first support level, now resistance following the ongoing dump, is $63,450.

At this price point, the analyst said this is the average price at which new whales buy BTC. It remains to be seen whether prices will recover and print above $64,000 in the coming days.

However, the fact that whales are in the picture is a net positive. Typically, whales, unlike retailers, tend to be HODLers and won’t be shaken off whenever prices fluctuate.

If bears are unyielding and prices break below $60,000, the analyst continued traders should watch how prices react at $55,540. From the trader’s analysis, Binance users have placed their support at $55,540. Therefore, prices dropping below this level could easily trigger panic selling as traders on this exchange dump scramble for safety.

Miners And Long-Term Holders: The Last WallsA level deeper, a key support level will be $44,400. This zone is where most miners are deemed profitable. As long as prices trade above this line, most miners, most of whom are whales, can HODL, expecting price gains. In early August, Bitcoin fell hard but didn’t breach this zone, highlighting its importance regarding BTC price action.

Below this, $25,000 is another accumulation level that traders will watch out for if there is a general collapse. The $25,000 is the average price at which long-term holders (LTHs) bought. LTHs are those who bought BTC over 155 days ago.

This cohort mostly comprises whales and network believers. Technically, a break below $50,000 and August 2024 lows might be the basis for another leg down to $40,000 and worse.

While bears might take over, there are also supportive factors that continue to spur bulls on. One of the world’s largest asset managers, BlackRock, recently added BTC to its Strategic Global Bond Fund as a hedge against traditional assets. Its spot Bitcoin ETF, IBIT, already holds billions of BTC on behalf of its institutional clients.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|