2020-2-22 01:00 |

The number of new Bitcoin addresses with a non-zero balance is at an all time high, surpassing the number of new addresses hodling BTC when prices hit $20K back in 2017. Bitcoin’s Richest addresses: Not as many as you might think Twitter user @IncomeSharks shared charts from Bitcoin onchain metrics API and Data site Glassnode Studio today, which show a logarithmic representation of address growth across a range of different metrics. One chart shows that Bitcoin’s price is directly correlated with both the creation of new addresses and new addresses that are already actively hodl’ing. $BTC addresses with non-zero balances are at an all time high. What's more surprising is that we are even higher than when we near $20,000. Hard to not be bullish on this kind of distribution and adoption. @glassnode pic.twitter.com/bNvt78C5rD — Income Sharks (@IncomeSharks) February 21, 2020 The total number of Bitcoin addresses is 615,463,205 addresses, as of February 20th, the most recent data point. There are 28,728,292 addresses that currently have a balance above zero. Of these 28 million addresses, only 788,101 are addresses of wholecoiners, or having a balance of at least 1 Bitcoin. There are 154,689 wallet addresses with a balance of 10 or more Bitcoin. Wallets with a balance of 100 BTC or more, are even more scarce, still, with 16,247 containing 100 or more coins. The very elite Bitcoiners of the world are far fewer in number still, with only 2,156 addreses containing 1000 BTC or more The Bitcoin illuminati, the addresses with a 10K or more BTC balance are only numberes at 105. (Looking at you, Trace Mayer and Roger Ver) Also to note the number of addresses with more than 1 $BTC have continued to go up. There are lots more charts like this at https://t.co/4PBxBQ7S12 pic.twitter.com/ftNYzTOgS6 — Income Sharks (@IncomeSharks) February 21, 2020 As halving hype increases, so do new addresses New users have been onboarding to Bitcoin in record numbers recently, but the amount of high balances on those addresses are extremely small. While there is 7,806,710 addresses that contain a balance of 0.01, there are only 708K with a balance of 1 bitcoin. Even though Bitcoin at $9721.5 (at the time of writing) is expensive, and possibly unattainable for the majority of the inhabitants of developing economies, $9,700 is well within the grasp of many middle class investors, and those with a higher amounts of income. The fact that Bitcoin has the potential to become the world’s standard for value transfer, and only 28 million addresses are holding non-zero balances right now, shows that the investment side of things is still extremely asymmetric even a decade later. Those who believe they have missed the boat still have a very real second chance, especially with the hype surrounding the halving in May. Bitcoin’s value is tied to the laws of supply and demand, and, according to a popular stock to flow ratio chart, the event should deliver a promising surge. Do you think the rise in non-zero balance Bitcoin wallet addresses is a bullish sign? Let us know in the comments below! Images via Shutterstock, Twitter @Incomesharks origin »

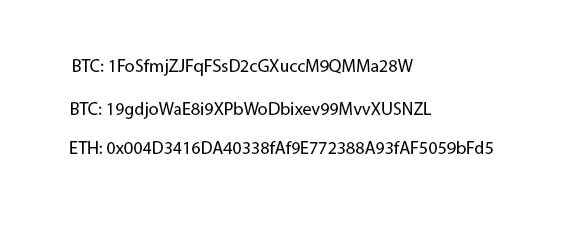

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|