2023-10-19 11:50 |

Quick Take

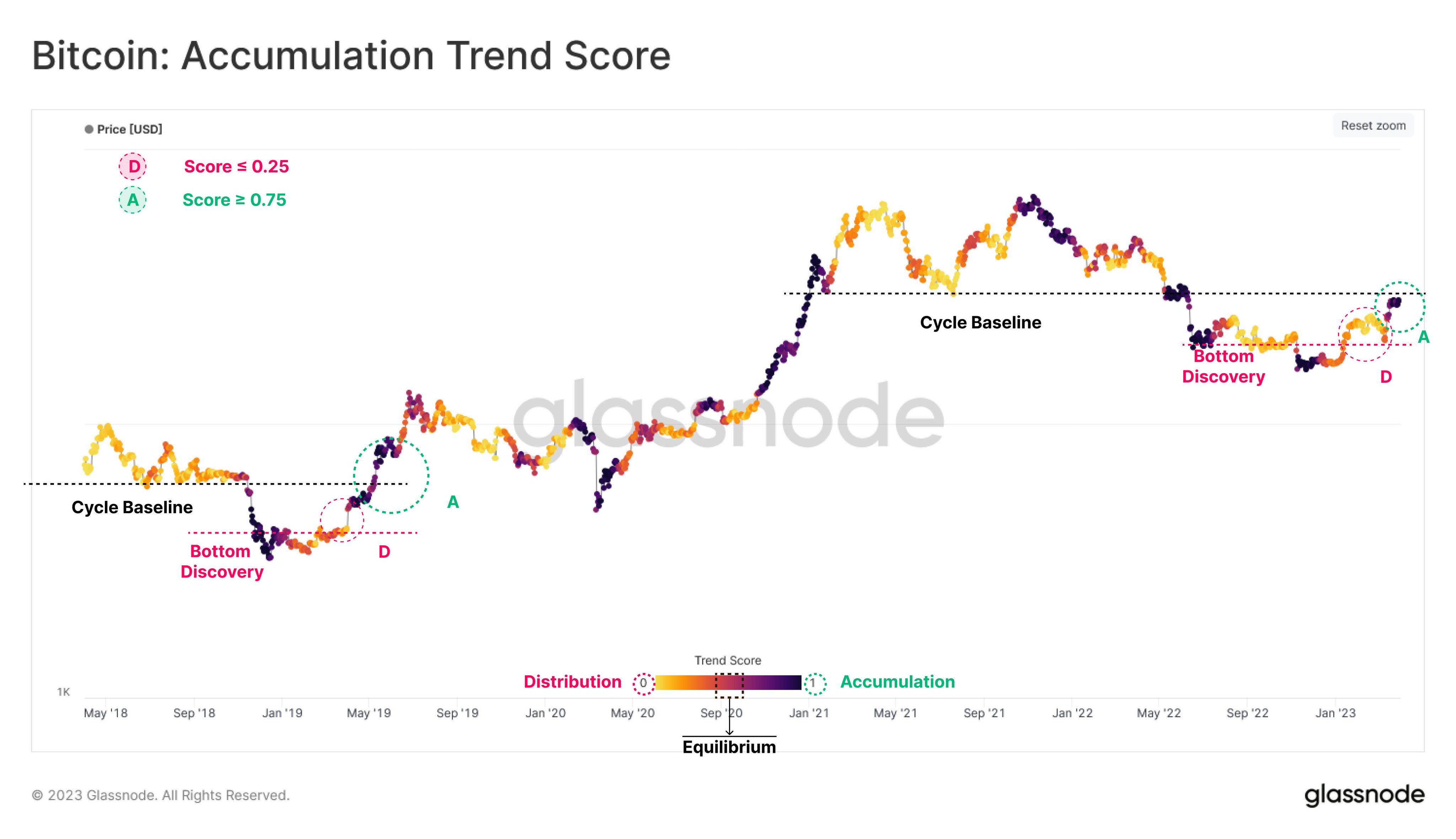

The Accumulation Trend Score, a metric indicating the relative size of entities actively accumulating Bitcoin, has signaled a shift. This indicator evaluates on-chain Bitcoin holdings, factoring in the size of an entity’s balance (participation score) and their recent acquisition or selling activity (balance change score).

On this scale, a score approaching 1 suggests extensive accumulation by larger entities, while a score nearing 0 indicates distribution or a lack of accumulation.

For the first time since July, the Accumulation Trend Score reached above the 0.5 mark on Oct. 17 while registering at 0.64 yesterday, Oct. 18. This upturn implies that significant cohorts are amassing Bitcoin, showing a trend towards accumulation on a network-wide scale.

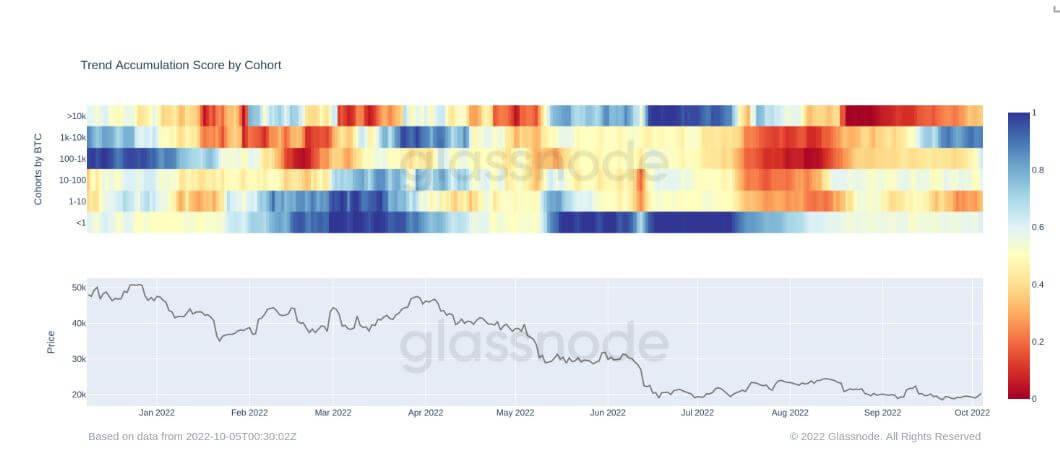

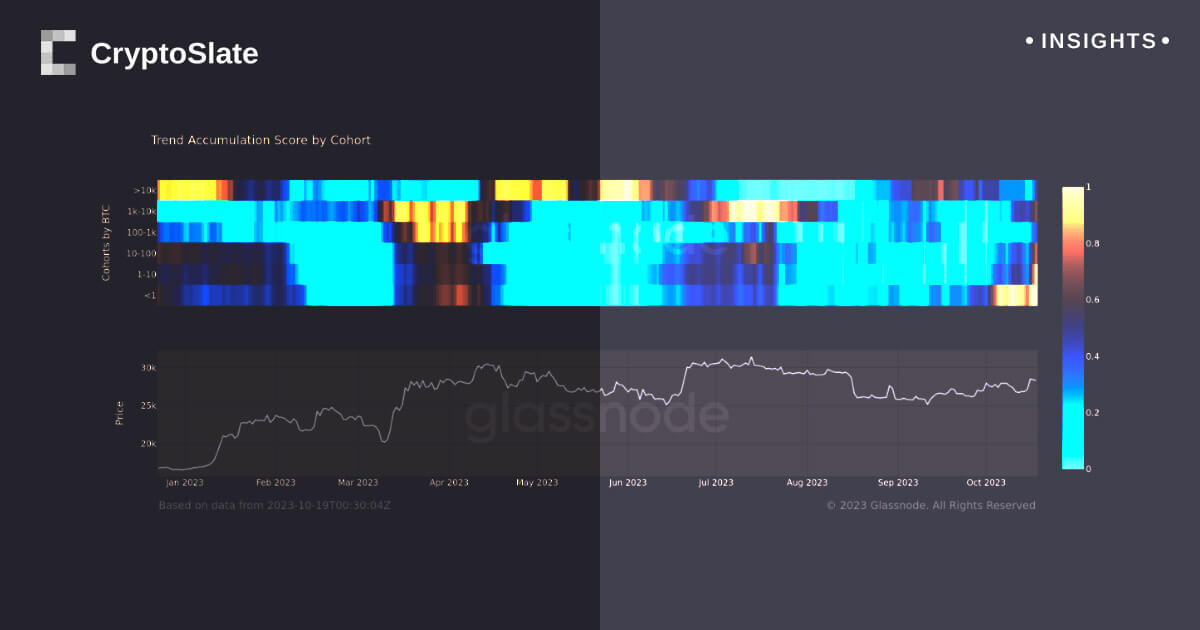

Accumulation Trend Score: (Source: Glassnode)The data reveals more profound patterns when broken down by cohort size. “Shrimps,” or those holding less than 1 Bitcoin, have consistently accumulated throughout October. Larger cohorts, namely those holding between 1-10, 10-100, and 1,000-10,000 Bitcoin, have shown a marked trend towards accumulation beginning this week. This surge in accumulation across various cohorts signals a broadening trend of Bitcoin acquisition.

Accumulation Trend Score: (Source: Glassnode)

The post Bitcoin accumulation hits highest level since July, signaling bullish trend appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|