2023-3-8 12:49 |

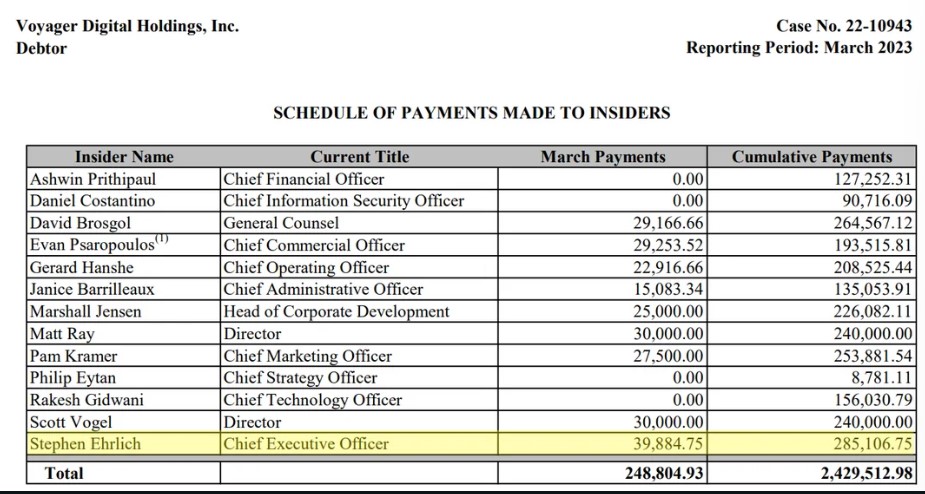

Binance.US has received approval to acquire the assets of Voyager Digital, a bankrupt crypto lender, in a deal valued at more than $1 billion. The acquisition will allow Binance.US to expand its services and strengthen its position in the competitive cryptocurrency market.

U.S. Bankruptcy Judge Michael Wiles approved the deal on March 7 after hearing four days of testimony from Voyager and the U.S. Securities and Exchange Commission.

Binance.US Trumps SEC PushbackAccording to Bloomberg, Wiles dismissed the SEC’s claims that the transfer of funds from Voyager to Binance.US violated U.S. securities laws.

Wiles said he would allow the exchange to complete the Binance.US sale and provide payback tokens to affected Voyager clients, which would reimburse them for almost 73% of their losses.

Several witnesses testified before the court on intricate issues such as whether or not personal information will be transferred to Binance.US and whether or not the transfer was in the best interest of creditors rather than liquidation.

SEC Objection Not Practical, Judge SaysThe court concluded that the concerns raised by the regulators did not exceed the importance of moving forward with the Voyager restructuring.

Just yesterday, Wiles said that no U.S. agency, including the SEC, could prosecute Voyager executives in connection with the issuing of a prospective bankruptcy token, so today’s approval comes as no surprise.

Relentless PursuitThe SEC is continuously facing accusations of attempting to dismantle the cryptocurrency sector. Critics claim that the agency’s recent actions, including heightened regulatory scrutiny and enforcement actions against companies and individuals involved in the crypto industry, are stifling innovation and hindering the growth of the sector.

Some in the industry argue that the SEC’s actions are disproportionate and unfairly targeting cryptocurrency companies and individuals. They point to the agency’s rejection of Bitcoin exchange-traded funds and ongoing lawsuits against major players such as Ripple Labs as evidence of a broader agenda to quash the emerging industry.

The legal battle between Ripple Labs and the SEC began in December 2020 when the SEC filed a lawsuit against Ripple Labs, its CEO Brad Garlinghouse, and executive chairman Chris Larsen.

The lawsuit alleged that Ripple had conducted a $1.3 billion unregistered securities offering by selling XRP tokens, which the SEC claimed were securities.

Proponents of the SEC’s actions, however, argue that increased regulation is necessary to protect investors and prevent fraud in a largely unregulated market. They contend that the agency’s efforts will ultimately benefit the industry by increasing transparency and trust in cryptocurrencies.

-Featured image from The Globe and Mail

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) на Currencies.ru

|

|