2026-2-15 16:39 |

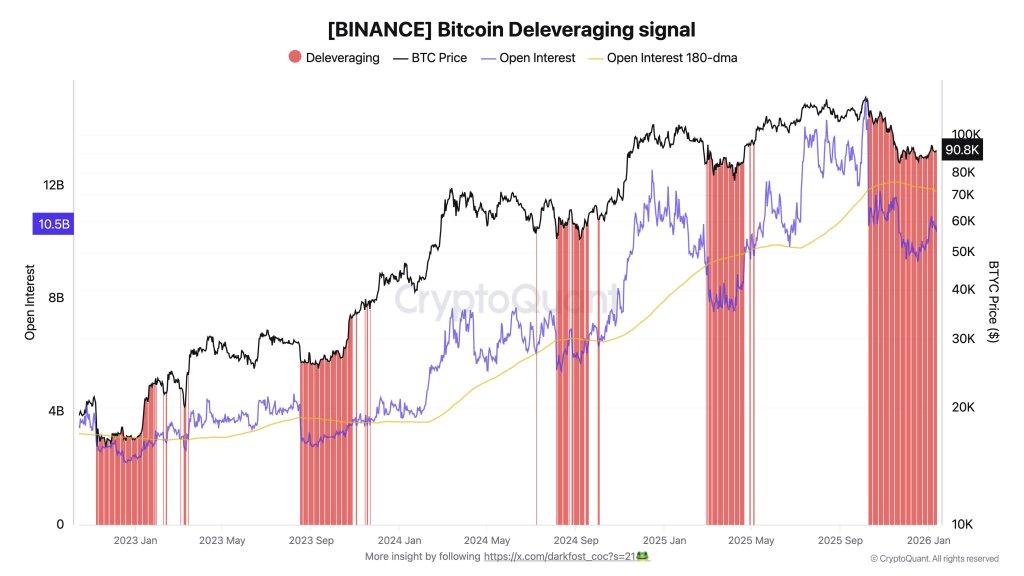

Binance Research this week published a wide-ranging market note that frames the current crypto pullback as a familiar, if uncomfortable, phase in the broader evolution of the market. The report argues that the roughly 50% decline from October’s all-time highs sits squarely within historical patterns of large drawdowns that, over time, have preceded renewed momentum and fresh peaks for Bitcoin. Binance’s analysts even point to this as Bitcoin’s ninth such “50% reset,” a pattern they say has proved typical across prior cycles.

At the heart of the research is a picture of capital rotating toward perceived durability. As Bitcoin consolidates, many altcoins have been left behind: oversupply from a frenzied 2025 token issuance cycle. The report notes roughly 11.6 million of the 20.2 million tokens launched last year are no longer actively traded, which has amplified downside for smaller projects and left many trading well below their initial valuations. That dynamic has concentrated attention and liquidity in the largest, most established digital assets as investors pare speculative exposures.

Yet the note is quick to distinguish noise from structural progress. Despite the pullback and ETF-related headlines that suggested momentum had evaporated, spot Bitcoin ETF assets under management have held up far better than price alone would suggest. Binance’s team points out that ETF flows appear closer to strategic allocation than to fleeting momentum plays, with episodes of net inflows in recent days that imply sticky, rather than purely momentum-driven, demand. That, they argue, makes the ETF channel a durable source of bid in the medium term.

Liquidity, meanwhile, has not fled the on-chain ecosystem. Stablecoin supply has stayed near cycle highs, the report cites levels around US$305 billion, indicating that dollar liquidity remains parked on-chain and ready to deploy when sentiment shifts. At the same time, real-world assets and tokenization are attracting interest as institutions seek low-volatility, yield-oriented exposure on-chain: Binance estimates the on-chain RWA market is approaching roughly US$25 billion, and highlights tokenized treasuries, commodities and yield structures as receptacles for capital in a risk-off setting.

Broader Macro StoryBinance’s market view ties much of the current price action to a broader macro story. Last week’s jobs data and related Fed implications have kept liquidity expectations elevated as a dominant force influencing crypto. January’s payroll print, while better than some forecasts, arrived alongside downward benchmark revisions for 2025 that paint the prior year as much weaker than earlier tallies, a nuance that the report says makes the Federal Reserve’s near-term policy path less likely to swing quickly to easing.

That “macro is calling the shots” theme, Binance warns, amplifies Bitcoin’s sensitivity to global liquidity shifts and helps explain the present de-risking across risk assets. But the note is not without constructive flashes. Binance highlights a landmark DeFi development as one of the week’s most meaningful signals: BlackRock, working with Securitize, moving to make shares of its tokenized U.S. Treasury fund tradable on UniswapX, and subsequent institutional acquisitions of Uniswap governance tokens.

The research team frames this as a blueprint for how regulated, large-scale TradFi flows can interact with decentralized infrastructure, a practical convergence of institutional capital and on-chain settlement that could unlock repeatable pathways for tokenized funds and other instruments. That episode, they say, shows liquidity is present; the market is simply selective about when it deploys it.

Looking ahead, Binance Research expects volatility to remain elevated as markets seek clearer signals. Key macro data, including forthcoming FOMC minutes and U.S. core PCE, will likely influence the near-term liquidity outlook, while events such as ETHDenver will provide a live read on developer activity and ecosystem momentum. The report’s central takeaway is pragmatic. The present drawdown is painful, but the underlying product and infrastructure advances, from spot ETF adoption to stablecoin rails and tokenized RWAs, continue to compound below the surface, laying groundwork for whatever comes next.

For market participants, the note reads as both a caution and a reassurance. The correction echoes prior structural resets, but it is happening in an environment that is more institutionally connected and technically mature than previous cycles. That mix, Binance argues, means the path back to healthier risk appetite will depend as much on macro and policy cues as on crypto-native catalysts, but that when conviction returns, the assets built during the reset are often positioned to lead the next phase.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) íà Currencies.ru

|

|