2019-9-10 16:30 |

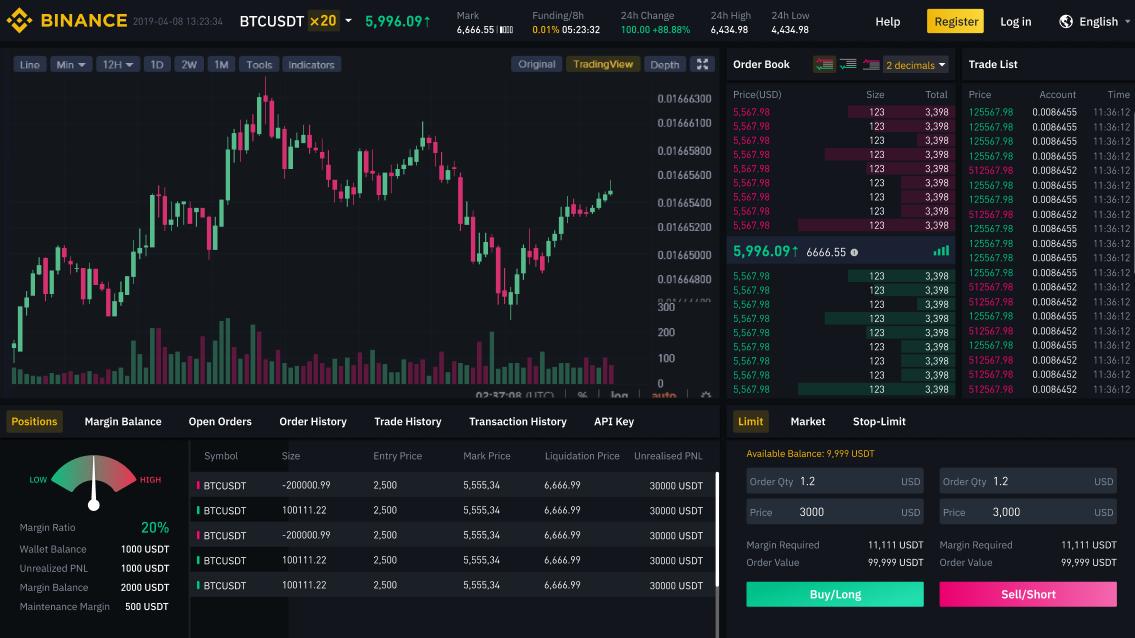

Binance has launched its futures markets in a closed invitation-only mode. Following a testing period on its two futures platforms, the leading exchange marked significant interest. Trading volumes reached $150 million, denominated in Tether (USDT). For now, Binance offers BTC/USDT futures markets, similar to BitMex.

Reddit users observed the initial performance of the Binance futures markets. The first day of trading achieved significant volumes in the BTC/USDT pairing. The sum is just a fraction of the leading futures market competitor, BitMEX, where activity surpasses $2.4 billion in 24 hours.

Binance now operates two futures platforms – its native trading system, as well as the trading system from the recently acquired JEX exchange. The leading crypto exchange joins the futures markets after OKEx and Huobi offered their own version of the derivatives. For now, the company sells both plain vanilla futures, and 100X leverage instruments.

JEX Platform Boosts TradingBinance acquired JEX just days ago, renaming it to Binance JEX. The platform received mixed reviews for ease of use. Binance attempts to address problems with derivatives trading, such as price information latency, as well as risk mitigation. The acquisition of the JEX exchange will also introduce its native asset, the JEX token, to Binance users.

The company stated,

In a longer term, JEX tokens will be gradually distributed to all users via marketing activities and community incentives; subsequently, the tokens will be gradually retrieved and burned in various forms including trading commission deductions and so on,

Binance futures will derive their price from a mix of exchanges, including itself, but also Huobi, OKEx, Bittrex, HitBTC, Bitfinex, and Huobi. This precaution is to avoid price manipulation and unnecessary liquidations in cases of more dramatic price moves.

The exchange also updated the conditions and documentation on its trading platforms:

You may find this handy. Official Documentation for the Binance Futures APIs and Streams. – Binance Futures API Documentation https://t.co/RyHLVWIyKV

— CZ Binance (@cz_binance) September 10, 2019

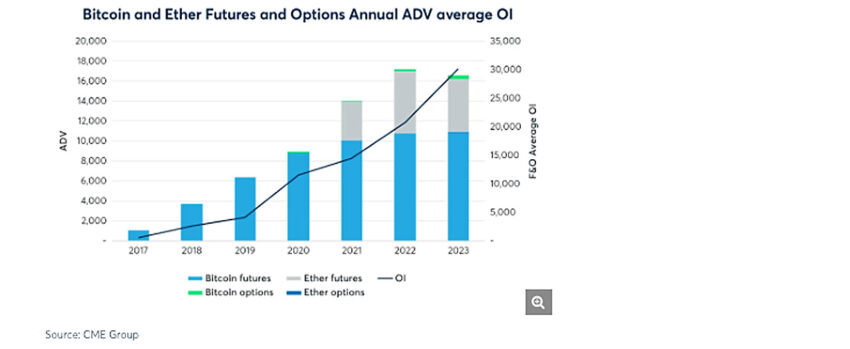

Binance Growth StagesUntil the first half of 2019, Binance was a relatively conservative exchange, offering basic trading pairs. The addition of futures puts it up as a potentially riskier market. Futures markets tend to affect Bitcoin (BTC) prices, based on BitMEX valuations.

The company also started to offer crypto-based finance solutions through its lending program. The exchange accumulates altcoins, offering high potential returns for lending.

Binance Coin (BNB) traded without change on the news of the futures launch. For now, the native coin of the exchange does not participate in the futures markets. BNB traded around $22.27, on slimmer volumes of $143 million in the past day.

What do you think about Binance Futures? Share your thoughts in the comments section below!

Images via Shutterstock, Twitter @CZ_Binance

The post Binance Open Interest on Futures Testnet Hits $150M USDT in 24hrs appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|