2019-3-26 18:00 |

The Binance Launchpad platform has recorded gains of over 270% for its three Initial Exchange Offerings (IEO) this year. With such returns, it’s no surprise that demand is now rising and other exchanges are now copying the new model.

271% Average Gains on Binance LaunchpadTokens of projects launched through Binance Launchpad have gained 271% of their IEO dollar price at the time of this writing.

So far, the platform has launched three projects, namely BitTorrent, Fetch.AI, and Celer Network.

As seen on the table above, the tokens of every single one of them has seen its price skyrocket at the time it got listed on Binance.

During its IEO, BitTorrent Token (BTT) was sold at a price of $0.00012. As soon as it got listed, its price catapulted with about 330 percent. It has increased even more since, currently trading at 483 percent higher compared to its IEO dollar value. The cryptocurrency has also increased against Binance Coin (BNB). Presently, it marks gains of around 154 percent.

Fetch.AI (FET) token was sold at a price of $0.0867. Following its listing, its dollar price increased by 367 percent. Currently, FET is trading 119 percent higher compared to its IEO dollar price and 36 percent higher against BNB.

Celer Network (CELR) token was sold at a price of $0.0067 during its IEO. Its listing price was around $0.030 or about 350 percent higher. At the time of this writing, CELR is trading at a price 213 percent higher compared to its IEO dollar value and 197 percent higher when trading against BNB.

On average, the tokens were listed at a price 350 percent higher than their IEO dollar value. Their ongoing performance is also somewhat impressive, as they’ve managed to retain a notably higher value, marking increases of 271 percent against the USD.

Demand Likely to RiseDespite being undoubtedly successful for the projects themselves, Binance Launchpad has experienced continuous technical issues handling the high buying demand.

In fact, it seems that people are getting more and more interested in participating, likely because of the returns outlined above.

Immediately after the last sale – that of Celer Network, Changpeng ‘CZ’ Zhao, CEO at Binance, said that it was “actually the highest buy demand sale we seen so far.”

Yet, out of 39,003 people, only 3,129 managed to buy CELR tokens, suggesting that less than 10 percent of everyone who attempted to buy actually managed to do so. The sentiment was similar throughout the previous sales as well.

VIP Access for BNB Hodlers ComingSince then, Binance has come up with somewhat of a solution. Instead of handling the orders on “first-in-first-served” basis and coping with their technical issues, Binance has decided to conduct the sales using a lottery format.

As Bitcoinist reported, the platform will be implementing a BNB daily holding average criteria for users who want to get tickets to participate in the sales. These tickets will then be selected randomly, allowing their owners to purchase a pre-determined amount of tokens.

Other Exchanges Replicating IEO ModelOther exchanges were quick to see the potential in having their in-house IEO factories.

KuCoin announced its so-called Spotlight platform and will host its first IEO on April 3rd. The model they are going for is more or less the same as it was on Binance Launchpad prior to their decision to implement a lottery-like format.

Huobi Global is another well-known exchange which has also boarded the new hypetrain. Their platform is called Huobi Prime. Unlike KuCoin and Binance, however, they’ve taken a fairly different approach.

Instead of conducting a “sale”, per se, Huobi Prime will directly list the new tokens for trading against USDT, Huobi Token (HT), BTC, and ETH. Each sale will go through three preliminary trading rounds of 30 minutes where users will only be able to place regular market orders at a tradable price which is capped for each round. Once they are through, regular trading of the new token will be allowed.

Huobi Prime will have its first selective token listing on March 26th.

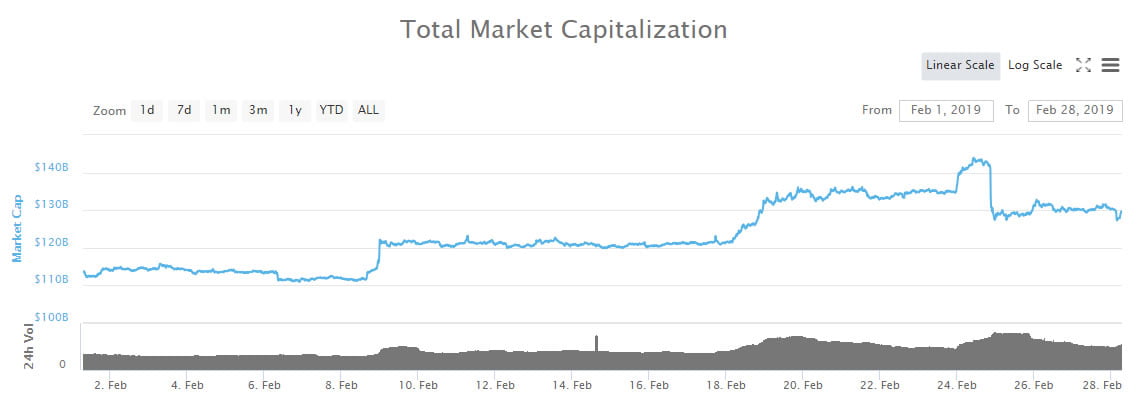

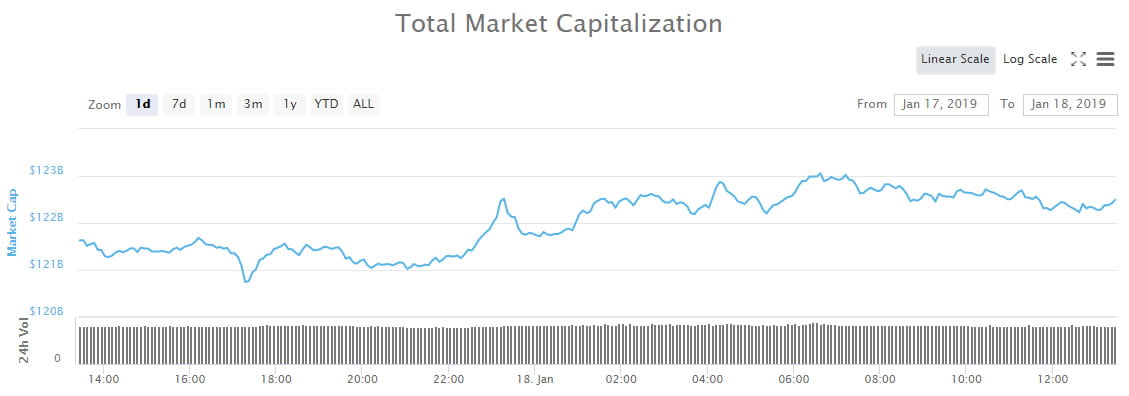

It’s also worth noting that this new craze has had a splendid effect on the exchanges’ native tokens.

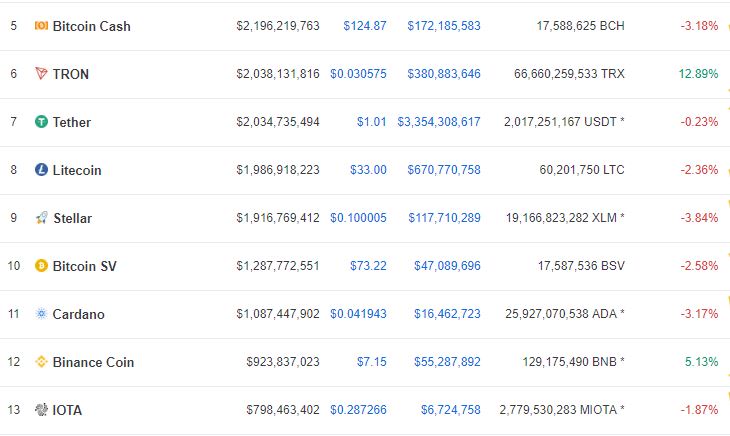

Binance Coin (BNB) has managed to more than tripple its price in the last three months. Huobi Token (HT) has surged by more than 130 percent in the same period, while KuCoin Shares (KCS) sees gains of about 120 percent.

What do you think of the newly shaped trend of exchange-backed IEOs? Don’t hesitate to let us know in the comments below!

Images via Shutterstock

The post Binance In-House Cryptocurrency Launches Have Averaged 270% Gains appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) на Currencies.ru

|

|