2020-6-1 18:09 |

Coinspeaker

Binance Enables Futures Historical Data

Binance Futures announced it will provide users with historical data to assist with backtesting and trading strategies. The data provided will be year-to-date tick level trading data, including official records of trade times, prices, and quantities.

Most of the biggest traders on Binance Futures are eager for Bitcoin (BTC), Ether (ETH), and 8 other biggest cryptocurrencies. And not just that, more than 50% of traders are for a long time on 10 crypto assets despite the current decline in the price of BTC.

The data indicates the most of the traders on Binance Futures still believe Bitcoin could see a resumption of the uptrend in the short to medium-term.

From March to April, the price trend of Bitcoin pretty much acted the same as the U.S. stock market.

On May 26, the Dow Jones Industrial Average (DJIA) jumped by 2.6% merely three hours after the market opened. Analysts think that most of this came as a result of the U.S. President Donald Trump

’s announcement about reopening the US economy and easing the restriction measures imposed due to the COVID-19 outbreak.

Since the reversing course in late March the U.S. stock market went up on a V-shaped recovery and crypto investors’ hopes for a Bitcoin rally have also increased.

Market is Consolidating, Not Entering the Bear CycleAccording to cryptocurrency trader Scott Melker, the falling volume of Bitcoin amid a pullback shows the market is consolidating, not entering a bear cycle.

Melker explained:

“Volume has been decreasing with price since Bitcoin topped at $10,000. Worth keeping an eye on, as that’s a sign of consolidation more than it is of a true downtrend. You want to see volume rising in whatever direction price is going to offer confirmation.”

Market data shows Bitcoin is most probably looking at a healthy unification rather than a one-sided correction, which is probably boosting the positive sentiment around cryptocurrencies on Binance Futures.

A third impetus that could be boosting the market for the strong desire for BTC at the current price is its price trend in the last month. After reaching a local peak above $10,000, BTC went down by some 13%. Investors however may think of a 13% pullback as of an applicable fall in order to re-enter the market.

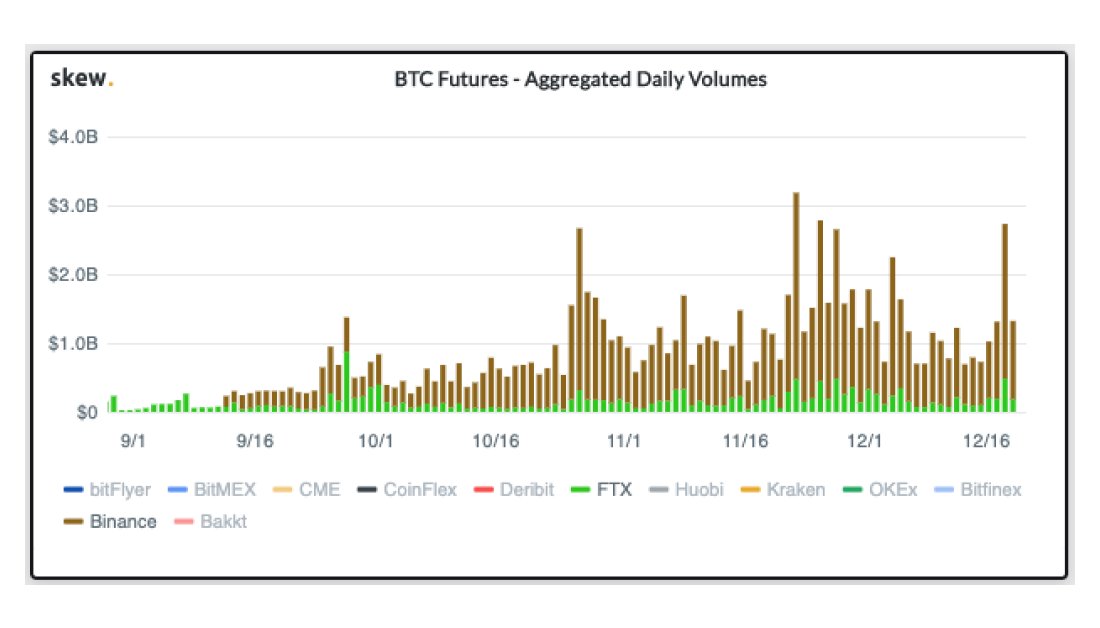

Other top futures exchanges such as Bitfinex and BitMEX are also guided by long contracts over shorts. Bitfinex and BitMEX show that 77.4% and 68.4% of all open positions are longs.

Reasons for Binance Futures SuccessAaron Gong, vice president of futures at major cryptocurrency exchange Binance, explained that the company made its product with the plan of becoming the top Bitcoin futures trading platform.

He said:

“We knew we would be there soon, and we made it in slightly more than 6 months’ time.”

According to Gong, there are three main reasons behind the success of Binance’s futures products: the low taker fees, new features and a large amount of altcoin pairs.

Gong added:

“Too many other exchanges offer negative maker fees, where most orders are just computerized market makers competing for best bid and ask with extremely limited taker interest during periods of low-volatility. We are the first major crypto exchange to launch max 125X leverage for BTC contracts, and the first of its kind to launch cross collateral and smart liquidation mechanism. These features have gained tremendous popularity amongst our users.”

Binance USD to Launch on Harmony MainnetDecentralization focused blockchain Harmony said that it would launch Binance Chain’s stablecoin, Binance USD (BUSD), on its mainnet. The move will commemorate the first anniversary of Harmony protocol’s Launchpad IEO.

$BUSD (NYDFS approved, fully audited, $170M cap) will launch on @harmonyprotocol mainnet!

Harmony’s sharded PoS protocol provides the high-throughput, fast settlement & low transaction fees necessary to power the growing demand for #stablecoin transfer.https://t.co/riGXkNGWf9 pic.twitter.com/He1cKr1hov

— Harmony (@harmonyprotocol) June 1, 2020

Harmony co-founder Nick White explained that Binance and Harmony share a “common vision of democratizing access to financial services. BUSD is the first stablecoin to be launched on Harmony mainnet, which will also help the protocol to capitalize on the growing demand of stablecoin.”

Binance Enables Futures Historical Data

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|