2019-10-20 19:54 |

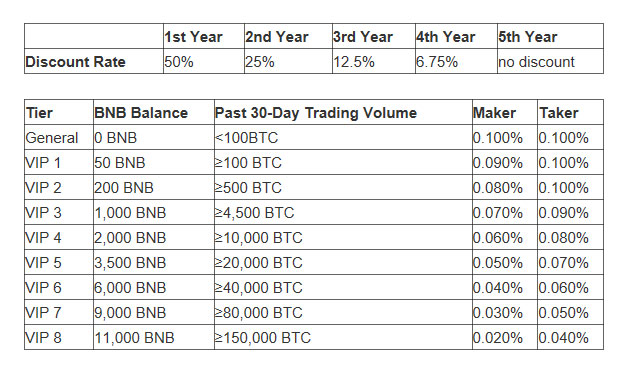

If you are a regular Binance user, you are probably well aware that the cryptocurrency exchange charges a 0.0005 BTC withdrawal fee, irrespective of the size of the withdrawal or network fee requirements.

The 0.0005 BTC withdrawal fee is currently around 33 times higher than the average fee required to ensure transactions are mined on the next block.

Payment Batching Benefits Everyone, Except YouBinance uses a process known as payment batching in order to reduce transaction fees to a bare minimum. By squeezing as many outputs as possible into a single transaction, Binance is able to cut transaction fees by as much as 80%. Binance also opts to maintain a legacy input address, which actually makes payment batching more cost-effective than a SegWit address.

This system also enables Binance to ensure that transactions are confirmed relatively quickly. If we look at the latest fee estimates, we find that the average Bitcoin transaction fee currently sits at around 6 satoshis per byte (sat/B), whereas Binance batched transactions are paid at around 100 sat/B, making them particularly attractive to miners.

Looking at the Binance Bitcoin hot wallet, we find that over a one hour time period measured, the platform sent a total of seven batched payments, each containing an average of 36 outputs. Across these seven batched payments, Binance paid a total of 0.01 BTC in transaction fees, equivalent to approximately $79.36 at current rates.

Now, assuming that each of the outputs in these batched payments represents a customer withdrawal and that these withdrawals were charged at 0.0005 BTC a pop, we quickly find that the exchange has racked up 0.125 BTC worth $992 in withdrawal fees for transactions that cost $79.36 to execute.

Overcharging is Big BusinessIf that is the case, then why is Binance charging 0.0005 BTC per withdrawal? Well, although the exchange has never made a public announcement on this, it could be argued that by charging 0.0005 BTC per transaction now, Binance will be able to offset any losses should Bitcoin transaction fees ever hike back up to the extreme levels seen in late 2019.

However, a more likely answer is that this is just one of the myriad ways Binance generates profit. After all, assuming the hour of transactions we logged is an average hour for Binance, the platform could be generating almost $22,000 per day in Bitcoin transaction fees alone.

When considering that Binance allows customers to withdraw hundreds of digital assets, withdrawal fee profits could be substantially more than our calculations suggest. Recently, BeInCrypto reported on the fact that Binance’s side chain is outperforming any of the other ones.

Which exchange platform is the worst offender when it comes to overcharging on withdrawal fees? Let us know your thoughts in the comments below!

Images are courtesy of Shutterstock.

The post Binance Earns More Than $20,000 per Day Overcharging on Transaction Fees appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) на Currencies.ru

|

|